Data supports markets

The Harbour Investment Outlook summarises recent market developments – what we are monitoring closely – and our key views on the outlook for fixed interest, credit and equity markets.

Tuesday, August 18th 2020, 12:20PM

by Harbour Asset Management

Key points

• Better-than-expected economic data and company earnings have supported risk sentiment over the past month.

• Continued progress towards a Covid-19 vaccine, alongside ongoing stimulus, has also added to the positive mood, outweighing concern about ongoing mobility restrictions and second waves of Covid-19 infection.

• The New Zealand economy continues to benefit from ongoing control of Covid-19, low mobility restrictions and policy support. Fiscal stimulus is likely to wane and ongoing border closure means complete recovery is largely contingent on a vaccine.

Key developments

Economic and company results continued to beat cautious expectations, and central banks confirmed their “whatever it takes” policy stance to supporting economic activity and, indirectly, growth asset returns.

Continued progress towards a Covid-19 vaccine, alongside ongoing monetary and fiscal stimulus has also added to the positive mood, overwhelming concern about ongoing mobility restrictions and second waves of infection.

Global Purchasing Managers’ Indexes (PMI) returned to expansionary territory for the first time since January, and 80% of US companies to report Q2 earnings so far have beaten expectations.

Global equities added 3.3% in July, NZ equities 2.4% and Australian equities 0.5%. Other risk-sensitive assets also responded positively through the month with credit spreads narrowing and the NZD gaining almost 3% versus the USD.

Volatility declined across most asset classes and bond yields fell under the weight of central bank quantitative easing (QE) programmes.

Covid-19 is not under control in some countries, and containment measures continue to limit economic activity. Second waves and the re-imposition of lockdowns in parts of the US, Japan and Australia are impeding their economic recoveries.

Among the world’s 10 largest economies, an easing in French and German restrictions, however, have offset increases elsewhere such that the average lockdown stringency for these 10 economies has remained around 60 over the past month (where 100 is equivalent to alert level four and zero is no restrictions).

Central banks are continuing to provide stimulus that, in most cases, can be maintained until inflation and employment objectives are met. Fiscal stimulus, however, cannot continue forever in its currently large size without debt levels for most countries becoming unsustainable.

Governments are aware of this, and expensive wage subsidy schemes that many developed economies have implemented are being reduced or are coming to an end.

The US supplementary unemployment benefits ceased in early August and although most expect these to be extended, the rate is likely to be markedly reduced. Australia’s “Jobkeeper” scheme, for example, was recently extended to March 28, 2021, but at lower rates and with tighter eligibility criteria.

The New Zealand economy continues to benefit from ongoing control of Covid-19 and low mobility restrictions.

Most high-frequency economic indicators have returned to pre-Covid levels and the Reserve Bank of New Zealand (RBNZ) continues to play a supportive role by keeping interest rates low via the official cash rate (OCR) and its $60 billion bond buying (QE) programme (of which, just over one third has been utilised).

Recent Government communication suggests substantial additional fiscal stimulus, beyond what has already been pledged and remains unallocated, is unlikely and the wage subsidy extension is due to expire on September 1.

The scheme is currently supporting more than 450,000 jobs – 16% of the labour force. Absent a further extension, the unemployment rate is likely to approach 10% by year end.

Exports of services remain the key area of economic weakness but border re-opening, that would allow complete economic recovery, is largely contingent on a vaccine which most analysts believe is unlikely before the middle of 2021.

What to watch

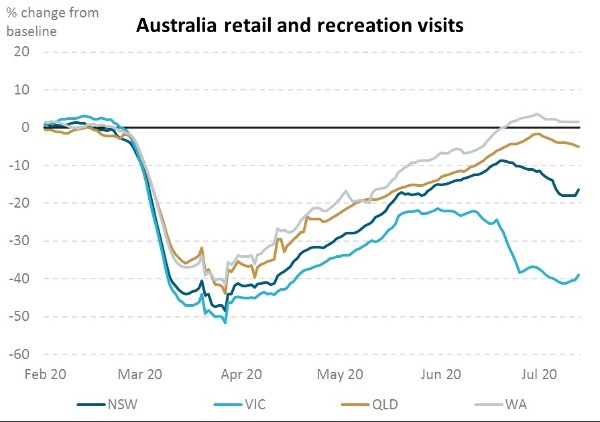

The economic impact of Australia’s Covid-19 second wave: Following an acceleration in infections towards the end of June, Melbourne announced a six-week lockdown in early July, and that has recently become more strict, akin to New Zealand’s level four.

Visits to retail and recreation facilities in Victoria are about 40% lower than normal now versus 20% lower one month ago.

Rising infection risks have also reduced mobility in neighbouring state, New South Wales.

Note: Data are rolling weekly averages. Source: Google Community Mobility Reports.

Market outlook and positioning

Within equity markets there is a wide gap in returns between the “stay at home” stocks and the economic re-opening stocks, which, in turn, has morphed into a growth versus value stock grouping valuation gap. We expect this gap will persist until such time as a clear, consistent re-opening path emerges.

Globally, second quarter earnings continue to come in stronger than what are proving to be overly-cautious expectations.

The New Zealand June reporting season may deliver similar outcomes, but a Covid-19-related extension to reporting deadlines may see result announcements drag into late September.

The combination of the unusual reporting season and the fractious nature of the economic recovery, including political volatility, will contribute to a wide dispersion in stock returns over the next six months.

We remain watchful and nimble within portfolios and continue to skew portfolios to the stocks that benefit from structural change such as accelerating technology transition, demographic trends, and the rise of sustainability

The fixed interest market continues to be dominated by the opposing forces of large amounts of government bond issuance and a central bank that is prepared to purchase enough bonds in the secondary market to prevent a meaningful rise in yields.

A commitment to keeping the OCR low is anchoring short-term rates near 0.25%. However, if we look through this phase, the distribution of future yield outcomes seems skewed higher.

This view is leading us to have a bias towards protecting funds from poor returns if bond yields rise. When bond yields are low, we are likely to be reducing duration.

In growth-focused multi-asset portfolios, we are modestly overweight equities and underweight bonds. The overweight position to equities has been trimmed as valuations are starting to reach more fair long-term levels, even accounting for the fall in discount rates.

Where we have the discretion to do so, our global equity exposure is currently unhedged which we believe should provide some downside protection to the portfolio.

We continue to be active with our positioning at both an asset allocation, sector and stock level.

The Harbour Income Fund has increased exposure to dividend-paying income equities, as yields on fixed interest securities have declined towards record lows.

Ongoing easy monetary policy is expected to support equities that can provide sustainable dividends, even if the pace of growth declines.

Our broader strategy continues to focus on identifying a diverse source of income-generating securities, complemented with active management.

This does not constitute advice to any person. www.harbourasset.co.nz/disclaimer

Important disclaimer information

| « a2: could the milk be starting to turn? | Generating income in a negative rates world » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |