Fidelity aims to take number two spot

Fidelity Life has set its sights on becoming the second-largest life insurer in the country but won't be paying any dividends this year, according to the company's annual report.

Tuesday, October 12th 2021, 2:19PM

by Matthew Martin

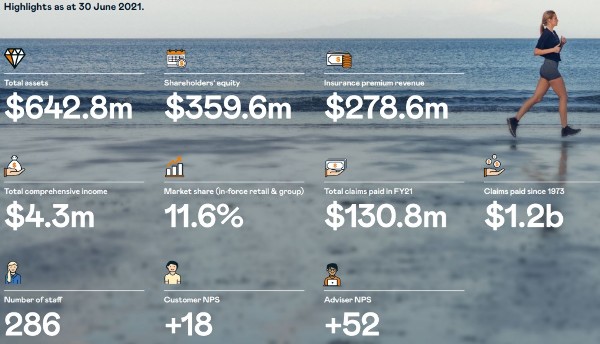

Fidelity Life remains the largest Kiwi-owned life insurer and has recorded an underlying profit for the year ended June 30 of $22.5m, up from $20.3m in 2020.

Total comprehensive income fell to $4.3m from $17.9m in 2020, reflecting a total of $9.3m invested in key transformation projects (net of tax), including the firm’s new technology platform and the proposed acquisition of Westpac Life.

Board chairman Brian Blake says the $400m Westpac Life deal was one of the most significant events in the company’s history and, once completed, would see Fidelity Life welcome Ngāi Tahu Capital as a major shareholder alongside the NZ Super Fund.

"We expect our in-force market share to grow from 11.6% currently to around 17%, positioning Fidelity Life as the country’s second-largest life insurer," Blake says.

"We expect to complete the deal at the end of 2021, pending regulator and shareholder approvals."

He says Project Watson (Fidelity's technology upgrade programme) and the proposed acquisition of Westpac Life are placing significant pressure on capital, requiring a prudent approach.

"As a result, the board has decided not to declare a dividend this year, and we appreciate shareholders’ ongoing patience."

Key drivers of Fidelity's profits were a $6.1m uplift in net premium revenue off the back of strong new business, fewer than expected policy lapses and robust expense management.

The company paid $130.8m in claims to its customers compared to $139.7m in 2020 and a sharp rise in government bond rates had a $7.3m impact (net of tax).

Further contributors were a one-off $1.8m gain on the sale of its Carlton Gore Rd building.

The company also incurred one-off tax adjustments totalling $3.4m covering an agreement with Inland Revenue to amend the historic tax treatment of a reinsurance arrangement and the derecognition of tax losses for its subsidiary, Fidelity Capital Guaranteed Bond Limited, ahead of its capital raise to help fund the proposed acquisition of Westpac Life.

“As well as strengthening our New Zealand-owned credentials and providing greater access to capital, having two iconic New Zealand investors on our share register sends a strong signal to the market about the quality and potential of Fidelity Life,” Blake says.

There remain two director vacancies on Fidelity's board following the retirement of Simon Botherway and Hamish Rumbold.

Their replacements will be made by Ngāi Tahu Capital and the NZ Super Fund and the company expects its board to return to its full complement of eight directors by the end of this year.

Chief executive Melissa Cantell, who started at Fidelity Life in January 2021, said she was pleased with the firm’s achievements and described the annual report as "a steady financial performance".

“We’ve worked hard this year and put strong foundations in place," she says.

"We continued to invest in our transformation, while at the same time delivering an underlying result which shows our core business of providing life insurance to New Zealanders is performing well."

| « Cigna business sold | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |