With its shares down over 50% year to date has The a2 Milk Company become of interest for value investors

In this article we revisit The a2 Milk Company to discuss if it now fits the criteria for a value investor.

Wednesday, June 30th 2021, 7:00AM

by Stephen Bennie

The a2 Milk Company (a2) has always been an interesting business, especially so in the past 5 years. From 2015 to 2020 the business delivered explosive growth. Revenues grew from $154 million in the 12 months to June 2015, to $1.73 billion in the 12 months to June 2020. Similarly impressive growth occurred at the bottom line, with profits increasing from $2.4 million to $388 million in the same corresponding periods, an increase of 16,000%! Scant wonder the share price rose from 70c to $20 over those 5 years of remarkable growth, as the company became a significant player in the global infant milk powder industry.

It is understandable then that by 2020 a2 had become a firm favourite with growth investors across Australasia and beyond. Indeed, it is highly unlikely that value investors have ever seriously looked at a2. Even back in 2015 when it was trading around 70c, it was not cheap on historic or current earnings, having been loss-making before carding a modest $2.4 million profit.

And then, in August last year, shortly after reporting its record $388 million profit, it became apparent to management that 2021 was going to be a tough year as Chinese demand for its infant milk formula collapsed amid increased competition. Just how tough 2021 was going to be has been consistently underestimated by management, which has resulted in a series of guidance downgrades as the 2021 financial year has progressed. The most recent announcement was perhaps the worst of all, a horrid update that indicated the current run rate was now loss making and that aging tins of infant milk formula were being literally dumped down the drain. At the time of writing this, a2 shares have fallen from a high last year of $21.70 to around $6.00, a drop of over 70%.

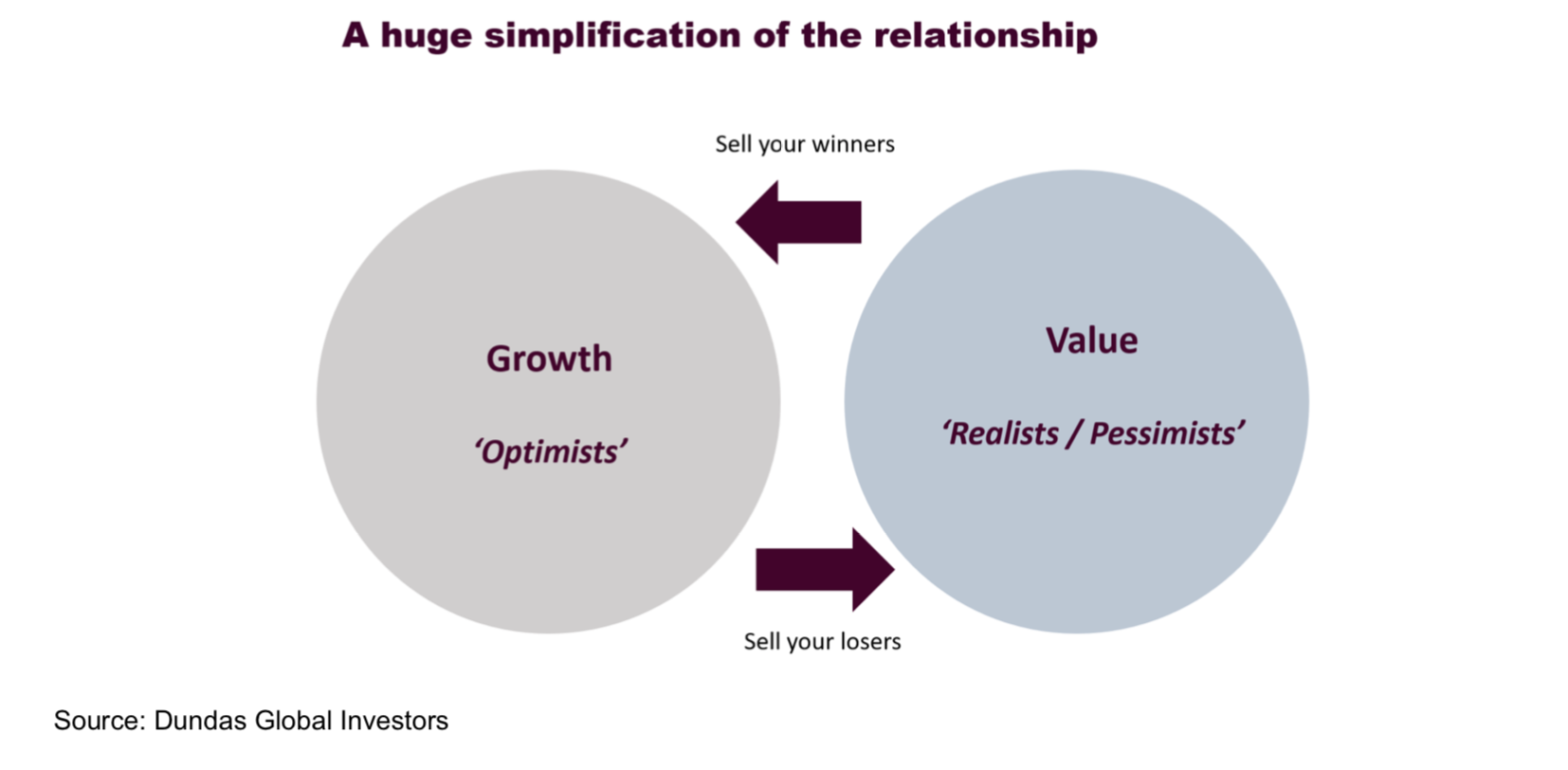

So, it makes sense to review the investment case of a2 milk via the lens of a value investor, to see if they might be getting excited. Before doing that I wanted to give some context to the discussion and in doing so reference this graphic that I have borrowed from Dundas Global Investors, a very experienced global equity investor based in my hometown of Edinburgh. It looks to show, in a simplified way, the relationship between growth and value investors. At their extremes, value and growth investors will generally not own the same company. The cardigan (with leather elbow pads) wearing value investor and the European sports car driving growth investor are not often sighted on the same company’s share registry. But as Dundas point out, there is sometimes a handing over of the baton as value investors sell their winners to growth investors. Sometimes the baton is passed in a different direction as growth investors sell their losers to value investors.

For example, Tourism Holdings was only of any appeal to a value investor back in 2012 when it was trading around 40c. It was a “dog with fleas” that only a cardigan wearer would have had the slightest bit of interest in. New Zealand and Australia were awash with camper vans but down on tourists, consequently earnings had cratered and so too had the share price. But a value investor that rolled up the sleeves of their cardigan would have been interested in the shares, given that they were trading at a 70% discount to the book value of the campervan fleet. Jump on 6 years, amid industry consolidation and a tourism boom, earnings had recovered and so had the share price. By the point that the Tourism Holdings share price had risen to over $6 and the share registry was strictly the domain of European sports car driving growth investors, as the shares were now trading at a 400% premium to the book value of its campervan fleet. Tourism Holdings was a winner that the cardigans were long gone from by that point.

For example, Tourism Holdings was only of any appeal to a value investor back in 2012 when it was trading around 40c. It was a “dog with fleas” that only a cardigan wearer would have had the slightest bit of interest in. New Zealand and Australia were awash with camper vans but down on tourists, consequently earnings had cratered and so too had the share price. But a value investor that rolled up the sleeves of their cardigan would have been interested in the shares, given that they were trading at a 70% discount to the book value of the campervan fleet. Jump on 6 years, amid industry consolidation and a tourism boom, earnings had recovered and so had the share price. By the point that the Tourism Holdings share price had risen to over $6 and the share registry was strictly the domain of European sports car driving growth investors, as the shares were now trading at a 400% premium to the book value of its campervan fleet. Tourism Holdings was a winner that the cardigans were long gone from by that point.

Returning to a2, the past 9 months have certainly seen growth investors selling a “loser“ but who have they been passing the baton to? The answer requires some guess work mixed with some deduction. The first cab off the rank would have likely been some growth investors selling to other growth investors, at the first profit warning. Next profit warning would have been a mix of that and a few early GARP investors. These are Growth at Reasonable Price investors; who tend to drive Japanese hot hatches in comfortable knit wear. The next profit warning probably had more growth selling and more GARP investors buying. The next profit warning had tardy growth investors waking up and selling and early GARP investors starting to sell to slightly more battle hardened GARP investors.

You will notice that I’m hesitant to say that value investors have been buying a2 in any serious way. This is because a2 is not ticking many of the boxes that would normally attract their interest. At current levels a2 is trading at a 380% premium to the book value of its assets, so it is not an asset play. It’s not cheap in terms of current earnings or next year’s expected rebound, the P/E ratio for FY21 is 48x and for FY22 it’s 25x. Another preferred approach for a value investor is to gauge how the current price relates to a normal mid-cycle level of earnings. That approach does not work for a2, there just is not the history that would give any indication of what that number might be. Another metric that would not entice value investors is that the enterprise value of a2 is still 3.1x revenues, which is higher than value investors typically like to pay for a company. The additional stumbling block for value investors with a2 is that its rise was so stratospheric and its subsequent fall so abrupt, that it is nigh on impossible to know what a bedrock steady state earnings might be, never mind trying to assess if it is cheap on that level of earnings.

Looking further down the track, a strong indication that growth and GARP investors are largely gone and that its now mainly owned by cardigan wearing value investors, is that the share price no longer goes down on bad news. That is because value investors are realists and accept that some bad news is part of life. Growth investors detest bad news, it punctures their rosy optimism, as well as the tyres of their European sportscars, and so they sell and are happy to do so at lower prices. Currently with the share price continuing to react badly to negative news, a2 clearly still has plenty of growth and GARP investors on the share registry. And likely only a handful of very early and unusually optimistic value investors.

Disclaimer

The following commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

About Castle Point Funds Management Limited

Castle Point is a New Zealand boutique fund manager, established in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims. Castle Point’s investment philosophy is focused on long-term opportunities and investor alignment. Castle Point is Morningstar Fund Manager of the Year 2021 – Domestic Equities.

About Stephen Bennie

Stephen is a co-founder of Castle Point. He has over 25 years of investments experience and 18 years of portfolio management experience in New Zealand and abroad. Stephen holds a Bachelor of Commerce (Hons) in Business Studies and Accounting from the University of Edinburgh in 1991 and is a CFA charterholder.

More information can be found at:

www.castlepointfunds.com.

| « Saving KiwiSaver: why contributions matter more than fees | For the first time FMA strips a manager » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |