Govt reckons it's tamed house price growth

The government claims that it has tamed raging house price growth through the changes it is making, primarily against property investors.

Thursday, May 20th 2021, 2:11PM

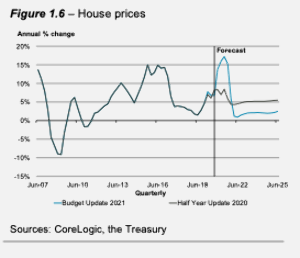

In the Budget Treasury forecasts that annual house price growth is forecast to reach a peak of 17.3% in the June 2021 quarter before easing to 0.9% by June 2022.

“This is a very sharp adjustment in house prices,” Finance minister Grant Roberston says. “But a very necessary one.”

Treasury says leveraged investors will be impacted the most as the removal of interest deductibility increases their tax liability.

“Highly leveraged investors will be more impacted than those less leveraged, implying that highly leveraged investors will demand fewer homes going forward.

“Furthermore, existing property owners facing higher tax costs may seek to divest to bring overall costs down. This will increase selling pressure and reduce demand in the market for existing homes.

Treasury says its forecasts assume that other buyer types will enter the market, moderating the downward pressure on prices. It says these buyers will won’t pay as muchas leveraged investors who exit the market.

“The overall result is that house price growth is forecast to continue, but at a significantly reduced rate compared to a scenario without the policy change.

Annual house price growth is forecast to reach a peak of 17.3% in the June 2021 quarter before easing to 0.9% by June 2022.

House price growth will rise to 2.5% in June 2025 after borders reopen, higher population growth and continued low interest rates.

“The slower pace of house price growth means house prices end up around 4% lower in June 2025 than forecast in the Half Year Update, and around 16% lower compared to an updated scenario without the policy change. “

Interest deductibility will remain in place for new builds for an undecided length of time, which is expected to result in a migration of leveraged investors from the market for existing property into the market for new residential developments. T

Treasury says this is likely to reduce the impact on house prices, as demand from some leveraged investors is redirected towards new housing rather than being lost entirely.

“Additionally, some owner occupiers and less-leveraged investors will be displaced from the new build market into the existing home market. To the extent that new and existing houses are substitutable, it is expected that prices across both markets will converge, but the incentives to build new properties are ambiguous and could vary by location.

“Nevertheless, the new equilibrium price for housing will likely be lower than without the tax changes, but higher than without the exemption for new builds.”

While the government is committed to the removal of interest deductibility for property investors but still does not know how much money it will raise.

“The removal of interest deductions could have positive fiscal impacts within the forecast period. The fiscal impact of the policy has not been quantified as this depends on final policy decisions.”

With its decision to extend the bright-line test it has not provided figures as the revenue raised will be outside the forecast period of the budget.

Of the three housing policy changes announced in March Treasury says in its economic update that “the removal of interest deductibility on existing residential properties is expected to have the largest impact on the housing market and the wider economy by significantly reducing house price growth over the forecast period.

“The extension of the bright-line test is likely to have a relatively smaller impact.

The Housing Acceleration Fund is expected to support business investment.

The centre piece of this year’s Budget is a lift to benefit payments, and this may be good news for property investors.

Main benefits will be lifted between $32-55 a week and student support increases $25 a week from April 1, 2022.

These increases could lead investors to increase rents, however Robertson says that is unlikely to happen.

However, Core Logic head of research Nick Goodall says there is evidence that when student allowances increase, rents in locations like Wellington and Dunedin also go up.

| « More money to police property rental laws | More policing of landlords ‘total waste of money’ » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |