Why life expectancy has improved – and how much further we can go?

Russell Hutchinson looks at improved life expectancy and four areas where changes could make the numbers even better.

Friday, November 27th 2020, 7:36AM

by Russell Hutchinson

Some people think that mortality improvements ceased with, say, germ theory, antibiotics, or improvements in child mortality - take your pick. Reducing the great increase in longevity over the last 200 years down to just one or two major steps forward.

Awkwardly for these 'tweet-sized' arguments, the truth is much more complicated, with contributions to increased lifespans from a very wide range of sources, continuing over a long period of time. Covid-19 notwithstanding, we think these can continue.

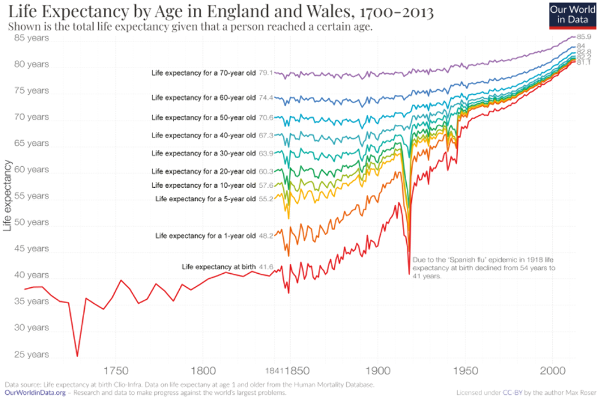

For evidence, take a look at the following chart showing life expectancy by age in England and Wales from 1700 to 2013. Improvement has been most dramatic in life expectancy at birth, from 41.6 years in 1841 to 81.1 years in 2013.

The large gains made due to reductions in child mortality have contributed enormously, but the continuing nature of the gains shows that no one event can be given all the credit, and of course, many improvements that lengthen those lives must be happening later in their lives.

To illustrate that, consider the improvement in mortality for lives aged 50. In 1841 if you had already reached age 50 you could expect live to age 70. in 2013 that number is 82.8. As recently as the year 2000, that life expectancy was 80 years - so in 13 years an average of 2.8 additional years of life were added.

Covid-19 may knock that around a bit, but the trend to longer lives should continue once we’re through that, much as it did after past shocks - like the 1918 ‘flu pandemic

You can read some great commentary on this chart at this link.

That should be a source of encouragement, because small changes accrue over time to big changes in society as a whole. For example, we became a society where knowing one's grandparents for more than a few years is the norm and knowing one's great-grandparents is increasingly common.

We should be more encouraged by the fact that if New Zealand could just improve in four key areas, we could substantially increase longevity again.

Those areas are in:

- obesity

- vehicle accidents

- deaths from self-harm

- workplace accidents.

In each case, if we were able to just move towards, say, the performance of one of the better performers in the OECD, we would save hundreds of lives every year.

I will reiterate that by re-phrasing in a slightly more emotive way: hundreds of people die every year from causes where we already know what could be done in order to save them.

Insurers and advisers have a valid role in advocating for better solutions for clients – not just in the design of insurance contracts but in our country as a whole.

| « A controversy or lost opportunity when we talk about sum insured | Are model portfolios an idea that is transferable to insurance? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |