Micro-investing platforms - the future is now

New research from the Financial Services Council (FSC) has revealed the surprising number of Kiwis using platforms like Sharesies, Hatch and Stake, why they’re using them, and what’s stopping those who haven’t yet jumped on the bandwagon.

Wednesday, June 16th 2021, 6:00AM

by Matthew Martin

The FSC research, The Rise of the Digital Investor, carried out by CoreData as part of the FSC’s ongoing Money and You series, provides one of the most comprehensive pictures of Kiwis’ views on micro-investing platforms.

However, there are concerns over the lack of regulation in the sector and whether people using the platforms were getting adequate financial advice.

“Over the past eighteen months we’ve seen the incredible rise of the digital investor, and our research has revealed that 38.2% of adult New Zealanders currently use, or plan to use micro-investing platforms," says FSC chief executive Richard Klipin.

"That's about 1.5 million Kiwis and reflects a transformational shift in how we are choosing to invest our money.

"That's no longer at the fringe."

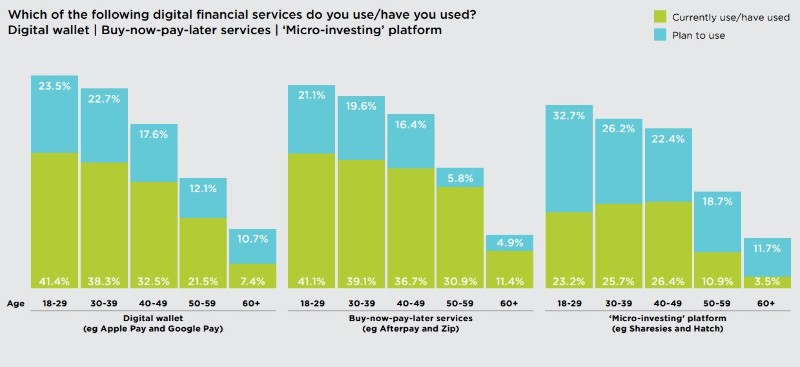

Klipin says the shift is particularly noticeable among younger New Zealanders, with around 55% of Generation Y (39-years-old or younger) likely to use them.

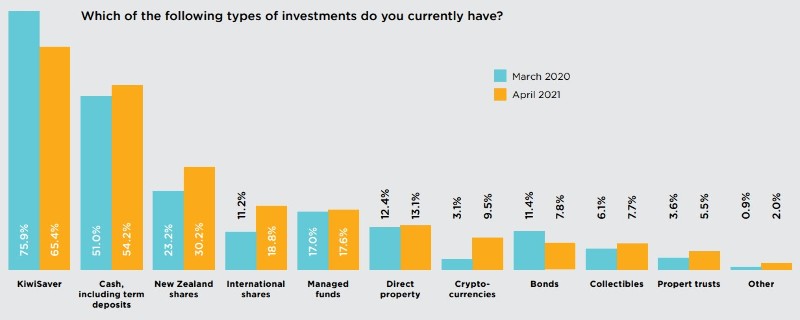

“The research shows that since early 2020 New Zealand has followed the global trend towards investing in shares, as well as more speculative assets such as cryptocurrencies. 21% of people are investing or have invested in cryptocurrencies – an increase of about 7% since March last year."

He says part of this is due to the rapid rate of tech adoption, which was turbo-charged by the pandemic, and the ease of access that tech provides makes investment more appealing for people who previously didn’t consider it as an option.

“It’s interesting to note the demographic differences. Younger generations and men are more likely to use these platforms than older New Zealanders and women.

"Over 40% of men use or plan to use micro-investing or digital currency platforms, compared to 32% of women who use or plan to use micro-investing platforms and 20% who use or plan to use digital currency platforms."

The research also shows over 90% of New Zealanders are using some kind of online platform for their banking, insurance and KiwiSaver, which points to a level of comfort and confidence in technology that has been around for a longer period.

However, despite the popularity of new technologies, New Zealanders remain wary of security and fraud.

“Most respondents were concerned with the risk of online fraud, identity theft or scams, that could result in financial loss,” says Klipin.

“Eighty per cent are concerned about online privacy - and after a number of high-profile cyber-attacks and ransomware attacks, it’s understandable and encouraging that many are wary about the privacy of their personal information and their finances when using online platforms.

He says it’s crucial the financial services industry, and the professionals who work in it, keep pace with new ways of investing and managing personal finances and provide the information to support considered financial decisions.

Ryan Bessemer, chief executive of Trustees Executors who supported the research, says it provides a unique insight into the ground-breaking and fundamental change that digital platforms are making to the way New Zealanders invest their money.

“Micro-investment platforms give consumers more control over their investments and will force better quality products to be available to the market," says Bessemer.

"Nevertheless, given this enhanced level of control, the value of good financial knowledge and advice is more important than ever before as we incorporate new tools and platforms into our personal financial planning.”

Bessemer says micro-investing and cryptocurrency investing platforms will probably be more closely regulated in the future and the lack of professional advice in the sector was a concern.

"Traditionally, people would have gone through the adviser channel and had someone holding their hands," Bessemer says.

"What are we doing to make sure people understand what they're doing and the risks involved?".

* The research was conducted via an online survey developed and hosted by CoreData. Data was collected between April 15 and April 26, 2021. A total of 2,035 valid responses were collected, which formed the basis of the analysis, and the report only included respondents aged 18 years or over.

* The sample is representative of the New Zealand consumer population in terms of age, gender and income based on the latest Stats NZ data.

Money and You: The Rise of the Digital Investor can be found here.

| « Britannia Financial Services rebrands - expands investment offering | Mann on a mission to diversify financial advice » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |