The cost of retirement increases - again

The cost of living in retirement has increased nearly 4% in the past year.

Thursday, November 18th 2021, 6:22AM  1 Comment

1 Comment

The annual Retirement Guidelines Expenditure report says people living in metropolitan areas need more than $800,000 in savings to fund a comfortable post-work lifestyle.

Expectations and aspirations for retirement will be very challenging for the majority of New Zealanders unless they prepare and plan, according to Massey University's Fin-Ed Centre report, authored by Claire Matthews.

The research states that a two-person household in the main cities in 2021 would need to have saved $809,000 to fund a "choices" lifestyle, while a couple living in the provinces would need to have saved $511,000.

Considering the average KiwiSaver balance is a little over $25,000, New Zealanders have a long way to go to avoid "sleepwalking" into retirement.

They say the average retired household continues to spend in excess of NZ Super, highlighting the importance of preparing for retirement and suggest most Kiwis will need to make provision for supplementary retirement income, in addition to what NZ Super can provide.

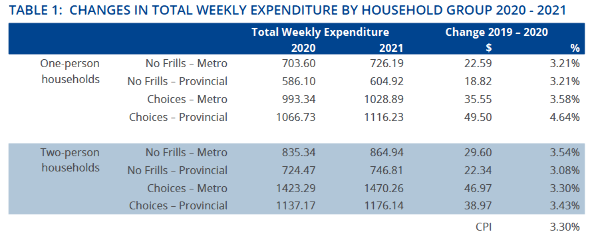

They calculate what retirees currently spend to maintain either a ‘no frills’ retirement or a more fulfilling ‘choices’ lifestyle that includes some luxuries. Costs are calculated for one and two-person households in metropolitan and provincial areas.

The lump sums required for a ‘choices’ lifestyle for a one-person household are $600,000 and $688,000 for metropolitan and provincial areas respectively.

Only two-person provincial households living a ‘no frills’ lifestyle come close to being funded by NZ Super, though they would still need savings of $75,000. A metropolitan two-person household with a ‘no frills’ lifestyle would require $195,000 savings at retirement in addition to NZ Super.

The guidelines say the key inflationary drivers for superannuants for the 12 months ending 30 June this year were transport, housing and household utilities.

The report is supported by Financial Advice New Zealand and financial services specialist, Consilium,

Consilium managing director Scott Alman says it’s clear people need to think carefully about planning for their retirement, and getting sound financial advice is the best way to start.

“It starts with budgeting and spending carefully and flows from there. Set a target, put a plan in place and chip away at it to ensure there is a good nest egg for when you retire."

Financial Advice NZ chief executive Katrina Shanks welcomes the report, saying it is a further timely reminder about the need for people to plan for their retirement.

“We need to drill home to people that they must start thinking seriously about saving for their retirement from an early age or they will struggle to live the lifestyle they want to once they stop work, and these guidelines clearly show what people need to aim for.

“Other research conducted for Financial Advice NZ shows the majority of those who seek professional advice will be better off in their retirement than those who don’t, so planning early and seeking advice on just how to do that seems to be the best method for achieving top results.”

Pathfinder's John Berry says while the numbers do seem a little on the low side, "...the underlying assumptions like how long they will live, if they own their own home and those sorts of things need to be worked through".

"The key message here is that it's never too early to start saving for your retirement and good advice is a critical part of preparing for this."

The guidelines do not represent recommended levels of expenditure but reflect actual levels of expenditure by retired households, adjusted for the effect of inflation.

| « Regulation will restore confidence in financial advice | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |