How big are financial advice businesses?

A little while ago we gave a summary of the data which shows that most advisers work for a business with lots of other advisers in it (for example, more than five thousand work in teams of 20 or more advisers).

Monday, April 18th 2022, 9:23AM

by Russell Hutchinson

The small financial advice business is a perception formed from the fact that a large majority of financial advice providers employ just one adviser (for example, over 1100 advice businesses out of 1770 employ just one adviser). It is easy to look at each of those facts separately and assume that they fully describe the world of advice work.

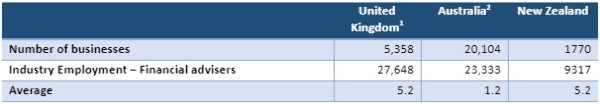

Another view is to look at our averages. It is particularly interesting to compare these with the UK and Australia, markets we often compare ourselves with having similar approaches to law and finance.

Rolling authorised bodies up into FAPs the average number of advisers per business is 5.3. Considering each Authorised Body as a business the average is 3.7 advisers. This can be contrasted with figures published for the UK and Australia, below. The implication is that we need to shift from thinking of the adviser market as being dominated by very small businesses (single adviser) and large advice-arms of big financial institutions (say, a bank). In fact, 2,000 to 3,000 advisers working in about 110 companies – depending on the measure – are employed by businesses sitting in between these extremes. That has major implications for how we will market to them and provide services to them.

We think that the Australian average may have moved quite a bit recently as many advisers have retired or left the sector due to current regulatory requirements and the impact they have on the adviser business model. Here in New Zealand, it seems that we have already made the shift to larger advice businesses. This brings advice into line with many of our other service sectors – allowing that when an individual is away from work for whatever reason, service continuity is assured. Along with that, it brings the overhead of management co-ordination.

| « “Finfluencers” and the law – which could include your social media posts | What are the chances of meeting someone who needs help with their insurance? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |