Advisers' AML risks assessed

Advisers remain low risk when it comes to a AML, but a new player is considered high risk.

Tuesday, December 7th 2021, 10:30AM

The Financial Markets Authority had competed its review of AML/CFT risk assessments and financial advisers remain medium to low risk.

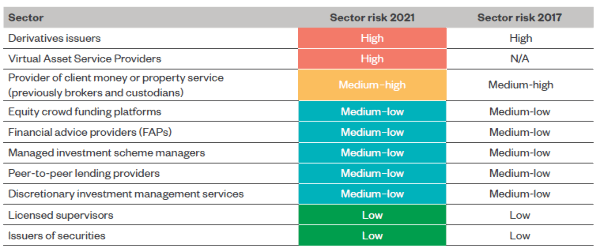

The one change to the risk assets is the introduction of cryptocurrency services [which it calls virtual asset service providers (VASPs)] and they have been deemed high risk alongside derivatives issuers (DIs).

The report outlines the factors that can increase a sector’s risk (see chart below) to money laundering and the financing of terrorism and is an update to the last report issued in 2017.

The FMA says it's an important document for entities that must report to the FMA under the AML/CFT regime because they need to make individual risk assessments of their businesses.

The report aims to improve firms’ understanding of money laundering and terrorism financing risks in their sectors, as well as identify trends and emerging issues.

The risk ratings of the 10 sectors the FMA supervises have not changed since 2017 as there has been little change in circumstances for reporting entities.

However, virtual asset service providers (VASPs) - which facilitate cryptocurrency, token, or crypto-asset transactions – have been added and rated as high risk.

FMA director of supervision James Greig says the sectors they supervise are generally expected to be the target of more sophisticated money launderers, as these criminals are familiar with capital markets and financial products.

“Derivatives issuers are naturally high risk because their products have high liquidity, accounts can be opened easily, and they can have many non-resident customers in higher-risk jurisdictions."

Greig says since the last assessment the risks of virtual assets, particularly cryptocurrencies, have become more prominent.

"Virtual assets allow for greater levels of anonymity and have global reach, making cross-border payments easy.”

The report found providers of client money or property service (previously known as brokers and custodians) were medium-high risk and noted there had been a rapid increase in the use of online investment platforms in this sector.

“The rapid growth of a large customer base using online investment platforms means they may be targeted by money launderers because their compliance resources may not have kept pace," says Greig.

“These platforms are highly liquid, allowing for high volumes of trading to take place without suspicion, and customers can create online accounts quickly without face-to-face verification, which favours anonymity.

"Although these platforms often have sophisticated systems to monitor accounts, they must collect sufficient information regarding the nature and purpose of the investment.”

| « RBNZ outlines options for cash system reform | FNZ onboards new client servicing company » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |