In defence of Magellan: Editor's Note

A stumble or two should not send a man to the gallows.

Wednesday, January 5th 2022, 5:46PM  2 Comments

2 Comments

In Joel Greenblatt's investing classic, The Little Book That Beats the Market, the author details how he assesses his "magic formula" for beating professional investors at their own game. Under multiple stress tests, the formula demonstrates stunning long-term outperformance. However, over the short run, it fails to beat the market roughly once every four years.

"There are plenty of times when the magic formula doesn't work at all! Isn't that great? In fact, on average, in five months out of each year, the magic formula portfolio does worse than the overall market. But forget months. Often the magic formula doesn't work for a full year or even more," he writes.

But is this a reason for Greenblatt to ditch it?

No. His conviction in the magic formula sees him through thick and thin. In fact, he says if the formula worked all the time, everyone would probably use it and it would stop working.

"To truly stick with a strategy that hasn't worked in years and years, you're going to have to believe in it deep down in your bones," he writes.

I had cause to recall this investing lesson while consuming the deluge of articles about the 'crisis of confidence' in Hamish Douglass and his Magellan Financial Group (ASX: MFG).

Tall Poppy Syndrome has long been a part of Australian culture, and in this industry, Douglass is one of the tallest, worshipped by advisers and retail investors alike. Investment managers should be held accountable for their performance but in the spirit of Christmas, let's look at the other side of the story of how Magellan is faring.

It’s been a dog of a year for the billionaire.

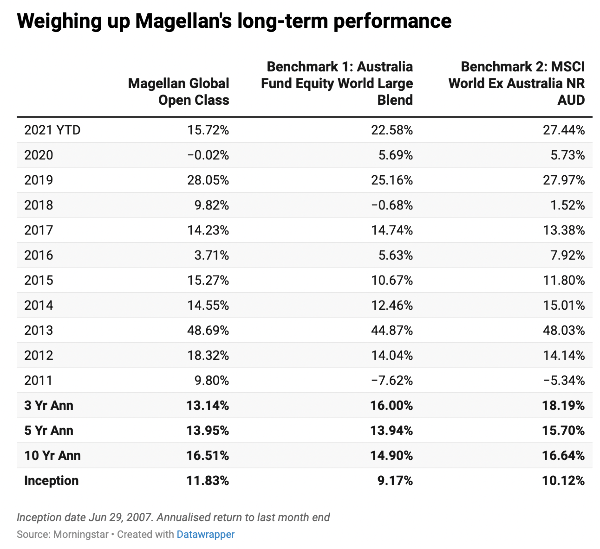

First, Magellan's flagship Global Equities Fund notched its second-year underperformance against the MSCI World index, as Douglass' cautious approach to pandemic investing missed the strong rebound in the US market, and a poorly timed (and hyped) entry into the Chinese market weighed.

Outflows followed, $1.5 billion for the September quarter, adding to the $351 million lost the quarter prior. Then, in the space of two days, details of Douglass' split from his long-time business partner Brett Cairns and wife Alexandra hit the press.

To cap it all off, news broke that Magellan's largest institutional client had pulled its $18.6 billion mandate, causing observers to warn others would soon follow. Magellan Financials' share price is down 60% this year, and many are questioning their faith. Like the great explorer himself, Magellan is charting a path in the face of great storms and mutineers.

In the era of low-cost passive investing, active management is a confidence game. It requires investors to believe they've found that rare investment manager who can actually outperform the market. But at what point should our confidence waiver?

One month of underperformance? 6 months? 3 years?

Douglass' reputation as one of the best macro thinkers in the market was built from scratch off years of outperformance. He demonstrated investing prowess above and beyond many of his competitors.

Since the inception of the Magellan Global Fund on 1 July 2007, it has delivered 11.83% pa after fees, outperforming its MSCI World Net Total Return Index by 3.71% pa. Before the pandemic, 2016 was a rare period when the strategy lagged, wrongfooted by Brexit and falling bond yields, but superior downside protection in 2008, 2011, late-2018 and early-2020 saw the strategy stand well above its peers.

No one is arguing for blind faith, but bouts of underperformance are to be expected, particularly for a concentrated fund with a buy-and-hold strategy. If you've trusted someone for the better part of a decade, it's not right to hang him at the first sign of distress.

Is this the beginning of the end for the star manager?

Only time will tell.

That's the risk we take with active management - no one can get it right every time, even the best of the best. All we can do is look at the evidence in front of us and continue to gather more.

What's clear is that Magellan has acknowledged its mistakes and taken steps to rectify them, putting new risk controls in place to limit its exposure to China and selling its shares in Tencent. Douglass has been upfront with clients about his conservative approach to investing amid the pandemic and focus on downside protection.

He has long argued that investors should focus on absolute returns rather than relative returns, introducing a 9% target for the business in the early days. In a 2010 Investor Report, Douglass wrote: "… our objectives of delivering very satisfactory investments returns over the medium to long term whilst minimising the risk of a permanent capital loss."

With the US stockmarket at record highs amid rising rates, high inflation and a surging virus, the current market environment is intensely difficult to navigate and defies logic (for some). If his prudent approach doesn’t sit well with you, then perhaps it’s better to move elsewhere—but don’t say he didn’t warn you.

The drama is an opportunity for investors to assess their own approach to investing. This hasn't been an easy time for Magellan investors — sticking with an underperforming manager is hard, especially when one of its biggest supporters pulls the plug.

If you hold a genuine, in your bones belief in the investment philosophy and the 50+ strong investment team, now is the time when you'll be tested. If the only reason you bought into the fund (or the stock) was you heard Douglass speak at an event or on a podcast, then maybe it's time to look at your own process for judging investments.

Emma Rapaport is the editorial manager for Morningstar Australia.

The author has a small holding in the Magellan Global fund. Views expressed in this piece are those of the author and do not speak for Morningstar as a whole.

Connect with Emma on Twitter @rap_reports.

| « 2021: A year so tough even the New Zealand share market fell | Is the inflation genie out of the bottle? » |

Special Offers

Comments from our readers

However, as history has demonstrated, differing investment philosophies are relevant at differing stages over time, with good advisors exercising their flexibility to preserve and enhance their client's outcomes throughout. Whilst a 'hold' strategy may eventually deliver an appropriate outcome, a key benefit of employing an independent financial advisor is to remove any emotion from ongoing investment decisions.

Sign In to add your comment

| Printable version | Email to a friend |

This would have a material and positive impact on the net performance Kiwi investors right off the bat. Easy!