Climate fund makes first investment

The new Climate VC Fund, managed by Lance Wigg's Punakaiki Fund, has made its first investment.

Thursday, August 26th 2021, 7:48AM

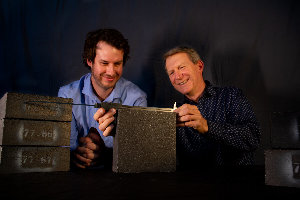

The Climate Change Venture Capita Fund's first investment is into MGA Thermal, an Australian clean energy company that uses state-of-art metallurgy to create shoebox-sized composite blocks for storing renewable energy.

“The company perfectly fits our criteria, which is to deliver venture-level growth and financial returns, alongside high emissions reductions. I’m excited to see this technology developing rapidly and delivering very large emissions reductions,” Dr Jez Wilson says.

CVCF joins several investors in an A$8 million funding round that will see MGA Thermal expand manufacturing capacity and export its thermal energy storage systems globally. The capital raise was led by Main Sequence Ventures, Australia’s deep tech investment fund founded by CSIRO, with participation from the Climate Venture Capital Fund and other Australian investors.

As fossil fuels are replaced by renewable energy sources, utilities face the ongoing challenge of storing huge amounts of dispatchable energy to meet demand in off-peak or high-demand scenarios. MGA Thermal’s solution enables conversion of existing infrastructure, including coal-fired power plants, into grid-scale energy storage or creation of new supplementary infrastructure alongside renewable sources to provide continuous, dispatchable energy.

This could help New Zealand avoid using coal to power the grid when renewable power is low.

The technology behind MGA Thermal is Miscibility Gap Alloy (MGA) technology – extraordinary shoebox-sized blocks that are capable of receiving energy generated by renewables, storing it cheaply and safely as thermal energy, then using it to run steam turbines at thermal power stations.

The blocks, which can be stacked like building blocks or bricks, are able to store enough energy to run a power station, in a cheaper, safer and longer-lasting way compared to other dispatchable solutions. A stack of 1000 blocks — about the size of a small car — has enough energy stored to power 27 homes for 24 hours.

MGA Thermal is working with partners to deploy the technology in Australia, Europe and North America. The company plans to double their team in the next 12 months as they scale towards making hundreds of thousands of MGA blocks per month.

“Our mission is to help accelerate the shift to renewable energy by providing a new way to store energy that’s clean, economical, and scalable. We are gratified by our investors’ recognition of our achievements and their confidence in our ability to execute on this exciting new phase of growth,” says Erich Kisi, chief executive of MGA Thermal.

“We believe that thermal storage will play an important role in the energy transition, and are overwhelmed with international and domestic interest to date. The potential opportunities and use cases for our technology are extensive. Whether it’s retrofitting our thermal power stations, providing power to remote communities, supplying heat to industry, heating houses and commercial spaces, or heating for electric vehicles, this can all be powered using renewable energy stored in our MGA blocks.”

| « Sticky investment for Pathfinder | Green bond market gets a boost » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |