Five KiwiSaver providers lose default status; Two new ones added

The government has slashed the number of KiwiSaver default providers from nine to six with five of the existing providers being removed from Dec 1.

Friday, May 14th 2021, 9:01AM  4 Comments

4 Comments

by Staff reporters

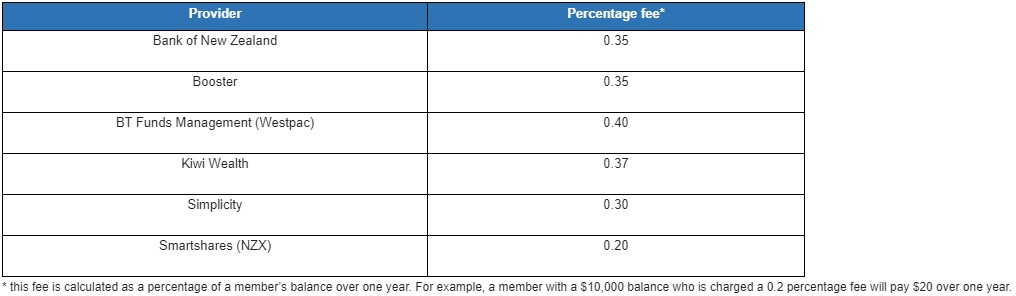

The two new providers are Simplicity and NZX's Smartshares while Bank of New Zealand, Booster, Westpac's BT Funds Management and Kiwibank's Kiwi Wealth retain their default status.

The five who will lose their default status are AMP, ANZ Bank, currently the largest provider, ASB, the second-largest provider, Mercer and Fisher Funds.

Finance minister Grant Robertson and commerce and consumer affairs minister David Clark said hundreds of thousands of New Zealanders will be "significantly better off in retirement" as a result of the changes, which include slashing fees and moving the default funds from a conservative to a balanced investment-fund type.

There are about 381,000 KiwiSavers in default funds because they were automatically enrolled when they started a new job but made no active decision about which provider they preferred.

The ministers said those joining the scheme at age 18 could have an extra $143,000 through lower fees and higher investment returns.

"The six default providers were selected because they offer the best value for money for their members in terms of lower fees and higher levels of service," said Clark in the statement announcing the decision.

The government had called for tenders in October last year and had signalled that providers would need to demonstrate they would go further to deliver more for default members.

Every seven years the government reviews the settings for default providers ahead of appointing a new set of default providers through a competitive tender process.

“We’ve also changed the default provider settings to enhance Kiwis’ financial wellbeing in retirement. This includes moving the default investment fund type from a conservative to a balanced setting to increase the likelihood of higher returns over the long-term.

“Another enhancement is ensuring default members receive higher service levels from their provider, including guidance at key points on their retirement journey to help them with things like selecting the right fund and contribution rate," said Clark.

The Government is also ensuring default funds are invested more responsibly, Grant Robertson said.

“We know many Kiwis care about where their money is invested, so we are excluding any investments in fossil fuel production. This reflects the Government’s commitment to addressing the impacts of climate change and transitioning to a low-emissions economy.”

“We’re sending a clear message to KiwiSaver members that the government believes they deserve much better bang for their buck," said Clark.

"Whilst default members will be transferred automatically, any KiwiSaver member will be able to choose to join one of the new default funds that will be available in the coming months.”

Good Returns will update this breaking news story later today.

Key changes to the default funds scheme:

- Six new providers will be appointed for the next seven-year term to provide services from 1 December 2021 (the appointments of the current nine default providers expire on 30 November 2021)

- The investment fund type has moved from conservative to balanced

- KiwiSaver fees will reduce, and will be simpler and more transparent

- Default providers will be obligated to engage with their members to help them make informed decisions about their retirement savings at key points

- Investments in fossil fuel production and illegal weapons will be excluded from default funds

- Default providers will be required to maintain a responsible investment policy on their website.

| « Mindful Money awards entries delight organisers | Mann on a mission to diversify financial advice » |

Special Offers

Comments from our readers

Good to see AMP out. They really do not perform that well and have effectively closed their doors anyway. The banks have also been looking to escape financial advice so again, a good move for them to be excluded.

I’d prefer to play in the higher margin higher balance Kiwisaver space currently dominated by the likes of Milford

Sign In to add your comment

| Printable version | Email to a friend |