What does the future hold for oil?

Hamesh Sharma of Pathfinder with an overview of the implications for energy stocks and airlines such as Air New Zealand. What does the future hold for oil?

Wednesday, May 6th 2020, 1:41PM

by Pathfinder Asset Management

By: Hamesh Sharma

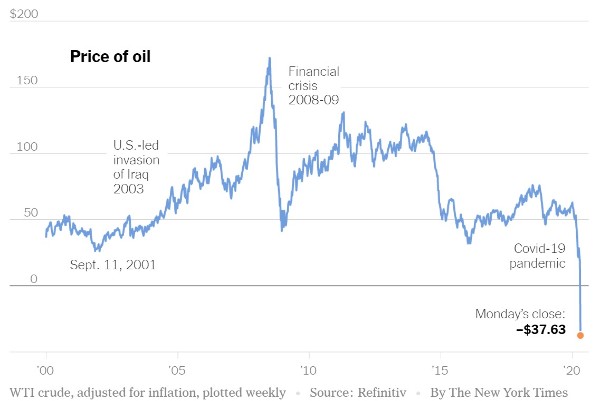

Late in April, for the first time ever, West Texas crude oil futures plunged to a negative value (a day before they expired) meaning that people were being paid to accept barrels of oil.

This may seem absurd, but demand destruction for oil (as the global economy is in lockdown) and the inability to store excess oil supply is wreaking havoc in the oil market.

This demand shock comes after the Saudi-Russian energy price war which began earlier this year, meaning there are issues on both the supply and demand side of the equation for oil.

Companies and countries worldwide: Saudi Arabia, Russia, the USA, Canada, Iran are all pumping out pretty much the same amount of oil as they were before the pandemic.

There have been some production cuts, as Donald Trump reportedly gave Saudi leaders an ultimatum to end their oil price war with Russia, or he would be powerless to stop lawmakers from passing legislation to withdraw US troops from the kingdom – threatening to upend a 75-year strategic alliance.

Oil has to be stored somewhere and all storage facilities are close to full. Everything from oil tanks to pipelines to rail cars to ships is at full capacity.

More recently, energy prices have collapsed across the complex with oil, LNG, and coal prices falling.

Spot Crude Oil (WTI) is currently around $20 a barrel, less than a bucket of KFC! Which remains in massive demand as NZ moved into level three lockdown.

So, what are the key implications for investors. While there has been some short-term relief, energy continues to be the worst performing sector over the last year.

Being an ESG-centric fund manager, we have avoided the turmoil across our KiwiSaver scheme (CareSaver) and managed equity funds and believe that this position will see us continue to outperform by avoiding the fossil fuels industry.

News-flow from Shell, Europe’s largest oil company, and shale gas pioneer Chesapeake Energy highlight how bleak the outlook for the energy sector is looking.

Royal Dutch Shell cut its dividend for the first time since World War II, showing that this time it might be different, even for Big Oil.

For decades Big Oil has used the strength of a large balance sheet to borrow money when the going gets tough and keep investors sweet until the next upward cycle.

As the coronavirus pandemic potentially causes lasting damage to energy demand, Europe’s largest oil company asked whether this strategy is sustainable.

Shell’s CEO Ben van Beurden is very cautious, “I think a crisis like this has the potential to catalyse society into a different way of thinking” he said in a Bloomberg interview.

Chesapeake Energy Corp, the oil and gas exploration and production company that was at the forefront of the past decade’s US shale boom, is reportedly preparing a potential bankruptcy filing.

Shale gas had been seen as revolutionary for transforming the US energy market, but with oil prices so low the economics of fracking shale gas no longer make sense.

Moody’s has cut Chesapeake’s credit rating deep into junk territory.

US shale oil producers will likely need to slash production (due to their high cost base) and their best hope is for a government-led bailout of some kind.

It is not just the oil producers which are under pressure, there have been second order effects on companies like refiners and retailers of oil such as Z Energy.

One sector which has been a victim of Covid-19 is the airline sector and it is worth noting Warren Buffett announced he has exited his airline positions over the weekend. The weak oil price is now compounding their issues.

Because airlines have hedged – or locked in – jet fuel contracts to protect against near-term fluctuations in energy prices, these contracts have become loss-making as airlines have reduced flying (are not consuming oil) and the oil price has plummeted.

Jet fuel hedging losses are reportedly what tipped Virgin Australia into voluntary administration, a form of bankruptcy protection.

Locally, Air New Zealand, which is already facing unprecedented challenges, now has another issue to deal with given in its last investor presentation 91% of second-half 2020 fuel volumes were hedged, and 56% of first-half of the 2021 financial year.

Oil prices went negative as the US, in particular, is awash in oil, and those left holding the nearest-term futures contract at expiration – and therefore required to take delivery of physical oil – would face very expensive US storage costs.

Until the supply glut is removed, that means there is a risk the current nearest-term contract price could also go negative as it approaches expiry.

In summary, our equity funds do not invest in the shares of oil producers or refiners. We don't like the industry going forward for several reasons.

Firstly, excess oil consumption poses an existential threat to humanity through climate change, but just as importantly fossil fuels is a sector that has had terrible returns for the last 10 years and will more than likely have equally terrible returns for the next 10 and 20 years.

Pathfinder is an independent boutique fund manager based in Auckland. We value transparency, social responsibility and aligning interests with our investors. We are also advocates of reducing the complexity of investment products for NZ investors. www.pfam.co.nz

| « The active passive debate continues ... | Bounce back » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |