Inside the FMA

Good Returns takes a look inside the Financial Markets Authority to find out who makes up its staff.

Thursday, February 3rd 2022, 6:00AM  5 Comments

5 Comments

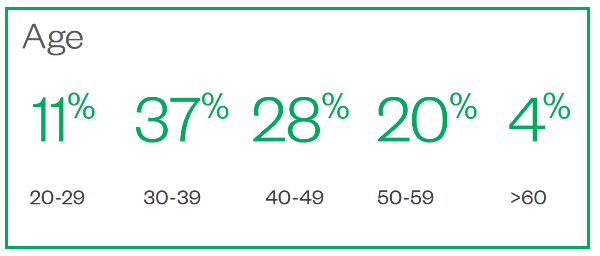

The FMA has grown in its first 10 years and had 242 employees on its books in the year to June 30, 21 its annual report shows. More than half of them, 142, were paid salaries of $100,000 or more.

The salary for the highest paid employee in the 2021 year was in the $570,000 - $580,000 band compared to $590,000 - $600,000 in the previous year.

The chief executive, Rob Everett, took a 20% pay cut for six months from June 1, 2020 as mandated by the government due to the Covid-19 pandemic.

Besides employees the FMA had a handful of contractors/temps and two secondees.

The average length of service as the authority has stayed static coming in at 3.2 years in 2021 and 3.3 years in 2020 and 3.4 years in 2019.

The number of staff who resigned in 2021 was 9.6% which is well down on previous years (2020: 13.8%, 2019: 22%).

One of the big changes in the past year has been where the FMA found its staff. Nearly half (48%) were internal appointments, while just 16% in 2020 were internal and 33% the previous year.

The second biggest source of staff was other government organisations (14%).

Some may be surprised that just 10% of new staff came from elsewhere in the financial services sectors. This has been static sitting at 9% in 2020 and 17% in 2019.

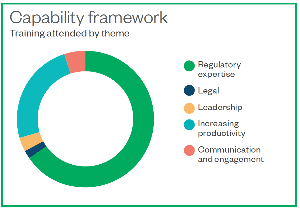

Under the heading "Capability framework, Training by theme" around two thirds had "regulatory expertise" and about one third were labelled as "increasing productivity". There are no numbers - see graph below.

The FMA, like many organisations in financial services, is not particularly representative of the population. Half of the staff identify as NZ European/Pakeha, 20% European, 17% Asian, including Indian and Middle Eastern), 4% Maori and 2% Pacific Islanders.

However, on a gender basis it was pretty even, 59% female/41% male.

During the year 7% of staff reported mental health issues and 2% had hearing/vision impairment.

| « [The Wrap] The year of the adviser | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Comments from our readers

Based on disclosures some insurers seem to pay higher. Just look at the Fidelity accounts or Partners Group holdings. Their decision as private businesses to pay what they want but these companies seem to pay higher than FMA - Fid are not that big relatively and made after tax $10m in 2021 but had 126 staff over $100k with highest on $650k.

The point is FMA salaries do not seem out of line with the NZ financial services marketplace and probably below market.

A bit like adviser rem really - the market forces have set a level and any interference has unintended consequences so best avoided unless there is compelling evidence of market failure.

David Seymour’s speech last week about the number of public servants who have been employed now under this current Government is excellent. ACT’s pledge to review all current Government Ministries requiring them to demonstrate the value they are adding to New Zealand tax payers is long overdue. Front line public servants like our nurses & teachers should be the priority for public spending not bureaucrats sitting in their glass towers in Wellington. The recent changes made to the CCCFA are a prime example of Seymour stating correctly that certain Government Ministries are actually negatively impacting New Zealand society now with their compliance & red tape.

Sign In to add your comment

| Printable version | Email to a friend |