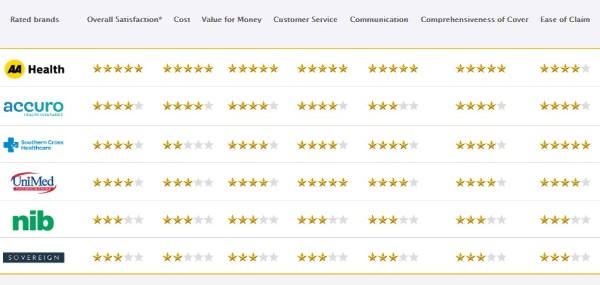

Canstar's top five Kiwi health insurers

According to a recent survey, AA Health Insurance has won this year's Canstar Most Satisfied Customers Award.

Wednesday, July 28th 2021, 3:13PM

by Matthew Martin

After a year when Covid-19 rocked the world, Kiwis say value for money remains their top priority when it comes to health insurance.

The insight, revealed in a Canstar survey to find New Zealand’s favourite health insurer, shows how policy cost remains a major tension for customers seeking cover.

The survey showed AA Health Insurance was the winner of this year’s Canstar Most Satisfied Customers Award, winning the title for the first time while picking up 5-stars for its cost and value-for-money proposition, alongside other key drivers of satisfaction, such as customer service, communication and comprehensiveness of cover.

However, it is important to note the AA Health policies are underwritten by nib NZ, which ended up fourth in the top five.

In the 2020 survey, nib NZ was third, AA fourth and UniMed was first.

Canstar NZ general manager Jose George says the past year has meant healthcare is now, more than ever, front of mind for many Kiwis.

“Health concerns are paramount at present and New Zealanders are understandably concerned about cover and if they can afford it," says George.

"AA’s sweep of 5-star ratings in key satisfaction drivers such as cost and value shows they are meeting these customer needs. AA is clearly ahead of the market in this regard, and they should be very proud of this award.”

AA Health Insurance strategy and delivery general manager Mark Savage says AA is delighted to receive the recognition from customers.

“In what can only be described as a challenging year, it’s great to see our customer-centric strategy resonating so positively,” says Savage.

“Building trust and offering the right support for our customers is our top priority and receiving this award is the cherry on the top.”

Health insurers’ response to Covid was also noted by customers in the survey.

AA Insurance and most other insurers offered eligible customers a Covid-19 support package, which included the option to suspend their health insurance policy and premium payments, some for up to six months.

Such moves may have contributed to the rise in Kiwis who are comfortable with the overall cost of healthcare, up from 45% last year to 52% now.

However, a quarter of Kiwis say they can only afford a surgery and specialist policy, as broader cover is too expensive.

Further, the "peace of mind" felt by Kiwis who hold health insurance has dropped, suggesting continued fears as the pandemic continues to ravage the world.

The survey also revealed the average monthly spending on health insurance was just under $200 per individual.

In Auckland, the cost rises to $213, while those aged over 70 are spending $362 on average each month.

According to Canstar, only people who had a health insurance policy and had made a claim in the last twelve months were included in the health insurance results, in this case, 1029 New Zealanders.

Brands must receive a minimum of 30 responses to be included in the awards however, some brands may miss out due to low sample size.

| « Input from insurers on solvency standards | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |