Expansion accelerates taper talk

The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed income and equity markets.

Friday, July 9th 2021, 10:41AM

Key points

- The MSCI All Country World (global shares) Index rose 1.2% (in USD) in June. New Zealand and Australian shares (in AUD) also performed strongly, returning 2.8% and 2.3%.

- Bonds delivered a small gain, with the Bloomberg NZ Bond Composite 0+Yr Index returning 0.12% in June. The fall in 10-year government bond yields in New Zealand was muted (falling just 0.03%) relative to the US, who saw their 10-year Treasury yield fall 0.13% over the month. Globally yield curves flattened in June.

- The market has sided with policy makers in deciding that inflation is transitory, for now. US headline inflation is currently 5% year on year, surveys suggest prices paid by firms are at historic highs and consumer inflation expectations have started to increase.

Key developments

Globally, equities were up 6.9% in USD (+7.2% in NZD) in the June quarter with stronger economic growth supporting earnings forecast increases. There was some real variation in returns across global markets and equity sectors during the month and quarter as investors factored in the battle between constructive reflation, pockets of inflation, the impact of the delta COVID-19 variant and risks around central bank monetary policy settings.

Australia was one of best-performing developed markets up 8.3% (in AUD) over the June quarter with its relatively large weight to banking stocks benefiting from better-than-expected domestic economic activity and its high weighting to resource stocks benefiting from better-than-expected global economic activity and supply shortages.

In contrast, weakness in New Zealand secular growth stocks including a2 Milk, Ryman, Auckland Airport, F&P Healthcare reflected stock-specific earnings uncertainty, investors switching to cheaper cyclical stocks and investors being wary about the impact of higher long term bond yields on the valuation of these long duration stocks. This meant the New Zealand share market only delivered a +0.9% return for the quarter.

The New Zealand market had a solid June month with a rebound in secular growth stocks driving the market up 2.8% as global long term bond yields fell, reflecting mixed economic activity and central banks, particularly the US Federal Reserve, leaving easy monetary policy conditions in place.

The global economy is continuing to charge ahead, powered by continued policy support and ongoing vaccine rollout that is allowing reopening. Policy uncertainty is the lowest in 15 years and financial conditions are extraordinarily loose. 25% of the global population has received at least one vaccine dose. If the recent pace of vaccinations continues, 80% of the world’s adult population will be fully vaccinated by the end of this year.

Vaccine success is translating into higher growth expectations as service sectors can reopen more quickly. The euro area, for example, is now expected to grow almost 5% this year (versus an expectation of 4% in April).

The Reserve Bank of New Zealand’s (RBNZ) objectives of 2% inflation and maximum sustainable employment are close to being met. Core inflation is 2% and headline inflation is likely to have increased to 2.7% year on year in Q2. Measures of capacity utilisation in the manufacturing and building sectors are close to all-time highs. Record-high job vacancies suggest the unemployment rate will continue to fall from an already low 4.7%.

The New Zealand Institute of Economic Research’s latest Quarterly Survey of Business Opinion (QSBO) further reinforced the underlying confidence in the economic recovery with sentiment well above pre-COVID levels.

What to watch

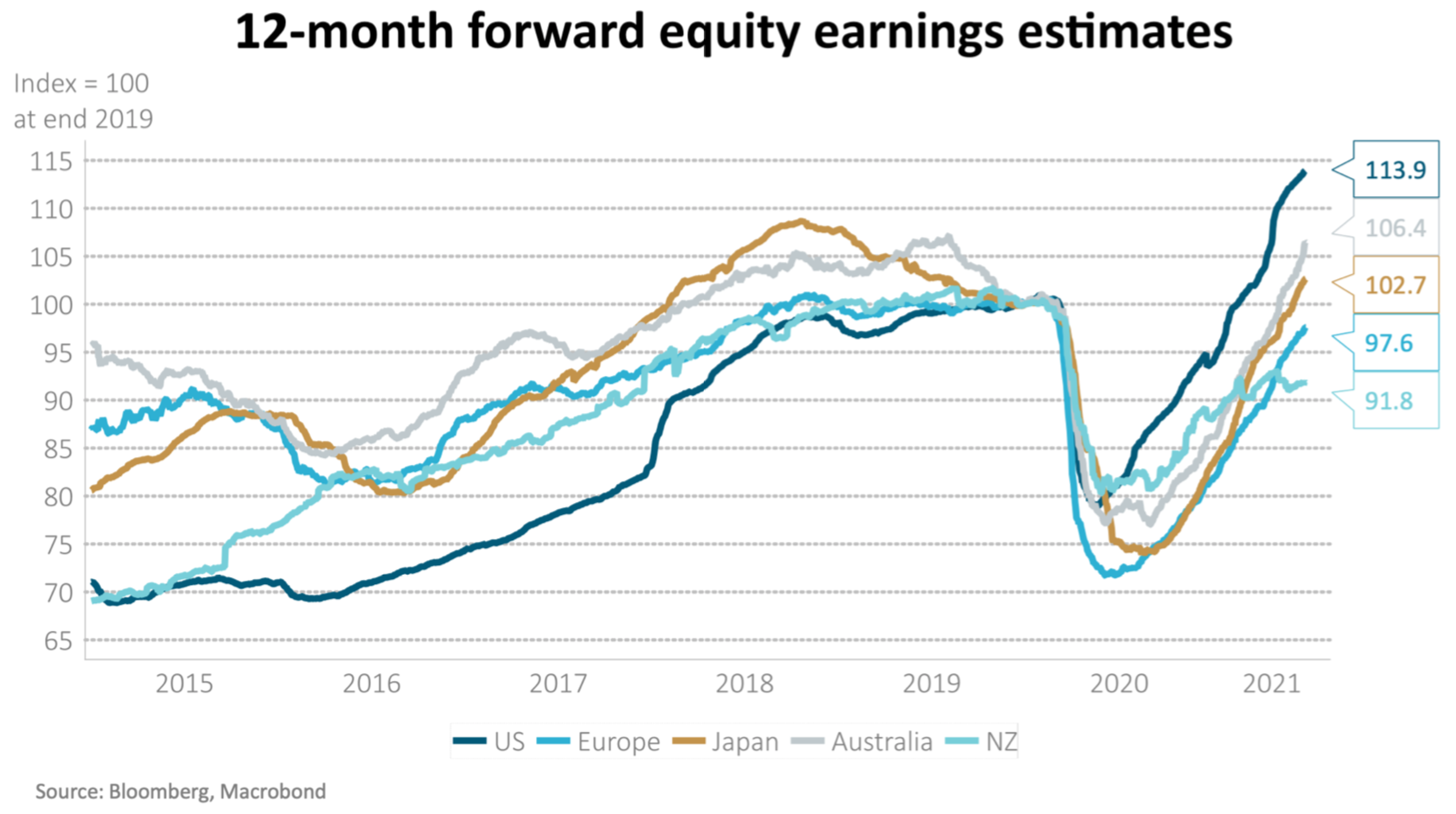

Earnings: While much of the talk in markets has been about interest rates, which are no doubt a key input into valuing equities, less attention has been paid to a factor which, over the long term, can be far more powerful, earnings.

As can be seen below, the earnings recovery has been extremely strong, with the US leading the way globally. So far this year, 2022 estimates for the S&P 500 have been upgraded by 14%. In our view, the risk of positive earnings surprises is still tilted to the upside.

Market outlook and positioning

While we are currently in a ‘Goldilocks’ environment for share markets, whereby economic growth is strong and central bank monetary policy settings are supportive, we may be entering a macro-economic backdrop which is less supportive, with a peak in the rate of economic growth and a peak in financial liquidity support.

The potential for gradual monetary policy tightening, with central banks removing ultra-supportive settings such as low official rates and quantitative easing, may contribute to periods of market and sector volatility as investors seek to position in advance of potential changes. It may also contribute to a moderation in investor risk appetite over time.

Within equity growth portfolios, we are overweight relative to their benchmarks in selected quality growth companies in the healthcare and information technology sectors, where the potential rate and sustainability of growth may not be fully reflected in share prices.

The portfolios have selected investments in cyclical growth stocks in the financial and materials sectors that may benefit from structural change. Conversely, the portfolios are underweight to the New Zealand energy sector where disruption risk remains high, and the utilities, communications and real estate sectors where valuations are high relative to their potential growth.

Within fixed interest portfolios, our investment strategy has continued to reflect a positive view of the economic outlook and that this brings higher inflation risks. We expect the RBNZ to hike the OCR more than market pricing suggests. We see the New Zealand economic recovery being more advanced than most developed countries, and that, in time, offshore central banks will also hike rates earlier than currently anticipated.

This outlook leads to a view that both short- and longer-dated bond yields will rise. We expect this to bring soft returns from fixed interest and we have been selling longer-dated bonds as yields drift lower.

The Active Growth Fund’s weight to share markets remains marginally above its benchmark index weight. While shares have come a long way off their March 2020 lows, the recovery has pleasingly been, partly at least, driven by strong earnings growth. The Fund is anchored in selected growth strategies which will benefit from structural tailwinds or strong thematics, complemented with quality defensive yield strategies.

The Fund has reduced its investment in value-orientated strategies; while these strategies have served the Fund well during a period of value outperformance, some elements of the reflation trade seem to be entering a period of fatigue.

The Income Fund’s investment strategy has been largely focussed on continued evidence that the recovery from COVID-19 disruption is nearly complete in the world’s developed economies.

From here, we are expecting economies to settle into a more stable expansion phase, underpinned by the large fiscal and monetary policy support that has been provided over the last 12 months. These stimulatory settings mostly remain in place, even though some fiscal packages are dropping off.

This does not constitute advice to any person. www.harbourasset.co.nz/disclaimer

| « For the first time FMA strips a manager | Woman loses over $100k in Forex scam » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |