Investors and traders both want good returns but are polar opposites

In this article we discuss how there are many ways to approach investing and the approaches of traders and long-term investors could hardly be more different.

Tuesday, May 18th 2021, 6:53AM  1 Comment

1 Comment

by Stephen Bennie

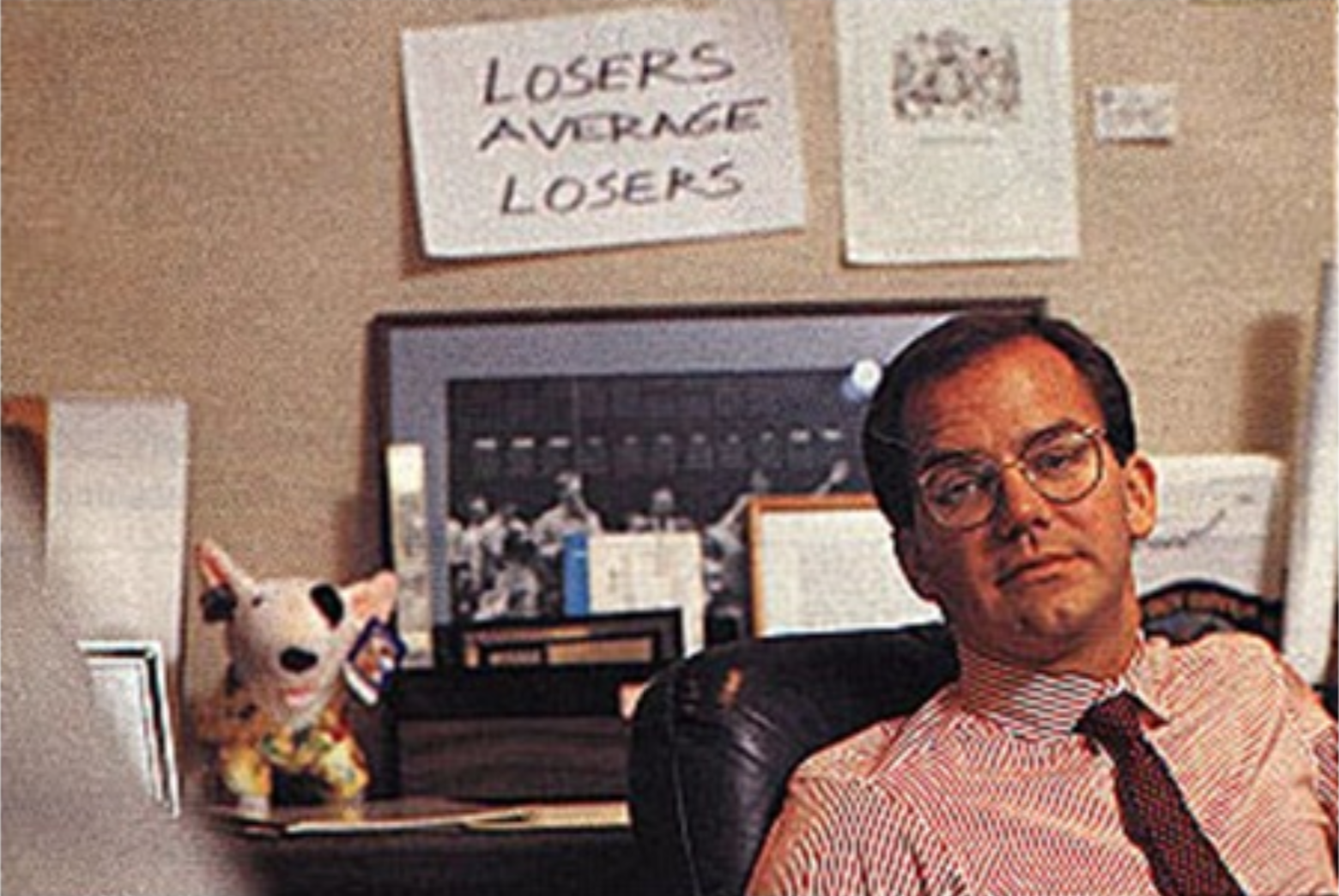

The grainy photo below shows a young Paul Tudor Jones from the mid1980s in the Stamford, Connecticut, office of his hedge fund, Tudor Investment Corporation.

This picture was from around the time that he correctly predicted and profited from Black Monday in 1987. It is estimated that he has since then grown his personal wealth to in excess of US$9 billion.

He is widely regarded as one of the most gifted macro traders of his generation. He was one of the contributors, or wizards, in one of the first books on investing that I read over 20 years ago, Jack Schwager’s excellent book, Market Wizards.

It is abundantly clear from this photo that Jones is first and foremost a trader, those famous three block capital words on the wall say it all: LOSERS AVERAGE LOSERS.

Experienced traders such as Jones have enormous respect for market momentum, it makes them rich when they are on the right side of it, but it can destroy them when they get on the wrong side of it.

And experienced traders are good traders because they have learnt this the hard way and as a result have it ingrained in their process. Or in the case of the young Jones, have a poster on the wall to remind him every time he lifts his head up.

Do not buy more of a losing trade.

A very important part of risk mitigation for traders is minimising losses. Many go into a position with a stop loss level already in place, in Jones speak this would be “winners sell losers”.

Essentially for the young Jones, it would be madness for an experienced trader to buy more of a position that was losing them money, “losers” average down.

Long-term investors, particularly high conviction stock pickers, have a polar opposite approach to their investments. And that is to be expected, given real long-term Investors operate with a five-year investment timeframe, while traders such as Jones can have an investment timeframe as short as five minutes.

For a stock picker a major component of their risk management is in-depth research and analysis that allows them to build a high conviction that the market has not realised that the company in question is trading at a significant discount to its long-term intrinsic value.

This creates a margin of safety that should shield an investor from any permanent loss of capital and at the same time create long-term wealth.

For a stock picker share price weakness is an opportunity to buy more shares at an even more attractive price. Averaging into a position creates even greater potential for future returns.

For them it is a case of “Don’t frown, just double down”.

Experienced stock pickers know that gains of 100% or more generally come from owning a company for several years. And at the same time, they know that at some point, or even several points, on that journey to 100% or more, the share price will have dropped by 25-50%.

Those fluctuations are inevitable, and a good stock picker takes advantage of those fluctuations and averages in.

For example, one of the best performers for the Ranger Fund was a long-term position that the fund had in AfterPay, the Australian buy-now-pay-later pioneer. It was held from 2017 until early last year.

During that time, it experienced three significant and separate sell offs, down 29%, down 30% and a drop of 55%. However, by holding through those periods and doing some averaging in, the fund ultimately made a gain of over 1,000% in AfterPay.

However, there has to be a caveat for the long-term investor, who is experiencing an investment going backwards on bad news. They have to reassess the investment case to determine that the long-term intrinsic value and upside remains.

Blindly doubling down and doubling down again, risks putting an investor into the “Losers average losers” camp. And as Jones well knows, you do not want to be that investor.

Ultimately though we believe being a long-term investor is the best way to create significant wealth.

And Jones has admitted that he would have created even more wealth for himself and his clients by staying in positions for longer.

| « Inflation about to hit Main Street | Pathfinder and ACC invest in All Black's mental health initiative » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |