Going beyond the returns: embracing fintech to deepen human connections

Digital technology has continued to play a vital role in the financial services sector since the late 60s, when the first ATM was introduced.

Sunday, October 18th 2020, 6:06PM

by Rachel Strevens

In more recent years, technology has evolved to not only provide functional benefits, but to also stimulate and foster emotive connections. The explosion of technology presents a massive opportunity for companies to forge unbreakable bonds with clients and to encourage them to become more emotionally invested in their financial wellbeing.

The recent market volatility has caused many investors across the wealth spectrum to seek advice on how to manage their financial wellbeing during this turbulent period. Safety and financial security is the initial driving force behind this behaviour, but what happens once this emotional need has been met? How do financial service providers continue to build lasting relationships that transcend these base-level needs? Companies need to start leveraging technology to go beyond satisfying customers’ basic needs, and start motivating and interacting with their customers to help them realise their full potential.

Understanding your customer’s motivating factors

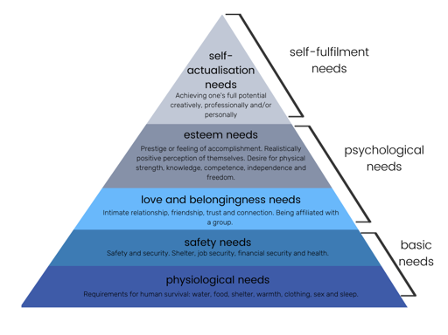

Maslow’s Hierarchy of Needs is a graphic model that is widely used to understand the motivational forces of an individual. It depicts hierarchical levels within a pyramid, and the theory is based on the premise that needs lower down in the hierarchy (basic needs) must be met before higher-order needs (psychological and self-fulfilment needs) can be satisfied. Naturally, as these lower order needs are met, customers are motivated to move up to the next set of needs that they have yet to fulfil.

Image: Maslow’s Hierarchy of Needs

Due to the nature of their service offerings, financial service providers clearly satisfy the lower-order needs of safety and security. Traditionally, customers would invest and put money aside without interacting with it for many years, resulting in little to no emotional connection to it. The acceleration of fintech has provided the perfect platform for companies to provide a service that goes beyond generating good returns and profits and encouraging positive emotional bonds. Interactive digital tools that help encourage a sense of ownership and emotional connection to investments is crucial to build enduring customer relationships.

Digital tools to support customers’ hierarchy of needs

80% of Generation X and millennial heirs are likely to change wealth advisors after inheriting their parents’ wealth. Having grown up in an online world, the next generation expects a tailored, digital investment experience that not only supports their financial wellbeing goals, but also helps guide them on their journey to satisfying their self-fulfilment needs. Some key digital tools and functionality include:

- Investment and performance tracking: Giving customers the ability to track their investments in real-time is a great way for them to develop a sense of accomplishment and meet their psychological esteem needs. Easy-to-understand visual displays combined with relevant performance information and market insights helps to educate and inspire clients to achieve their investment and retirement goals, even during times of market turbulence.

- Digital advice and chat bots: Digital advice and chat bots help to reinforce the “always on” digital experience by addressing customers’ investment information needs in real time. These tools can be configured to go beyond addressing the basic financial security needs of a customer, and can be woven into the customer portal to provide key pieces of information and advice throughout the customer journey. Intelligent algorithms create a curated experience for each customer, helping to support the need for interpersonal relationships by building trust and personal connection between advisors and customers.

- Integrated CRM: Providing timely and relevant information is essential to building trust and rapport with investors. A central point that houses all client data, such as an integrated CRM, is the cornerstone of an effective client retention strategy. Regular fund updates and market performance reports will keep investors engaged and informed, supporting them on their journey to satisfying their self esteem need for knowledge and development.

- Digital financial calculators: Placing these tools directly into the hands of investors provides a truly educational and supportive experience. Not only does it help satisfy their lower-order safety needs, but it also provides a really engaging way for them to understand their current and future financial situations better. Making financial calculators accessible to customers helps to support their higher-order esteem need for positive and stable self-evaluation.

In the wake of social distancing and the global lockdown, digital has gone beyond playing a technical function, and developed into a valuable tool for human connection. Companies need to adapt their business models and leverage the personalisation benefits of emerging technologies to build meaningful and long-lasting relationships with the next generation of investors. Financial service providers are perfectly positioned to provide a more comprehensive service experience that not only addresses financial security needs, but also supply relevant information and advice to support investors on their journey to self-fulfilment.

Get the latest report from Invsta for comprehensive insight into the top emerging technology trends: https://www.invsta.com/2020-report-download

Disclaimer: Rachel Strevens is the CEO and Founder of Invsta. This article is intended to provide information and does not purport to give business advice.

Invsta is a B2B fintech company that provides a range of white label modules and interface solutions for wealth advisers, fund managers and KiwiSaver providers. Invsta’s digital solutions are focused around 2 core areas: providing an interactive and engaging online client experience, and improving back office efficiencies. Through their solutions, they’re helping companies to reduce costs, improving access to financial products and advice, and delighting investors with ease of use and digital engagement.

Rachel Strevens is the CEO and Founder of Invsta.

| « [FSC Conference] The rise of the machines; Robo like a toddler | [Get in Shape] Minister's first words; Botica busts myths; Get to know climate change; new report » |

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |