Bad backs dominate health cover claims

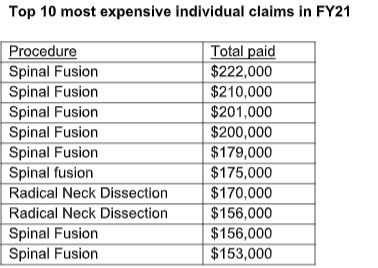

Surgery for bad backs has topped the list of most expensive surgical claims funded by Southern Cross Health Insurance with the highest individual claim coming in at $222,000.

Friday, October 1st 2021, 11:43AM

by Matthew Martin

In the year to June 30, eight of the top 10 most expensive health insurance claims paid by Southern Cross were for spinal fusions - surgery which permanently connects two or more vertebrae in the spine – with four claims topping $200,000.

Over the year, Southern Cross paid out more than three million claims valued at $1.12 billion.

Southern Cross chief medical officer Stephen Child says the expense and volume of these claims demonstrate the value and benefits of health insurance.

The next two most expensive claims were for radical neck dissection surgery, which involves the removal of cancerous tumours, with each claim totalling more than $150,000.

Child says spinal fusion is a highly complex procedure and therefore can be very costly.

“Spinal fusion surgery is a very serious procedure that’s typically performed by an orthopaedic surgeon or a neurosurgeon.

"Often it involves the implantation of extensive metalware and artificial bone, which results in additional cost and expense.”

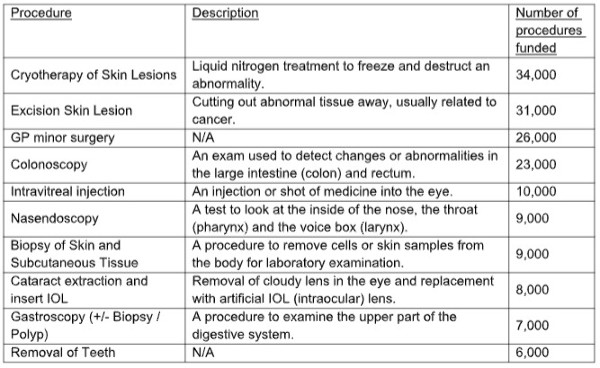

When looking at the most common claims paid by Southern Cross, the highest by volume was cryotherapy procedures (34,000 individual claims), followed by excisions of skin lesions (31,000) and minor surgery performed by a GP (26,000).

Cryotherapy breaks down skin lesions or skin abnormalities at the site through freezing. A skin excision procedure involves the cutting of abnormal tissue away from healthy tissue.

Colonoscopies, which look for signs of bowel cancer and investigate causes of pain, bleeding or changed bowel habits, were the fourth most commonly-funded procedure, with 23,000 claims paid by Southern Cross.

“Given the high incidence of skin cancer in New Zealand, it isn’t surprising skin lesion removal is one of the most common procedures we fund,” Child says.

Although the individual claim costs can be high, Southern Cross Health Society’s affiliated provider programme has helped to dampen rising healthcare costs, achieving more than $220 million of savings for members through the programme since 2012.

| « [UPDATED] Feedback prompts changes to Asteron's trauma cover | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |