Interest in interest rates is rising

In this article we discuss the impact low interest rates have had on investors and consider the importance of the recent increase in rates

Tuesday, April 6th 2021, 7:43PM

by Stephen Bennie

At the recent Heathcote Meet the Managers roadshow, 13 investment managers presented, and it was surprising that almost every single presentation in one way or another touched on the recent rise in interest rates and their potential impacts. This was particularly unusual given that interest rates were not even the theme of the roadshow and all the investment managers prepared their presentations independently. There can be little doubt that low, to zero, to even negative interest rates have had a profound impact on investment markets with the recent rises in interest rates attracting some attention.

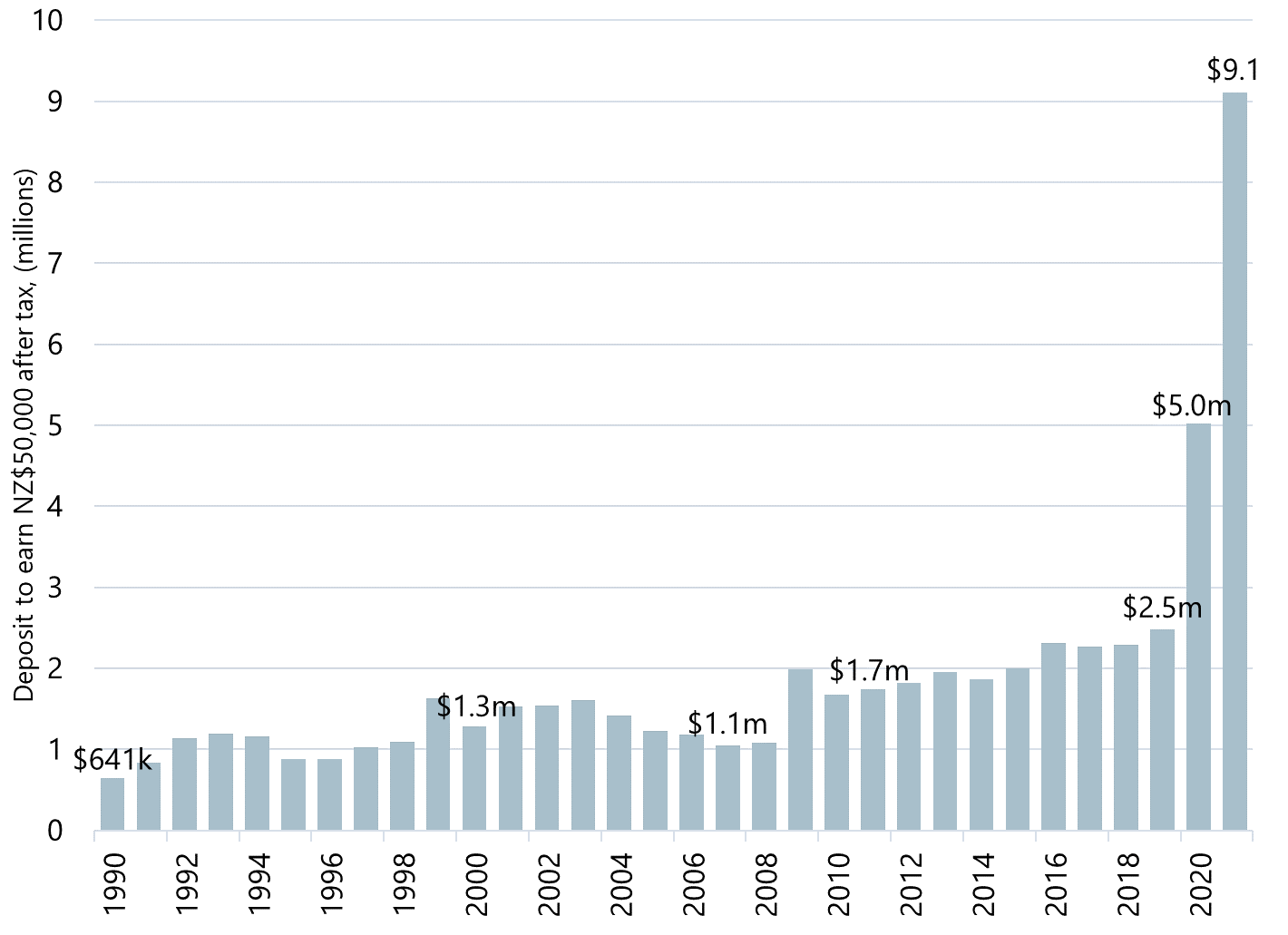

Just to get an understanding of exactly how profound those impacts have been it is useful to take a step back and look at a longer-term trend. The chart below, produced by the Forsyth Barr research team, gives an excellent visual impression of how interest rates have impacted investors and the value of their savings over the past 30 years.

Back in the mid-1990s, an investor with $880k in the bank could earn $50k a year, after tax, by investing in rolling 6-month bank deposits, with interest rates around 8.5%. As you can see from the chart the amount needed to earn that $50k has been steadily rising as interest rates have been consistently dropping. It has got to the point now that an investor now needs an eye watering $9.1m, invested in rolling 6-month deposits, to generate that same $50k return. It is hard to imagine having $9.1m in the bank and not feeling comfortable but that is what a less than 1% return on your savings does.

This perverse situation has been facing investors around the world as central banks eased in a concerted fashion to manage through the Global Financial Crisis in 2009 and then doubled down to deal with the negative shocks of virus-related lockdowns in 2020. The result is that global investors, not just New Zealand investors, have in recent times been forced to travel up the risk curve to generate an acceptable return. A consequence of this is that risk assets get more expensive, especially those that deliver some yield.

Source: Forsyth Barr

The New Zealand share market has many listed companies that give investors access to that extra return with their dividend yields. Those attractive yields have certainly drawn in global investors, as well as local ones, which has seen share prices rise consistently in recent years. But, as the presenters at Meet the Managers picked up on, there has been a recent reversal in interest rates, as they have been rising from near zero levels. There can be little doubt that this played a part in the 7% fall in the S&P/NZX 50 index in February, a month in which many global share markets made new all-time highs. Essentially the tail wind that supported dividend yield share prices eased off as interest rates ticked up.

However, the reality is that, while interest rates may have ticked up, investors remain a country mile from enjoying an 8.5% return on a term deposit. So, while the presenters at Meet the Managers understandably discussed the issues raised by rising interest rates, investors are a long way from being able to come back down the risk curve with interest rates at their current levels. Which in turn means that while the tail wind for the New Zealand share market may have eased off, it is still a long way from experiencing any real headwinds from higher interest rates.

Disclaimer

The following commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

About Castle Point Funds Management Limited

Castle Point is a New Zealand boutique fund manager, established in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims. Castle Point’s investment philosophy is focused on long-term opportunities and investor alignment. Castle Point is Zenith FundSource Boutique Manager and Australasian Equity Manager of the Year 2019.

About Stephen Bennie

Stephen is a co-founder of Castle Point. He has over 25 years of investments experience and 18 years of portfolio management experience in New Zealand and abroad. Stephen holds a Bachelor of Commerce (Hons) in Business Studies and Accounting from the University of Edinburgh in 1991 and is a CFA charterholder.

More information can be found at:

| « Responsible goes retail: why Mint has opened the SRI tin | Effective vaccine, better earnings spur on markets » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |