KiwiSaver funds soar, non-contributors still a worry

More than 1.2 million KiwiSaver members did not invest in the scheme in the year to March 31, showing that while KiwiSaver has hit new heights in funds under management, there are big opportunities for providers and advisers.

Tuesday, September 28th 2021, 9:04AM

by Matthew Martin

The FMA's Paul Gregory.

The Financial Markets Authority (FMA) has just released its KiwiSaver Annual Report for the year ended March 2021, which shows total funds under management reached $81.6 billion, or double the $40.8 billion held in 2017 (see table below).

Overall membership increased 2.1% to 3,090,631 and the number of members who contributed to their accounts increased 3.9% to 1,883,118.

However, those in the scheme not contributing totalled 1,207,513, or 37%, and fees collected by providers cracked the $650 million mark.

Compared to last year, where KiwiSaver made an $820 million loss due to a market downturn around Covid-19 concerns, this year's results show a sharp rise with investment returns skyrocketing to $13.2 billion - a staggering 1708% increase.

FMA director of investment management Paul Gregory says the last year was momentous for KiwiSaver, with unprecedented growth after weathering market difficulties.

Combined fees revenue was $650.3 million, up 20.7% from last year while funds under management increased by 31.7% to $81.6 billion.

Gregory says the rate of growth in fee revenue was a function of the percentage-based investment management fees that providers take as a cut of their members’ balances, not a sign that fees charged were increasing.

“Our focus on value for money over several years has been based on providers generally not passing on the benefits of KiwiSaver’s growing scale."

But Gregory says there are some encouraging signs with several managers reducing their investment management percentage fees to increase the value provided to their investors.

"Over time we are looking to see this approach to value for money to continue, so the current trend of KiwiSaver managers as a whole earning strongly increasing income from fees should slow and stabilise.”

He says that trend was evident with fixed fees, or administration fees, which decreased by 4.8% to almost $80.8 million, as a number of KiwiSaver schemes reduced them or changed their structure.

“This is appropriate, as these fees were only intended to help providers cover costs in KiwiSaver’s early stages,” Gregory says.

Gregory says the year also saw significant shifts in the FMA's regulatory focus for KiwiSaver providers with two important pieces of guidance for fund managers being released - one focused on the accurate labelling of funds' ethical and responsible investment claims, the second focusing on value for money.

“Reflecting on our guidance and the Government’s changes to the default providers coming into effect in December, we believe both will improve outcomes for investors, impacts which will play out over the long term.”

The report shows only a small minority of investors are choosing funds explicitly labelled as responsible or ethical, however, a broad range of research shows that many investors are increasingly expecting that their provider will be taking a responsible approach to investing their money.

FMA’s research has shown that 31 of 37 schemes claim that they consider aspects of responsible, ethical or ESG investment in their decision-making.

KiwiSaver Annual Report by the numbers:

Total membership: 3,090,631 up 2.1%

Average (mean) balance: $26,410 up 29%

Total funds under management: $81.6 billion up 31.7%

Investment returns: $13.2 billion up 1708%

Members contributing: 1,883,118 up 3.9%

Members not contributing: 1,207,513

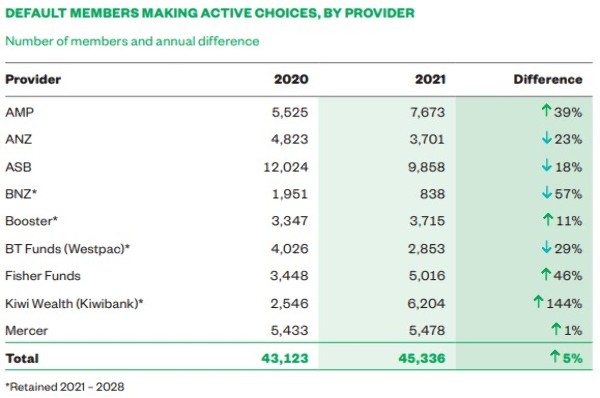

Members in default funds: 356,021 down 6.6%

Total member withdrawals: $3.05 billion up 7%

First home buyer withdrawals: $1.4 billion up 18.8%

Combined fees revenue: $650.3 million up 20.7%

Members salary/wages contributions: $4.8 billion up 16.3%

Government contributions: $891 million up 6.1%

Employers contributions: $2.7 billion up 19.5%

| « Experts ponder compulsory KiwiSaver | ANZ scales up, drops membership fees » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |