Covid could come back to bite Kiwi insurers

New Zealand's health and life insurers have weathered the initial storm of Covid-related claims but the Reserve Bank says future outbreaks could change the landscape and providers should be ready.

Tuesday, May 11th 2021, 12:58PM

by Matthew Martin

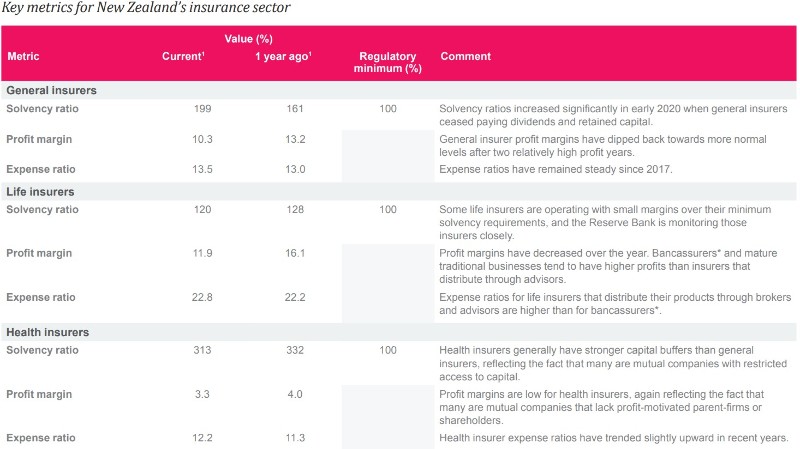

According to the RBNZ Financial Stability Report for May 2021, the insurance sector is in good shape stating insurers have retained capital during the period of economic uncertainty and solvency capital ratios remain high but they should be wary of overseas trends and future outbreaks.

"There remains a risk that further outbreaks could lead to significantly greater mortality rates and higher levels of claims on life insurance policies," the report states.

"There is also emerging evidence that Covid-19 can have recurring or long-lasting negative health effects on individuals who recover from the virus, and this may lead to elevated levels of disability and trauma claims over the long term."

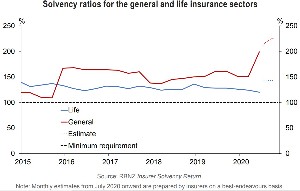

The RBNZ report also states the solvency ratio for the life insurance sector dipped slightly in June 2020 but is estimated to have increased to 143 per cent as at October 2020 (see graph). The solvency ratio for the health insurance sector remains above 300 per cent.

"There is a risk that as the size of overseas claim costs becomes clearer, overseas parent insurers may look to reduce financial support for their New Zealand businesses or seek higher dividends to shore up their financial positions," the RBNZ says.

Major New Zealand health and life insurers say they are ready for any challenges Covid can throw at them.

Just one of the insurers spoken to by Good Returns had claims for Covid-related deaths but all of them say they do not expect many claims for ongoing health issues caused by the virus.

Cheif executive of nib New Zealand Rob Hennin says nib extended cover on all hospital policies, at no extra charge, to include chest, lung, kidney, bladder or other treatments caused by Covid-19 until December 31 last year but they did not receive any claims for Covid-19 related treatment.

"However, the pandemic’s impact on healthcare treatment generally was profound and is continuing.

"Forecasting our general claims experience remains problematic while the threat of Covid-19 continues and without clarity about attrition in deferred healthcare activity as well as longer-term consequences for underlying demand.

"As such, we have retained AUD$60.4 million of our initial AUD$98.8 million group provision in recognition of treatment that is still deferred for our members," Henin says.

An AIA NZ spokesperson says the company has seen four claims for Covid-related deaths, otherwise very few other Covid-related claims have been lodged and "...the low levels of claims are as expected in light of New Zealand’s elimination strategy and tight border controls".

"We have put in place plans to manage these, and any future Covid-19 related claims, which focus on ensuring prompt claims processing and turnaround times."

AIA says teams have been working closely with impacted customers and Covid-19 lockdowns have meant customers haven’t always had access to their usual treatments and requirements.

"We have worked to address these challenges, for example completing rehabilitation via video conference instead of in-person sessions."

Fidelity Life chief insurance officer Kath Johnson says the impact of Covid-19 was not as bad as predicted with the company receiving only six Covid-related claims.

"That said, many New Zealanders have suffered financial hardship due to a loss in income...and we’ve been able to help hundreds of customers keep their cover in place until they’re able to get back on their feet again."

Johnson says none of their policies exclude Covid-19 and, providing New Zealand continues to keep the virus at bay, does not expect a dramatic increase in claims.

She says from March 18 2020, Fidelity Life stopped accepting new applications for redundancy cover, or for add-ons to existing policies, and they don't have plans to start accepting new applications again.

"An emerging area of interest is where a customer with an income protection claim is suffering from so-called ‘long Covid’.

"Rather than treating this as a Covid-specific claim, we’d apply our usual proactive intervention claims management approach which involves engaging workplace rehabilitation providers and obtaining guidance from the treating medical specialist and an occupational physician to design tailored return to work programmes.

"Research is still in its infancy in this area but aligning customers with the right rehabilitation team is essential, as it is with all other claim types."

| « Partners Life introduce nominated representatives | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |