Will corporates embrace remote working?

Will the success of corporate employees working from home during lockdown lead to a permanent shift to workers being home-based?

Friday, May 22nd 2020, 6:31AM

by Castle Point Funds Management

By Stephen Bennie

In the past decade there have been two major developments that make working from home more efficient, the roll out of ultra-fast broadband and the technology that allows for seamless online, virtual teamwork.

However, there remained an understandable scepticism by corporates regarding the potential drop off in productivity that could result from remote working. So, office workers largely continued to work in offices despite the potential to work seamlessly from home.

There were a few things that we learned during lockdown, ranging from home baking to how only crazy people run big cat zoos.

We also learned whether companies could operate in lockdown. Our own experience was seamless both in how our company continued our day-to-day operations, and how our outsourced service providers can also operate as normal.

Essentially, it was a very thorough test of the impact on productivity if all staff moved to remote working. If productivity held up or even improved, this could lead to a fundamental shift in how corporates viewed office workers, working from home.

Our experience was very much that it was business as usual and we are unaware of any office-based corporates that were not able to continue operations despite their offices being closed.

Last week, Jack Dorsey, CEO of Twitter remarked that: “The past few months have proven we can make that work. So, if our employees are in a role and situation that enables them to work from home and they want to continue to do so forever, we will make that happen.”

Google and Facebook have extended their work from home policies into 2021.

We have also heard of call centres remaining on a work from home basis despite being able to return to the office as New Zealand has moved to level two. Call centres and other office settings, which do not allow for social distancing are another reason that companies may choose to continue with remote working.

In New Zealand we had Covid-19 clusters stemming from the tavern in Matamata, the Bluff wedding, the college in Auckland and several rest homes.

We did not have a cluster related to a call centre. However, South Korea did.

The Korea Centers for Disease Control and Prevention (KCDC) has written a report on the call centre cluster that recently occurred in Seoul. It related to a 19-floor office building in one of the busiest urban areas of Seoul.

The building had commercial offices on the first 11 floors with residential floors above. The office workers did not generally move between the floors and there was no common dining area.

The KCDC tested 922 employees, 203 residents and 20 visitors and sent 16,628 text messages to people within five minutes of the office, based on cell location data, to also be tested.

The KCDC testing found 97 cases of Covid-19 associated with the 19-floor office building, with 97% of them coming from the level 11 call centre. The spread follows what is sadly now a well observed pattern of exponential growth.

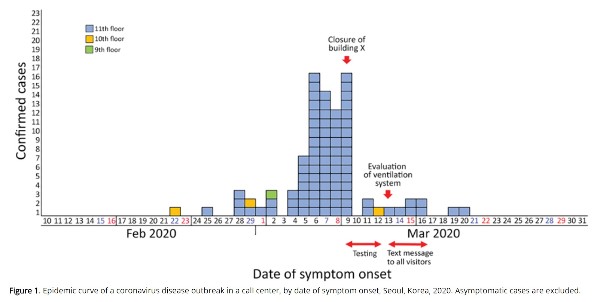

The chart below shows how the first symptomatic level 11 case, the first blue box on the February 25, was followed within six days by seven more cases and then seven days later another 68 cases. At which point the building was finally closed and the testing began.

The KCDC testing uncovered how concentrated the cluster had been on level 11 and how concentrated it was in a particular section of the call centre on that level.

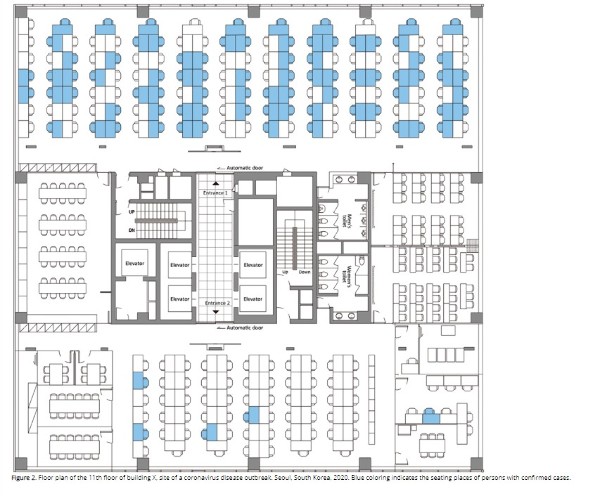

Below is the floor plan of level 11 which shows in blue the desks of the workers that contracted Covid-19.

It is visually clear why the KCDC investigated the role of the ventilation system in the spread of the virus – especially with so many of the cases in a section served by a common ventilator unit.

The floor plan above shows how ruthlessly the virus spreads when office workers are in close proximity for several hours at a time, as is normally the case in a call centre or compact office setting.

It is likely that New Zealand is in the minority of countries that did not experience an office-based Covid-19 cluster.

As the KCDC summed it up: “This outbreak exemplifies the threat posed by SARS-CoV-2 with its propensity to cause large outbreaks among persons in office workplaces. Targeted preventive strategies might help mitigate the risk for SARS-CoV-2 infection in these vulnerable groups.” One strategy that works well is working from home.

Ultimately, if companies start to see that they can have a meaningful percentage of their employees based at home, they will start to reassess the amount of office space they require.

Large corporates annually spend tens of millions on office rent. While you could argue that going forward, a call centre will have to be far more spaced out hence, driving a need for more office space, it is hard to see a company doing that when it could have the employees working from home just as productively as at the office.

Will a company decide to double its rent bill or significantly reduce it when neither option impacts on worker productivity? We expect corporates to go for less rent and more remote working when faced with that choice.

| « Optimistic view of New Zealand equities likely to continue [+VIDEO] | The risk of finding income in a low-interest-rate world » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |