MJW KiwiSaver survey reveals balanced and growth fund overlaps

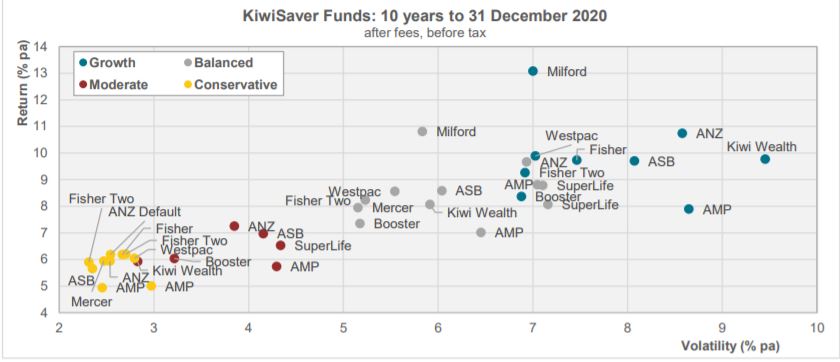

A survey by MJW Investments looking at the performance of KiwiSaver funds over the last ten years reveals a large overlap between balanced and growth funds.

Tuesday, January 26th 2021, 6:00AM

With KiwiSaver now at $62 billion FUM, the superannuation scheme has enough data behind it for the numbers to tell an interesting story when analysed.

A recent MJW Investments survey has reflected on the past ten years of the scheme, analysing the performance of various scheme providers and the differing levels of returns across balanced, growth and conservative funds.

The report says, “As we would expect, fund category (or equivalently, allocation to growth assets) is the most obvious determinant of return. Over the long term, investors can generally expect growth assets to provide a boost to return and this is indeed the pattern we see here.”

Although this is illustrated by the high collection of growth funds towards the top of the returns graph, possibly the most interesting group of data is the number of funds which highlight an overlap in the returns in balanced and growth funds.

The report explains that “there is a relatively large overlap between the growth and balanced funds. Risk and return for the conservative (and moderate) categories are fairly tightly clustered but the spread within categories becomes more pronounced in the balanced and growth categories. The range of returns for balanced funds is around 4% while for growth funds it is over 5%.

“Thus, choice of provider is perhaps relatively more important for the more aggressive funds and relatively less important for the more conservative funds.”

At the top end of the return scale over the decade is the Milford balanced and growth funds which are each outliers with high returns relative to their respective categories.

By contrast, each of AMP’s funds find themselves at the lower end in terms of returns.

The full survey can be found HERE:

| « Juno to increase KiwiSaver fees, not pursuing default status. | Default KiwiSaver: Which providers are fighting to keep their status? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |