Even in the toughest of markets earnings growth is rewarded

In this article we have a look at how earnings growth shines through.

Friday, March 25th 2022, 9:19AM

by Stephen Bennie

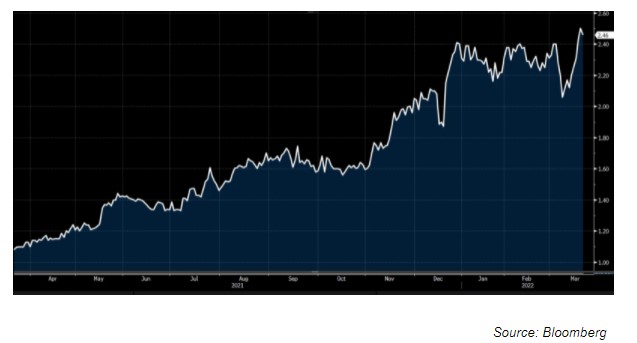

2022 has continued to be challenging for global share markets with the MSCI World index set to post its weakest March quarter in over a decade. The drivers of this volatility are clear and evident: escalating commodity prices, rising interest rates and exceptional geopolitical events have concerned investors as these factors combine to create peak uncertainty. And investors do not appreciate uncertainty, it clouds an already unknown future. What is appreciated is a clear path towards earnings growth, ideally one that a company can travel for a long time. Where that is happening a share price can rise even in the most challenging of environments, just like in the case of OFX Group, a position in our funds.

Chart showing OFX Group share price doubling despite volatile markets

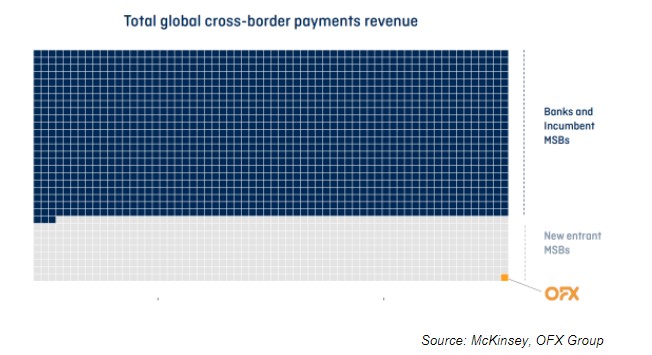

OFX Group is a cross border payments business, which basically means that its customers have money that they want converted into a different country and currency and OFX helps them do that. Banks and Money Service Businesses (MSBs) are the two places that customers can go for that service. It’s a huge market, cross-border payments are expected to exceed $220 trillion in 2022. And it has been growing steadily at around 5% year on year. It should always excite an investor to find a business that has unlimited scope to grow its market share in a growing industry and OFX Group with a current market share of less than 0.05% definitely falls into that camp. OFX‘s market share is the tiny red dot in the diagram below.

Plenty of scope to grow in a growing market

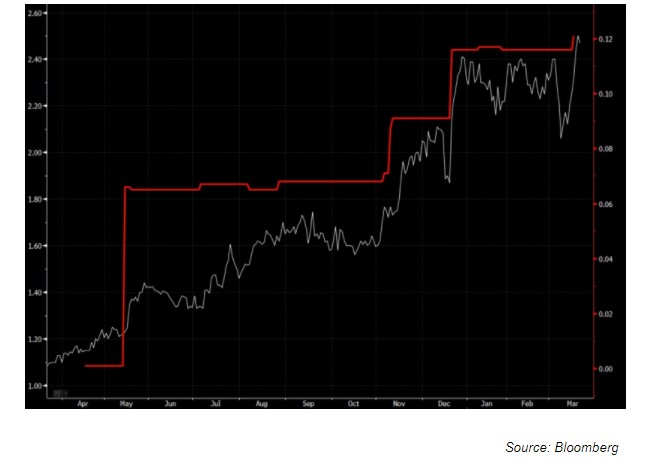

As you can see from the diagram above the large banks and incumbents dominate the market. And as can often happen with incumbents with a large market share an element of complacency creeps in and they can end up overcharging while underinvesting in their service and systems. This creates a situation where a company that is investing in their service, and pricing that service competitively can take market share. Taking market share in a growing market can do great things to a company’s profitability. There is increasing evidence that the team at OFX are achieving this feat. The chart below shows how over the past year the earnings per share that OFX is expected to earn next year, the red line, has been rising sharply.

Chart showing high correlation of share price to earnings revisions

The tantalising opportunity of taking market share in a huge and growing market has been there since OFX first listed in 2013. But it struggled to execute. No-one has a divine right to take market share, it has to be earnt; there are always competitors vying for that extra sale. And the previous management team at OFX were not able to get the formula right, they bungled a rebranding and failed to execute on strategic goals. After five years of struggling and failing the board decided that it was time to build a new management team. At that stage they hired Skander Malcolm to join as the new CEO. Or as they put it at the time: -

“The Board believes strongly in the growth prospects and future for OFX. Richard Kember has achieved a great deal in setting place a growth strategy and investing in our technology and people. The Board thanks him for his contribution. However, a delivery of the strategy has not been to the Board’s or the shareholders’ expectations. Having conducted a search process, we believe Skander is the right person to lead OFX going forward”.

Ouch, that was a pretty loaded “However”, it felt like it needed to be in bold.

Malcolm over the course of the next 2 years completely rebuilt the executive team. Such significant change was clearly needed but it also takes time for the effects of such a dramatic change to come to fruition. But as the chart above showed, rubber is now heading down the road, earning expectations are quickly ramping up as the team at OFX are finally growing their market share, particularly in the key North American market.

North America is attractive for two main reasons, it’s the largest market and the incumbent operators are perhaps the laziest in the world, their service is slow and very expensive. This creates a large amount of low hanging fruit and OFX has made a couple of key moves in an attempt to capture some of that fruit. Late last year they acquired a Canadian cross-border payment business, Firma. This was a highly complementary bolt-on acquisition that had large synergy benefits and significantly increased OFX’s presence in North America. The other smart move was becoming one of the marquee sponsors of the North American Ice Hockey League. While ice hockey isn’t big in New Zealand, in America and Canada it is one of the biggest professional sporting leagues and the exposure OFX is getting from its sponsorship is helping it grow in that market.

Cracking the North American market is key for growth

So, despite the current general market turmoil OFX is being rewarded for delivering earnings growth. Indeed it’s likely that the share price would have performed even better in a more benign market. Most important though, in our view for investors in OFX, is what will the business earn in three to five years time? Finally, there is the potential that it grows its market share and becomes a significantly larger business.

Disclaimer

The following commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

About Castle Point Funds Management Limited

Castle Point is a New Zealand boutique fund manager, established in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims. Castle Point’s investment philosophy is focused on long-term opportunities and investor alignment. Castle Point is Morningstar Fund Manager of the Year 2021 – Domestic Equities.

About Stephen Bennie

Stephen is a co-founder of Castle Point. He has over 25 years of investments experience and 18 years of portfolio management experience in New Zealand and abroad. Stephen holds a Bachelor of Commerce (Hons) in Business Studies and Accounting from the University of Edinburgh in 1991 and is a CFA charter holder.

Stock photos can be found here:

More information can be found at:

| « High valuations and rising interest rates = Volatility | Rewarding the value hunters » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |