Kiwis concerned about retirement savings

More than 60% of New Zealanders are worried they will not have enough money to support themselves in their retirement, a new KiwiSaver study shows.

Wednesday, July 28th 2021, 1:09PM

by Matthew Martin

According to research undertaken by the Financial Services Council (FSC) - KiwiSaver at a Crossroads - almost three-quarters of those surveyed would also like KiwiSaver to be compulsory and support an increase in contribution rates.

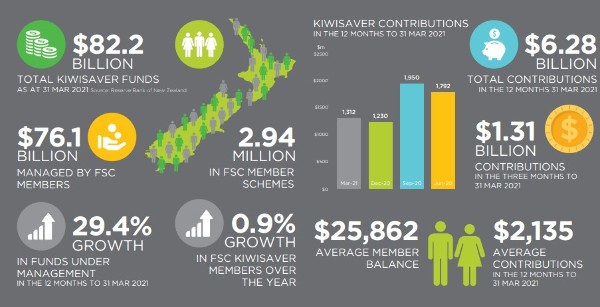

However, with the average KiwiSaver balance sitting at just over $25,000 many Kiwis will find it difficult to retire comfortably.

As KiwiSaver celebrates its 14th birthday this month, the FSC has released new research looking at what New Zealanders think about the scheme that has around $82 billion invested, the role it plays in their retirement preparedness, and where it needs to head in the future.

“This research shows that New Zealanders overwhelmingly support KiwiSaver and want its role to be increased”, says FSC chief executive Richard Klipin.

“With 78% supporting compulsion and almost three quarters (73%) supporting an increase in contribution rates, there is widespread public support for action in both areas.

“As an additional indicator of support almost 80% of respondents thought they were getting value for money for the KiwiSaver fees they pay."

Klipin says the research also found New Zealanders are deeply worried about not having enough savings for their retirement.

“64% of New Zealanders, which represents 2.5 million people, are worried they won’t have enough to retire comfortably or afford where they want to live.

“With the average KiwiSaver balance just over $25,000, there’s a yawning gap between what New Zealanders have in their KiwiSaver and what they need to save," he says.

“That means most Kiwis will fall short of being able to fund a modest retirement, let alone a comfortable one."

Klipin says when you consider property ownership is on the decline and many younger Kiwis probably won't own their own homes by retirement, $25,000 is not going to be enough.

“With 17% of New Zealanders not contributing to KiwiSaver at all and more than 30% contributing only the minimum 3% there’s no doubt that we need to do more to help New Zealanders build their KiwiSaver balances,” says Klipin.

Financial literacy was also an issue with a quarter of survey respondents saying they didn't know how much they needed in retirement, and 22% didn't know the balance of their KiwiSaver.

Klipin says that while overall, the findings show New Zealanders strongly support changes to KiwiSaver, a wider discussion is needed and there is a trade-off between the pace of change and affordability.

“Implementing changes as part of a phased approach would help ensure that vulnerable customers are not thrown in the deep end right away and have time to prepare for any significant changes to the KiwiSaver scheme.

“KiwiSaver has made good progress over its first 14 years, and we hope this research illuminates some of the issues and the possibilities for a way forward.

“Getting these issues right is not easy and we don’t claim to have the answers."

The research was conducted online between April 15 and 26 by CoreData and collected a total of 2,035 valid responses. It is representative of the New Zealand consumer population in terms of age, gender and income based on the latest Stats NZ data.

| « Westpac drops KiwiSaver fees | KiwiSaver rides the waves » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |