FSCL sees spike in overall complaints

Complaints made to FSCL have gone up in the past year but remain on the low side for health and life insurers while complaints against finance companies and lenders have dropped.

Friday, October 15th 2021, 12:11PM  3 Comments

3 Comments

by Matthew Martin

Susan Taylor.

The independent disputes resolution service, Financial Services Complaints Ltd (FSCL), has released its annual report for the year 2020/21, stating that complaints received have gone up from 768 last year to 931 and the number of complaints upheld or partly upheld increased from 11 last year to 33.

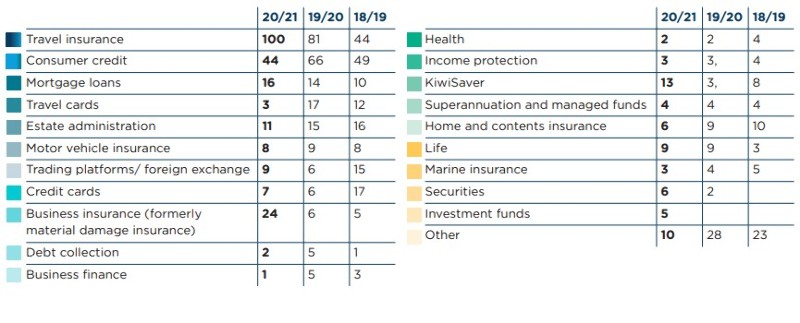

According to the report, complaints made against insurers were the highest proportion of cases investigated at 43%, which was up on 35% in the previous year.

However, most of the complaints against insurers were for travel insurance (100 complaints), followed by 44 for consumer credit and 16 for mortgage loans.

Only two complaints against health insurers were received (the same as last year), income protection complaints stayed steady at three and nine were made against life insurers.

FSCL chief executive Susan Taylor says in the report that last year was their busiest year on record "...when we had a 36% increase in cases received (383), this year was back to business as usual with 254 cases opened".

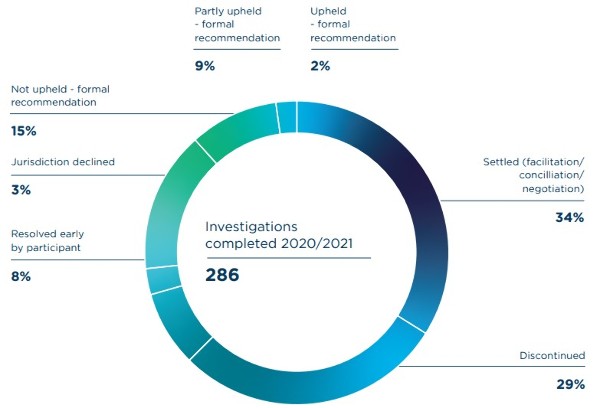

"We completed the investigation of 286 cases, compared to 298 in 2019/2020," Taylor says.

FSCL dealt with 1,370 enquiries about financial service providers, where an enquiry is a more general query relating to a financial service, rather than a formal complaint.

It also negotiated or awarded compensation totalling $1,751,388, up significantly from $989,641 in 2019/20.

The largest individual settlement was just over $500,000 in a case that we conciliated between a financial adviser and their client.

This was significantly higher compensation than the amount the FSCL is formally able to award ($200,000), but both parties were keen to resolve their issues through a conciliation process.

FSCL board chairperson Jane Meares says the year had seen considerable change to many of the laws FSCL deal with on a day-to-day basis, "...and we also anticipate changes to our scheme rules by the end of this year".

"The Ministry of Business, Innovation and Employment is currently reviewing the approved financial dispute resolution schemes’ rules," says Meares.

"One of the likely changes is an increase in the scheme’s financial cap from $200,000 to $350,000. I believe this review is important and will help to provide access to justice for more consumers."

FSCL also continues its efforts to use the title of Ombudsman.

"Which we believe will also improve consumers’ access to justice. I am pleased to say that FSCL successfully reviewed the Chief Ombudsman’s decision refusing our use of the name, with the High Court finding that the Chief Ombudsman had pre-judged FSCL’s application.

"However, we have appealed the High Court’s order to the Court of Appeal as we would like the Court to direct the Chief Ombudsman to give FSCL use of the name, rather than referring our application for a further (third) consideration.

"We hope the Court of Appeal hearing will be later this year or very early in 2022," says Meares.

| « FMA keeps watch on advertising rulebreakers | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Comments from our readers

Like a dog with a bone....

Sign In to add your comment

| Printable version | Email to a friend |

It would be informative to learn what the sector breakdown of these 33 cases were.

Also it would be interesting to see a summary and analysis of the thematic reasons these decisions were made.

And while I am at it, it would be interesting to see the sort of and magnitude of penalties awarded (banded as necessary) in those complaints.