Searching for that right level of diversification

In this article we look at how many stocks are required to achieve diversification

Friday, April 22nd 2022, 9:29AM

by Castle Point Funds Management

Its long been a topic of discussion by investors, what is the minimum number of holdings required for acceptable diversification in an equity portfolio or an equity fund for that matter. Academics have gone hard at this question with numerous studies seeking to find the perfect number of stocks to hold in a diversified portfolio. In part because the answer can, in theory, be found empirically by crunching the numbers and back testing various hypothetical portfolios. Academics relish serious number crunching, and this topic provides plenty of scope for that. One of the early studies by Fisher and Lorie in 1970 noted that: “the number of possible portfolios containing eight different stocks that could be selected from a list of 1,000 is more than 24 quintillion”. They also noted that “at current (1969) costs for computer time, complete enumeration of all such portfolios of eight stocks would have cost approximately $150 trillion”. As a consequence their study was based on random sampling across the United States share market.

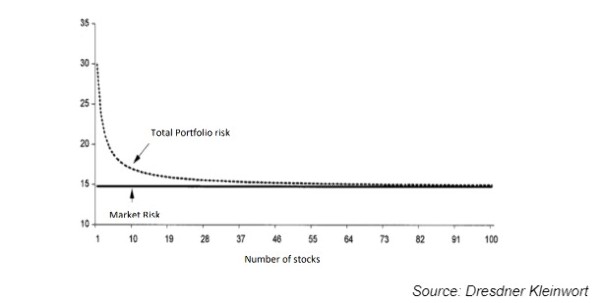

That 1970 study by Fisher and Lorie became a foundation for the notion that 95% of the benefits of diversification are achieved from having 30 stocks in a portfolio. The chart below is a visual representation of that reduction in risk resulting from increasing the number of stocks held. Countless other studies have essentially delivered similar results. This body of academic work means that anyone that has studied finance at college or university has almost certainly been taught that an equity portfolio with less than 30 stocks is too risky.

Chart showing the reduction in standard deviation from increased diversity

So, it is quite the revelation for many to hear Charlie Munger, one of the most experienced investors in history, reveal in a 2017 Q and A session that the Munger family portfolio, which he manages obviously, has only 3 holdings. He disclosed that the Munger family owned shares in Costco, Berkshire Hathaway and a mutual fund run by Himalaya Capital. And that he thinks that university professors that recommend owning at least 30 or more stocks are “dispensing balderdash”.

Meanwhile legendary investor Peter Lynch, who also wrote “One up on Wall Street”, opines that “Owning stocks is like having children – don’t have more than you can handle, five to eight is plenty”. He makes his point well, but I would be surprised if a family with five children always feels under control, never mind eight.

Here we have two exemplary practitioners totally contradicting the academics. Who is right and who is wrong? My take is that both arguments have their merits. Munger and Lynch are more concerned about returns than risk, they are well aware that the more shares you own the less likely you are to generate exceptional returns. Ultimately an investor in shares owns them for return because if risk was their primary concern then they would have their money in the bank. However, a wise equity investor always has an eye to the risk that they are taking on. As Munger noted, “Costco or Berkshire Hathaway ain’t going bust any time soon”.

The path that Castle Point takes with its benchmark unaware equity fund is to normally have between 15 and 20 holdings. This might look like a halfway house between Munger and the academics but to us it seems like a common-sense approach to managing clients’ savings.

Indeed, common-sense is definitely of great benefit to an investor looking to achieve sensible risk management. Having a mix of different types of companies across different industries achieves a great deal of diversification. So too does having some large cap stocks and some small cap stocks. And having a mix of early-stage businesses and some very established businesses is also of benefit. This can all be readily achieved in a 15 stock portfolio but it does require some methodology to building your portfolio. It is true what Munger says, that if you are a “no nothing investor” and you are randomly building your portfolio then you should probably be owning a more than a 100 stocks. However, if you are paying a professional investor to manage your equity investments you should probably expect to see a little more conviction and concentration in their portfolio.

Disclaimer

The following commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

About Castle Point Funds Management Limited

Castle Point is a New Zealand boutique fund manager, established in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims. Castle Point’s investment philosophy is focused on long-term opportunities and investor alignment. Castle Point is Morningstar Fund Manager of the Year 2021 – Domestic Equities.

About Stephen Bennie

Stephen is a co-founder of Castle Point. He has over 25 years of investments experience and 18 years of portfolio management experience in New Zealand and abroad. Stephen holds a Bachelor of Commerce (Hons) in Business Studies and Accounting from the University of Edinburgh in 1991 and is a CFA charterholder.

Stock photos can be found here:

https://castlepoint.sharepoint.com/:f:/s/Consultant/EsyXv-TcMlpDn8nDLVXk8tsBWBOMAeERgXPKwmjt8aVzeA?e=BJbuYg

More information can be found at:

www.castlepointfunds.com

| « [GRTV] Why a new KiwiSaver fund is launched | [GRTV] Rising interest rates drive investors into value stocks » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |