Fidelity aims for sustainable commission structure

Fidelity Life is rolling out a new commission model which has persistency at the heart of its offering.

Friday, March 19th 2021, 3:26PM  11 Comments

11 Comments

Adrian Riminton

The new structure is designed to be simple and transparent, chief distribution officer Adrian Riminton says. But it is also about creating s sustainable model for the company.

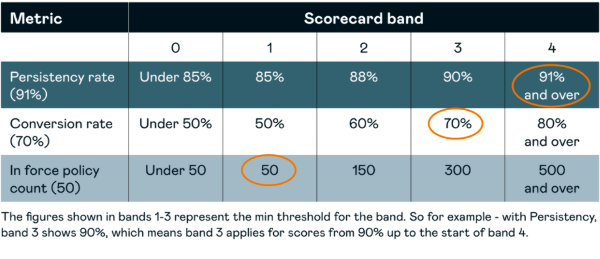

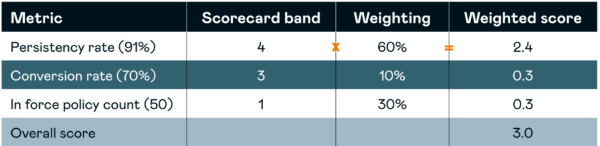

Like Partners Life, Fidelity is using a score sheet to set commission levels. The three factors in its matrix are persistency (60%), in-force policy count (30%) and conversion rate (10%).

Advisers are scored in five bands across these three metrics.

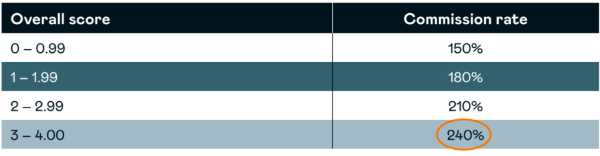

A weighted score is then calculated and these correspond to four commission bands. The lowest commission is 150% and the highest 240%, with intermediate bands of 180% and 210% (see table below).

The new model was put together before new chief executive Melissa Cantell joined the firm. She was happy with it and has not changed anything.

“It’s got my full backing,” she says.

The company is clearly aiming to improve persistency. Currently overall persistency rates across its products sits in the order of 90%, Riminton says.

Another change will see the simplification of ongoing commission for new business, with renewal and service commissions to be combined into one rate of 10% and referred to as "servicing commission".

Overrides gone

Last year Partners Life shook up the industry when it decided to pay any override commissions to FAPs as opposed to dealer groups. This decision had wide ranging impacts on the market including leading to the sale of Newpark to SHARE.

Riminton says Fidelity Life will not be paying override commissions. Instead the total amount of commission available is included in its new package (with the highest being 240%).

This will be calculated at a FAP level.

How it is paid out is a decision for advisers. For instance if an adviser wanted to split the commission and include paying a portion to a dealer group that would be possible.

He says some dealer groups are still trying to work out their models in the new licensing environment.

Fidelity is supportive of dealer groups, he adds.

“We still believe a number of groups provide valuable support to advisers.”

Fidelity is also planning to introduce a new “commission on submission” payment to its remuneration package.

While eligibility details will be confirmed in the coming months ahead of July, the company estimate 50% of all advisers will be eligible to receive commission on submission. If they’re eligible and opt to take commission on submission, they’ll receive a fixed 30% of their total initial commission as per their scorecard calculation

Below is an example of an adviser whose metrics are:

91% persistency

50 in force policies

70% conversion rate

A weighted average score is then calculated

The Overall Score then determines commission levels

| « Disclosure warning as new regulations come into effect | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

All are based on a measurement which rewards volume.

Other than all providers being obliged to pay the same to all FAPs - therefore being forced to compete on products and services, and eliminating adviser remuneration bias - I don't pretend to have the answers.

I understand why a corporatised distribution group such as Lifetime would desire that, and understand why supplier company's would push for it (fundmentally reducing thier distribution costs/increasing efficiency), but why would that be preferable either from a regulatory or individual adviser perspective?

If we consider the example of NZFSG there will presumably be hundreds of AB's and FA's under that model, all of whom have spent years if not decades building up an agency business which is their personal asset.

What legal right does anyone have to determine that their asset should be essentially zero'ised and all future revenues from it directed to another legal entity without their consent?

There is certainly no moral or ethical right to do so.

while I was a member of an Auckland based adviser business a client of mine phoned the 0800 number and asked for assistance to increase his current insurance. This was passed onto a partner in the business who completed the business. The insurance company paid the correct entity (Which was myself). To cut a long story short the insurance company on the instance of broker business reversed the initial rem as apparently a sub agency with this company does not have automatic rights to initial commission. What I am saying Tony is behavior of convenience which you question in your last two sentences has been about for the 30 plus years I have been in the industry.

"Behaviour of convenience" is correct, and it seems to persist simply because it goes unchallenged publicly.

I'd love to see some very explicit and clear public guidance from MBIE or the FMA about who is legally allowed to be paid commissions and who is not, as there are varying "legal opinions" swirling about, most of which strike me as being "opinions of convenience" too, which arise due to the lack of clarity on the subject.

For example; there appears to be a widely held institutional belief that one can ONLY receive commission if one provides regulated advice as defined in law. I haven't found anything yet expressly prohibiting commission sharing (e.g. splitting commissions with a referral relationship), and given the potential impact on agency structures, marketing and prospecting and strategic alliance activity, and future capital value of practices this strikes me as being a reasonably biggish issue. I offer this simply as an example of course, and I'm certainly not a lawyer and am not expressing an opinion on the legality. But if someone like myself, also of many decades duration in the business and with probably a higher than average understanding of the rules of the game cannot figure out what the legal position is, then "opinions of convenience" gain traction in the void of uncertainty, and that cannot be good for the industry at large.

@dcwhyte - thanks David. A gentleman as always.

There's nothing in the legislation or the code that states how remuneration should be paid other than advisers giving advice need to be transparent about how they are paid and what conflicts of interest exist. And everyone receiving commission should be stating commission is a conflict of interest.

There is a distinction between the regulated aspects of commission and the commercial agreements that sit around that commission. How much, who is paid, and what for are all commercial aspects of the transaction. Every insurer, like every other business, has the fundamental right to determine the price of its products and services as well as what it is and is not prepared to pay for the components of what it pays for to acquire those products and provide those services.

We have an interesting position in our industry, against most others, where the insurer gets to dictate the value of the services it receives, aka the advice we give and the clients we introduce to them. This is a dynamic that the government and the regulator may look closer at, but they haven't yet.

TBH, I think they have taken the mature approach of letting the new changes flow through before looking at remuneration, as the changes may drive things that they don't have to regulate. We have seen the noise on service commissions, this has both been an internal FMA discussion that has flowed out to the providers with the changes some have made.

Time will tell, and I very much doubt volume-based remuneration is going to disappear. It may be heavily veiled, but it will still be there in some shape of form.

Sign In to add your comment

| Printable version | Email to a friend |