How much more life insurance needs to be sold

Swiss Re calculates how more life insurance needs to be sold to bridge the underinsurance gap - and the number is huge.

Tuesday, September 21st 2021, 2:31PM  7 Comments

7 Comments

by Matthew Martin

Swiss Re has released its first report covering New Zealanders' attitudes and behaviours towards life insurance and estimates the mortality protection gap (MPG) for New Zealand households – the gap between households' financial resources and the protection they need to maintain their standard of living in the event of the death of a primary earner – at $670 billion.

The report - Closing New Zealand's mortality protection gap - also estimates the MPG will rise to $750 billion within the next 10 years due in part to rising consumption and household debt levels.

Swiss Re says the industry needs to act now considering that only 39% of people surveyed own a life insurance policy.

More than 80% of those surveyed believe that losing the income of the primary earner will affect their family significantly and that almost two-thirds of households in New Zealand have some form of MPG.

Swiss Re estimates that less than 36% of households in New Zealand have enough assets to weather the financial shock the loss of the primary earner would present.

The remaining, over 64%, face a gap of differing degrees of severity with about a fifth of households having just 10% or less of the financial resources required to cover their protection needs - in other words, a protection gap of 90%.

Swiss Re estimates the MPG per household in New Zealand at more than $830,000.

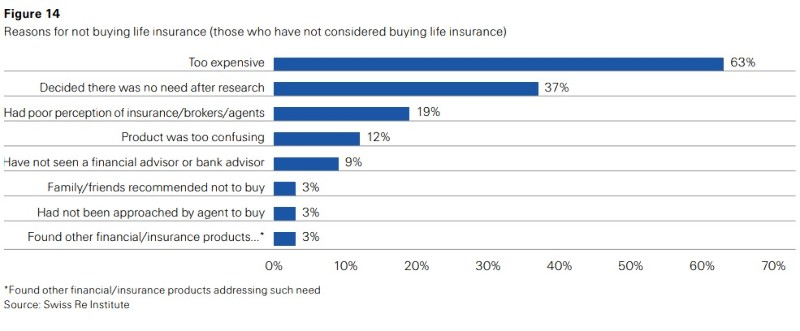

The report also examines how to close the gap in New Zealand, but it won't be easy with the report finding that perceived high cost of life cover is the key reason not to buy life insurance with almost two-thirds of respondents considering it too expensive to buy.

The report states that to address cost concerns, insurers could consider offering products with flexible premium payment options and coverage terms, flexible mortality products with different pricing and sum-assured options, or commission-free online/direct insurance to lower the cost.

However, buying life insurance is not a preferred option to enhance protection for New Zealanders.

On average, only 16% of survey respondents would buy life/mortality cover and all age groups aimed to earn more, spend less and invest more to cover the gap.

Swiss Re's New Zealand head of life and health Kresh Wright says insurers need to understand their communities and their needs and vulnerabilities in designing products and services.

"We must also recognise and address the obstacles to New Zealanders protecting themselves and their families. Now is the time to act to close the protection gap and strengthen resilience in New Zealand."

Swiss Re's head of life and health for Australia and New Zealand, Leigh Watson, says the industry has a role to play in helping households understand their financial exposure "...and there is no better time to do this than in response to the unfolding global health crisis".

"We as life insurers have a unique opportunity to ensure that our insurance offerings and benefits are sustainably designed and priced, providing value for our consumers and adequately reflecting underlying risks from unexpected events," says Watson.

| « Southern Cross boosts surplus profits; Claims paid tops $1 bill | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

The calls to action around sustainable products and pricing are truisms and have been for a long time, Are they saying the current products and pricing are not sustainable ?

The MPG at $670 Billion = 200% of GDP. Knee jerk response is that that seems a lot.

Also the headline says - how much more needs to be sold.

Perhaps the buyer has a different perspective. What is the answer to the question "how much more insurance needs to be bought?"

Don't more than 85% of those born live to over 65?

And what % of death policies actually transacted over say the last 30 years ended up being paid out as a claim - i.e. the insured died in circumstances where the policy responded?

Clients surely need to assessed against their needs reconciled with an ability to pay with the potentially conflicting priorities of using disposable income for protection or for wealth accumulation.

The headline number seems high and higher than other independent assessments as mentioned above. Is this re insurer using a recognised methodology or just pushing an agenda?

The best way insight is from the reasons for not buying and unexpectedly the main reason is cost. It could be that families are focusing on the need for wealth accumulation (including paying off the mortgage) rather than protection through life insurance.

The suggestions actions seem very vanilla. The usual pushing of commission free direct products is rolled out. Not sure how that fits in with learnings from FMA reviews and the AU royal commission.

Given the relative low number of insureds, I'm curious to know how two-thirds of those surveyed know how much life insurance costs in the first place to make such a judgment.

It's clearly a convenient excuse.

Perhaps some more value discussions versus cost discussions are in order.

I'm convinced underinsurance here in NZ has far more to do with entrenched welfareism than anything else.

Sign In to add your comment

| Printable version | Email to a friend |

There is clearly a gap and also they are using a different methodology but is anyone surprised that Swiss Re who make money out of NZers spending more on insurance are saying the gap is higher.

Massey seemed to say the morbidity gap around ongoing income and also the cost of permanent disablement was much higher.