Financial Advice NZ launches new liability cover offering

Financial Advice NZ has launched its new liability programme giving its almost 1700 members access to a range of insurance products including much sought after PI and runoff cover.

Friday, June 11th 2021, 6:28AM  3 Comments

3 Comments

by Matthew Martin

Financial Advice New Zealand chief executive Katrina Shanks says the new liability programme is for its members only and took seven months to put together with its broker Marsh New Zealand.

Shanks says the new insurance scheme is available to all advisers, including financial planners, and will start on July 1.

With PI insurance costs escalating, Shanks says the new liability programme offers great value for money and further incentives for members who qualify for "trusted adviser" status, plus runoff cover for FAPs and individual advisers.

"Professional indemnity insurance is a hardening market in these uncertain times due to the changing regulatory environment and the risk appetite of insurers, and the process to finalise this programme has been robust," she says.

"We have worked very hard on your behalf in a very difficult market.

"We know prices have gone up, but we have tried to keep them as low as we can and given you enough options to suit your business."

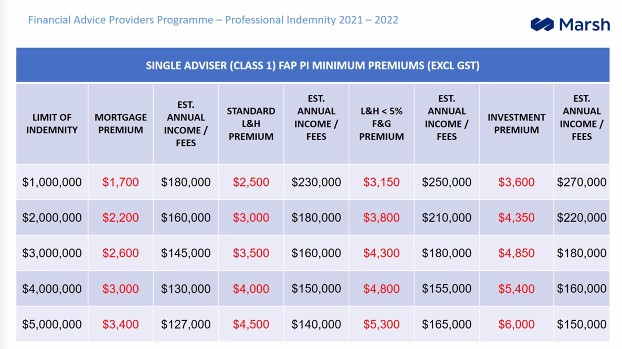

Class 1 FAPs (sole advisers with their own license), will face premiums ranging from $1,700 to $3,600, depending on the advice stream.

The liability programme will cover all advice provided by the FAP.

Meanwhile, costs for Class 2 FAPs (licensed FAPs with between 2-12 advisers) will need to pay premiums of between $2,250 to $4,300, depending on the advice stream.

Marsh New Zealand central region manager Marijke von Molendorff says the policies are being underwritten by NZI and QBE who have spread the risk 60% - 40% respectively.

She says the features of the programme are different depending on the size and licence class of each FAP and premiums are calculated based on income (see tables below) and people can pick and choose indemnity cover levels.

There are also premium reductions for FAPs with 80% or more of their advisers being marked as trusted advisers by FANZ, as well as options for runoff cover both before and after legislation changes on March 15.

Financial Advice NZ members can transfer from other schemes but some boxes need to be ticked, so it would pay to contact FANZ directly about this.

"Having an effective, sustainable, and comprehensive programme is important," says Shanks.

"Which is why we’re pleased to be able to offer a programme that meets the needs of FAPs in both Class 1, sole advisers, and Class 2, more than two financial advisers in a FAP.

"We believe what we have come up with is competitive in the current market and offers benefits that recognise you belong to Financial Advice NZ as your professional body."

Shanks says Financial Advice NZ has negotiated some outstanding extensions to the programme (see below).

Other aspects of the programme include:

• Continuation of monthly payment options for annualised premiums under $5,000 (+gst.) All Class 1 licence holders can pay monthly for a further 12 months regardless of the annual premium.

• Options to increase excesses to reduce premiums.

• You choose your limit of indemnity from $1,000,000 to $5,000,000, but with an option to provide an excess layer for higher limits.

• The premium is determined by the advice stream you provide, with a minimum premium payable.

• Depending on your advice stream(s) mix, you may be eligible for included Fire & General protection.

Premium Range for PI

• For a single adviser (Class 1) the FAP minimum annual premiums range from $1,700 to $3,600 depending on your advice stream(s).

• For multi adviser (Class 2) the FAP minimum annual premiums range from $2,250 to $4,300 depending on your advice stream(s).

Additional options

• Access to run-off cover for past advice

• You can also add on other insurance protections such as Management Liability with the following policies included:

- Public Liability

- Employers Liability

- Statutory Liability

- Directors and Officers Liability

- Legal prosecution defence insurance

- Employment disputes

- Cyber liability

| « Looking forward to full licensing - but don't wait too long | Mann on a mission to diversify financial advice » |

Special Offers

Comments from our readers

The outcome of a rate based on turnover is good, you will that the same rate may be applied whether a sole adviser or multiple adviser FAP - the premiums shown are most probably minimum premiums. How the premium is apportioned within a Class 2 Multi adviser FAP may mean that newer advisers with Turnovers of less than those figures above will see a better premium than a sole adviser, however a number of advisers who have fee incomes of much more than those above will see a large premium, especially when you take into account the need to buy run-off cover in addition at approx 90% of your expiring premium....

Clinton Stanger

Sign In to add your comment

| Printable version | Email to a friend |

There has always been an understanding that there is a cost to play, the upside for those with multiple advisers is the approach is at the FAP level and is based on turnover, so the per adviser premium rates could be more reasonable than for the single adviser operations.