KiwiSaver: The opportunity set of a lifetime

NZ Funds chief executive Michael Lang outlines three ways the financial services industry could further grow KiwiSaver.

Monday, October 26th 2020, 9:37AM

by Michael Lang

“Kiwis are clueless, careless and deluded about money and retirement savings.” This is how our media interpreted the Commission for Financial Capability’s recent financial survey.

For many New Zealanders who work in the financial advice industry, such articles make for depressing reading, and are all too common.

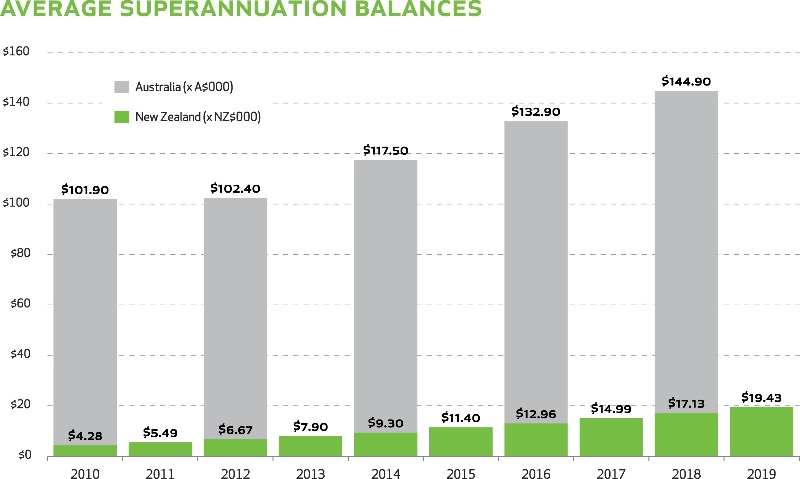

There is no disputing however that New Zealand has fallen behind financially. We could have adopted KiwiSaver in 1992 but chose not to. Right now, saving for retirement is compulsory in Australia at 9.5%, but only optional in New Zealand at 6% (or less). The average Australian has around $145,000 in their superannuation scheme, while the average KiwiSaver member has around $20,000.

This represents the opportunity of a lifetime. One of the more remarkable pieces of news this year was the story that Space-X had successfully sent astronauts into space. While that has been done before, this time was different.

Space-X is a private, for-profit enterprise, and was able to do it faster, cheaper and more safely than NASA. As the first man to step foot on the moon, Neil Armstrong might have said, “One small step for space exploration, one giant leap for commercial enterprises”.

In Space-X’s achievement lies a message of hope for us all. It is easy to lay blame for what should be done at someone else’s doorstep: Government should have made KiwiSaver compulsory; MBIE should have disbanded the default KiwiSaver oligopoly years ago, and so on.

But the truth is, the investment industry should look to itself, not others for the solution. Space-X showed private enterprises have the power to change the future – better than any government or regulatory authority can. If Sir Michael Cullen could help New Zealand accumulate an additional $70 billion in a decade, then imagine what a difference 24 licensed KiwiSaver managers and 9,000 financial advisers could make, if they really want to.

Here are some of the financial needs that New Zealanders have raised with us which commercial enterprises could start to solve:

(a) an attractive way to save more into KiwiSaver, without having the money locked up, so that families can save more but not lose the option of accessing their funds should they wish to;

(b) ways to accelerate the building of wealth through KiwiSaver, without putting their retirement savings at risk (something along the lines of paying down a mortgage on a house over time generates a higher return on equity than buying the house outright); and

(c) more investment options in retirement now that interest rates are close to zero, which has negatively impacted term deposits, bonds and endowment schemes.

Despite the market distortion of default KiwiSaver providers, a perceived focus by the FMA on fees over the benefits of quality financial advice, service and ultimately client outcomes, and the hand-wringing of the Commission for Financial Capability, New Zealanders should know we will get there. And when we do it is unlikely to be because of a single government or regulatory decreed solution (be that ever lower fees or balanced funds for all).

On the contrary, our best chance of solving New Zealanders’ savings shortfall is to encourage strong and profitable market participants who innovate, experiment and compete rigorously (on a level playing field) for a share of the $725 billion-dollar prize, which is what our market will look like when we catch up to Australia.

Welcome to one of our most exciting and important marketplaces since New Zealand decided to deregulate.

Michael Lang is Chief Executive at NZ Funds. New Zealand Funds Management is the issuer of the NZ Funds KiwiSaver Scheme.

| « It's time sharebrokers had uniform fee disclosure | Juno to increase KiwiSaver fees, not pursuing default status. » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |