Scams under-reported by Chinese New Zealanders: FMA

The FMA are urging Chinese New Zealanders to beware of investment scams, but an Asian adviser says the regulator needs to do more.

Monday, February 22nd 2021, 6:00AM

by Daniel Smith

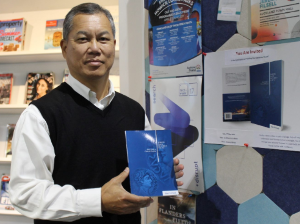

Albert Kwok

Amid the Lunar New Year celebrations, the FMA is reminding Chinese New Zealanders how to spot an investment scam and what to do if they encounter one.

In 2020, the FMA received almost 200 reports of scams and fraud, but only a handful of complaints were from Chinese New Zealanders. That’s despite a 2020 FMA survey finding around one in five Chinese New Zealanders had been approached about a potential investment scam – the same as the overall population.

FMA director of regulation, Liam Mason suspects many scam victims are choosing not to report scams: “They may not know who to contact about a scam or may think there’s no point because it’s a small amount or they haven’t actually lost money.

“We’re also aware of cases where scammers have even warned victims will get in trouble with New Zealand authorities if they report the crime. This is obviously not correct.”

Mason says the FMA’s Chinese-speaking staff are dedicated to investigating scams, and its call centre uses interpreters to help complainants when English is not their first language.

“We want to hear from anyone who has encountered a potential investment scam – whether they are just suspicious or have actually lost money, or know someone who has.”

Albert Kwok is a financial adviser with Stedfast Advisory Services based in Howick. He deals with many Chinese New Zealanders and says that the problem with scams does not start and end in that community.

“I personally think that it is not only the Chinese community that is affected by scams but minority communities across the board.”

According to Kwok why Chinese people are particularly affected is because of their culture.

“Some Asians will not report scams because they see it as a loss of face. If they lose money, they walk away.

“The FMA are right and the Asian community in New Zealand are less likely to make complaints if they fall into a trap.”

Kwok believes that the remedy for this situation is more engagement from the regulator with communities.

“I don’t think there is enough engagement from the regulator with minority communities. Not only the Chinese community, but also other minorities.

“This is not solely the fault of the regulator. What we need is people from within the community to be involved in financial services to reach out to them.”

According to Kwok, compounding the issue further is “The barriers that the regulators have put up makes advisers less likely to help the community."

“We need more advisers to be willing to put up their hands and help these communities. What’s more the advice has to be free and I am not sure how many people are willing to give free advice.”

Though this solution may sound extreme, Kwok himself walks the walk, offering free financial education programmes to communities in need through volunteering in his communities.

Kwok says that there needs to be a change in the Asian-New Zealand community regarding scams and that this change can only come with more engagement from the regulator and from advisers in the community.

“When it comes to crime, you should complain. If you lost money through someone cheating you or if you are the victim of a scam, you should complain.

“More advisers in the community would help. I suspect that a lot of people in the Chinese communities don’t even know who they can complain to.”

Further advice on how to spot a scam and what to do if you encounter one – including reporting them to the FMA – is on the FMA’s new Chinese language scams webpage (投资类骗局).

| « FSPR updates: What advisers need to know | Mann on a mission to diversify financial advice » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |