Elections, Covid waves come to the fore

The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed interest, credit and equity markets.

Monday, November 9th 2020, 8:34AM

by Harbour Asset Management

Key points

• At the time of writing, Joe Biden is poised to become the 46th US President of the United States, most likely presiding over a split congress. This likely outcome has broad implications for markets including less fiscal stimulus, decreased prospect of corporate tax hikes and more cohesive foreign policy.

• Second Covid-19 infection waves in Europe have resulted in the reimposition of lockdowns which are likely to have a negative impact on economic activity.

• High frequency New Zealand growth indicators have largely returned to pre-Covid levels since the country reverted to Level 1 in early October. However, the level of activity remains below pre-Covid levels.

• The earnings season in the US painted the picture of a robust earnings recovery. At the time of writing, 417 companies have reported earnings with 84% of companies beating consensus earnings expectations.

Key developments

Global equity markets fell over the month. In the first two weeks markets were up reflecting solid earnings results, central bank monetary policy support, vaccine optimism and expectations of further US fiscal stimulus. But markets fell into month end reflecting a surge in northern hemisphere Covid-19 cases, mixed US tech results and US election/fiscal stimulus uncertainty.

Expectations of better economic activity lifted US longer term bond yields, while equities sensitive to potential further lock-downs weakened as Covid-19 cases increased. Globally, utilities and communications sectors held up, but the energy and IT sectors were weak.

The New Zealand equity market (S&P/NZX 50 Gross with imputation) bucked the global trend, finishing the month up 2.9%. The outperformance of the market was driven by stock and sector-specific factors.

The surge in northern hemisphere Covid-19 cases provided support for the largest stock in the S&P/NZX 50 index, F&P Healthcare (FPH). FPH returned 7.3% in October as investors anticipated an extended period of demand for its hospital respiratory products.

The electricity generation/retail sector also performed strongly as the Labour Government signalled a potential agreement around the timing of closure for the Tiwai Point aluminium smelter and some stocks benefitted from inclusion in a global clean energy index which is tracked by a fast-growing exchange-traded fund.

NZ Government Bond yields were stable over the month. The domestic market was dominated by the consensus view that the RBNZ would continue with their outlook that economic risks are to the downside.

Cuts in the OCR in 2021, along with the proposed Funding for Lending programme and ongoing buying of government stock via LSAP, are widely expected to hold yields across the yield curve at very low levels. In addition, forward guidance for interest rates is likely to keep the potential open for negative interest rates, although, increasingly, the strength of New Zealand economic data may bring a spotlight on whether this is the most likely outcome.

The continuation of the Labour Government reinforced the sense of status quo.

Second infection waves in Europe have resulted in the reimposition of lockdowns that are likely to have a negative impact on economic activity. US cases are also picking up.

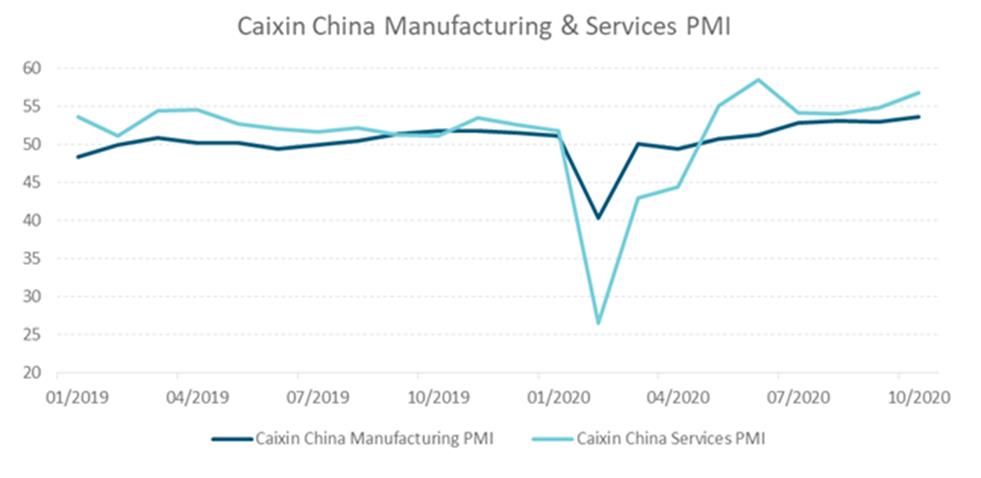

Despite this, the global economy continues to recover, and data are beating expectations. In particular, the Chinese economy has shown remarkable resilience, strength in the industrial sector has now underpinned a strong recovery in the retail sector.

This strength was underpinned by encouraging Caixin Manufacturing and Services numbers which were both ahead of expectations.

Source: Bloomberg.

What to watch

The implications of a Biden Presidency and split Congress: At the time of writing our working assumption is a Biden Presidency with a Democrat house and Republican senate. This has a number of key implications for markets including:

• A Democrat clean sweep would have resulted in a large fiscal expansion, partly funded by corporate tax increases. The more likely outcome now is a smaller fiscal package with no tax increases.

• The lower level of reflationary fiscal expansion is likely to result in lower rates for longer. Lower interest rates should benefit longer duration stocks such as growth-focussed technology and healthcare companies.

• A more cohesive foreign policy, particularly with China. While Biden is likely to continue to push hard on issues like intellectual property, he is more likely to work collaboratively on issues like trade and climate change.

Market outlook and positioning

A constant influence in the last few months has been the presence of central banks providing ample stimulus for economies to continue to beat expectations.

Liquidity and low interest rates have prompted financial and real assets to continue to perform, albeit with increasing volatility. The blunt impact of lower interest rates has also stimulated the housing market, a sharp pick-up in both first-time owners and investors has reflected unprecedented monetary stimulus and the attraction of buying real assets in a time of significant uncertainty.

It is hard at the moment to see a circuit-breaker for either the housing market or investors switching from cash and bond markets to growth assets though, over the near term, the path of Covid-19 second waves and vaccine trajectories will continue to influence investor sentiment.

Generally, we remain constructive on the outlook for earnings results and, with supportive policy, we continue to be relatively fully invested. Equity growth portfolios remain anchored in the healthcare, technology and consumer staples sectors.

The balance of the 2020 year is likely to reflect the influence of political risk, economic trends, perspectives on the re-opening of economies and news on Covid-19 vaccines. Corporate earnings guidance may continue to be difficult, but we expect greater clarity as evidence emerges on a continued economic recovery.

Market commentators are also increasingly focussing on the negative consequences of very low interest rates. Behaviours in the housing market are looking somewhat feverish. QE is designed to lift asset prices but risks of a bubble are mounting. It is also not clear that lower interest rates are encouraging businesses to borrow.

We think the logical implication of better data and some negative low-rate consequences is that the RBNZ dials back their strong recent guidance about lower interest rates. It may be better for them to have the option to cut if necessary, but also to hold steady if that is appropriate. We see scope for a mild re-pricing of bond yields at higher levels in the near term.

Over a longer term, we expect the massive amount of fiscal and monetary stimulus to ensure we see a sustainable economic recovery. Accordingly, bond yields seem skewed towards higher levels over time. This implies a bias towards short duration positioning within fixed interest portfolios.

In growth-focussed, multi-asset portfolios, we reduced exposure to equities to a neutral position in the lead up to the US election. Within the equities exposure, the portfolios remain overweight to structural growth companies as the pickup in Covid-19 cases in

Europe and the US poses a challenge to cyclical and value stocks in the near term.

The Income Fund strategy is quite closely aligned with the multi-asset portfolios at present. It holds a modest overweight to equities, also reflecting the view that very supportive monetary policy can enable equities to outperform bonds and that the additional risk is acceptable. Positioning is not aggressive, reflecting both the sense that the market already prices in a reasonable recovery and that political risk prompts some scope for volatility.

Important disclaimer information

| « It’s inflation Jim but not as we know it | AMP's move to passive creates opportunities for active managers » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |