Cigna applies new commissions for advisers

Cigna New Zealand has released details of its new commission structure that came into force at the beginning of this week.

Friday, April 16th 2021, 1:59PM  1 Comment

1 Comment

by Matthew Martin

According to Cigna's website, the new simplified commission structure will see advisers paid from month two for renewal commissions, all advisers will receive 100% commission, an "as earned" payment option has been introduced, and there will be more discounting options available.

Cigna's top brass made the announcements during a live webcast to more than 1200 advisers and industry commentators on Thursday last week, however, details of the changes were not publicly available at the time.

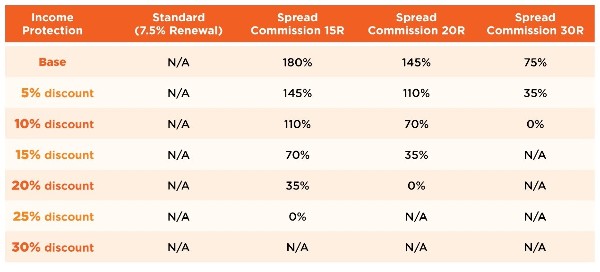

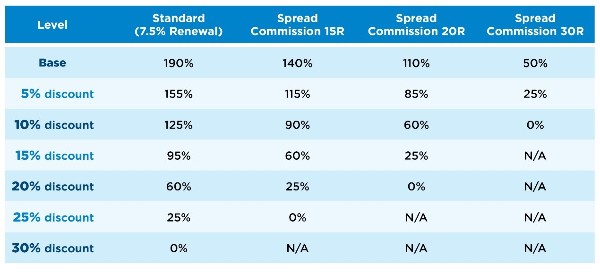

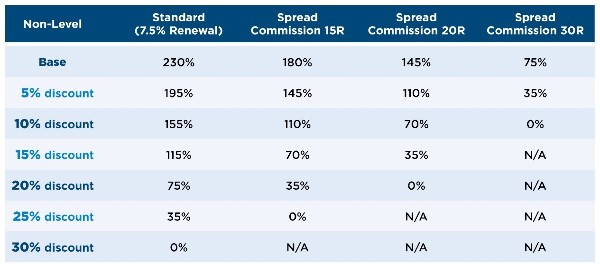

According to a release from Cigna, renewal commissions will now be paid from month two and any new benefits or policies issued from April 12 onwards will be on the new commission basis (see tables below).

"We recognise that the servicing of your customers doesn’t start from month 13, it starts from the moment their policy is issued.

"With the new regulatory environment you’re now operating in, we acknowledge the extra time and work you’ll be dedicating to your business," the company states.

Another change brought in by Cigna is that all advisers, regardless of persistency level and/or group affiliation, will now receive 100% of Cigna's documented commission rates.

"We can help facilitate any splitting of commissions you need to do, but you are in total control of where it goes."

Cigna has also introduced an "as earned" payment option where advisers get the option to receive commission payments over the first two years, instead of upfront.

"With this option, there’s no clawback if a policy was to lapse in the first two years."

Regarding discounting options, Cigna says it's added more selections to its discounting options.

"Updating our commission to include best in market features reflects our ongoing commitment to you and helps ensure New Zealanders have continued access to the quality advice you provide."

Cigna says if an as earned book is sold the commission will move to the new adviser and will continue to be paid monthly rather than as a lump sum.

There will also be no commission overrides for FAP holders, with the same rates available to all advisers, and Cigna says while it will continue to monitor persistency, conversion rates and customer feedback received, "this will not impact on commission rates provided."

| « Compass Life heads in a new direction after buy-out | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |

The As Earned discount options are the new bit that I find interesting, as this does provide true remuneration flexibility to the market.

How well it's used will be another story. But does open the door on more portfolio driven management in the risk space when building a new book (operating capital heavy, which is the challenge)