Over the peak

Sky-high inflation numbers continue to garner much attention, but are they already yesterday’s ‘fish and chip wrapper’?

Friday, July 29th 2022, 9:12AM

by Devon Funds

By Greg Smith

After a traumatic first half of the year for financial markets, the second half of 2022 has started off much brighter. After losing more than 16% in the six months to June, the NZX50 is up around 4% in July. It is a similar story in the US where the S&P500 is 7% higher month to date after falling some 20% in the first half of the year.

The title of our article at the end of June asked “Are we at a Turning Point?” In that piece we suggested that “high levels of pessimism, high cash balances and depressed market multiples” could mean that we are almost at the end of this year’s volatility. Whilst early days, this could well be proving the case already, with the markets rebounding with some gusto in July.

So, what has been the catalyst?

Markets had priced in a substantial amount of bad news during the first six months of the year, with investor angst centred around rising inflation, rising interest rates and the rising prospect of a recession. All three subjects are logically inter-related, with inflation at the epicentre.

Markets last year discounted rising levels of inflation as a problem associated with the pandemic, and something that would likely be transitory. Central banks then pivoted to the idea that it wasn’t, a matter that was put to rest by Russia’s invasion of Ukraine in February, which turbo-charged the prices for a host of commodities.

The war is still ongoing of course, but the heat has come out of a host of commodities. Oil has fallen below US$100 a barrel, iron ore is back around US$100 and copper has similarly weakened. Even soft commodity prices have moderated. Central bank efforts to cool red-hot demand look to have been successful.

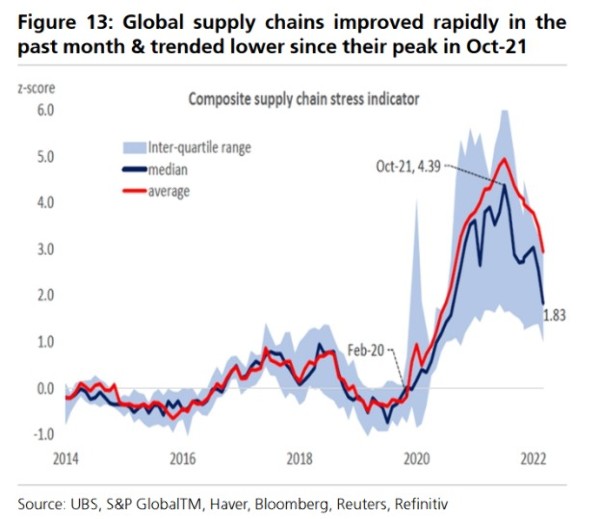

Supply chains, whilst back to normal, are also slowing freeing up, as highlighted by the below graphic from UBS.

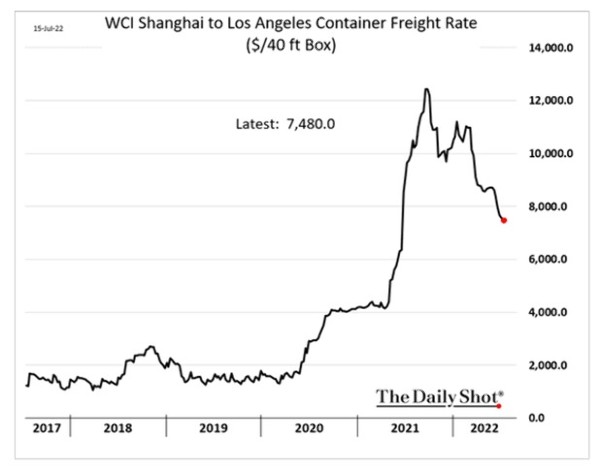

Shipping costs have also eased from the record levels that were seen in 2021.

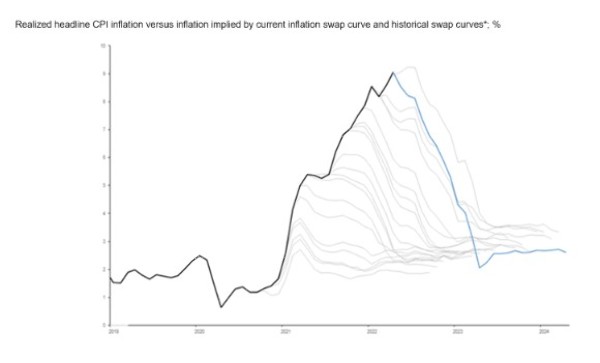

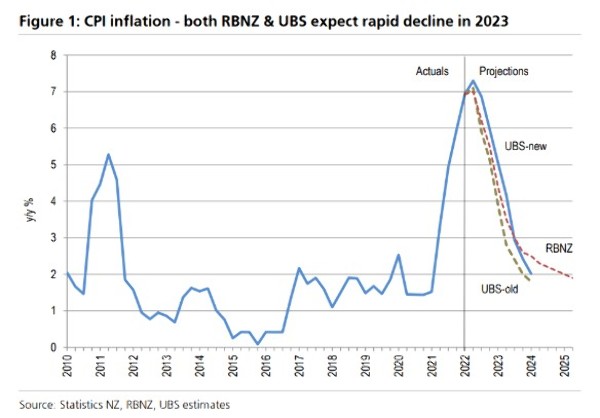

Backward looking inflationary prints have meanwhile continued to punch out some big numbers. In the US, annual inflation hit 9.1% in the June quarter. In New Zealand the CPI came in at a higher than expected 7.3% for the same period(??). Across the Tasman, Australian CPI this week came in at 6.1% in the June quarter, which was slightly lower than consensus forecasts of around 6.2%.

But are the June quarter inflation numbers already yesterday’s “fish and chip wrapper?”

Source: JP Morgan

The world’s central banks are clearly sticking to the task at hand in terms of trying to get multi-decade highs in inflation down, but at the same time there are signs that the tightening that has occurred has already had some initial success in this regard.

Markets surged this week as the Federal Reserve unanimously voted to raise interest rates by 75 basis points for the second straight meeting in a row. This marks the most aggressive tightening since the 1980s, taking the benchmark rate to a 2.25%-2.5% target range. Officials remain committed to bringing inflation back down towards 2%.

Investors were receptive to comments from Jerome Powell that forward guidance was effectively “dead” with officials making decisions on a meeting-by-meeting basis, dependent on economic data. The hawk’s wings have been clipped, possibly in an acknowledgement that a lot of heavy lifting has already been done in the efforts to tame inflation.

Chair Jerome Powell said that a “soft landing” was still the aim but noted that ongoing increases in rates were appropriate to “expeditiously” combat exorbitant levels of inflation. Officials noted that pockets of the economy (including spending and housing) were slowing. However, he also noted that job gains in recent months had been ‘robust’ and that the labour market was tight, with unemployment at 50-year lows and vacancies around record levels (a similar situation to NZ and Australia). Significantly, Jay Powell said the US was not in recession.

Second quarter GDP numbers have confirmed that technically, the US is in recession. The view from officials however is that the recession is not a real one, particularly with the economy creating around 400,000 jobs a month. This is hard to dispute.

The rate increase takes the Fed’s benchmark to a “neutral” rate which the central bank sees as neither stimulating nor restricting growth. This sets up the possibly of the central bank (dependent on economic data) tilting to a more gradual pace of increases going forward and dialling back to a 50bps rise in September. With the economy slowing, and inflation ‘potentially’ peaking, investors are receptive to the Fed taking ‘the middle ground’ it seems. And as we know, generally (but not always), where the Fed goes, other central banks tend to follow.

The NZ reporting season is not set to start for a few weeks, but an interesting lead can be taken from the US reporting season which is well underway. Many releases have been on the positive side of the ledger, but even for those that haven’t, there have been upward share moves where outlook statements have been upbeat.

A good example is Google owner Alphabet. The shares surged on the company’s result, despite overall earnings and revenues falling short of expectations. Revenues at Google’s search business were robust however, allaying fears raised by Snap last week over a global ad market slowdown – Google is the world’s biggest seller of online advertising.

It was a similar story for Microsoft (held in the award-winning Devon Global Sustainability Fund) which missed earnings and revenue estimates but reported a massive jump in revenue growth for Azure and cloud services. Management at the software maker also issued upbeat future guidance, with revenues expected to rise 10% to around US$50 billion next quarter. The tech titan is a key bellwether, so this also provides cause for optimism around the broader economy.

In both cases outlook statements provided some cause for optimism. This fits with the narrative that a lot of bad news has been priced in by markets. Many are saying we are in for, or already in, a recession. As Jay Powell so astutely noted, this makes “no sense,” particularly when looking at the jobs market, which is also a barometer of future activity.

Corporates are also feeling the pressure of inflation, and this has been another theme to come out of the US earnings season to date. Companies with strong pricing power are handling cost inflation better than those that don’t have it. Coca-Cola and McDonalds are two prime examples of companies that have been able to leverage their strong market positioning and mega-brands to pass rising costs down to end-consumers.

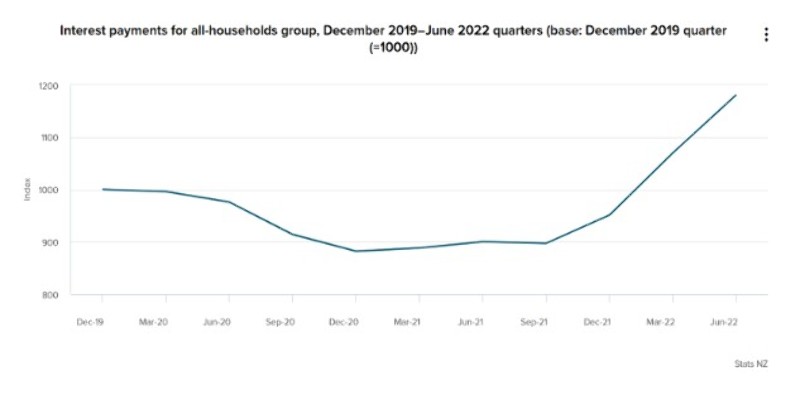

At Devon we continue to back high-quality companies that have pricing power and strong economic moats. Even if inflation has peaked, cost pressures are not going to go away overnight. Furthermore, even if an actual recession is avoided, consumer spending could continue to be under pressure, given mortgage bills (generally the biggest expense for most households) aren’t going down any time soon.

A reminder of the rising cost of living faced by kiwi households came from Stats NZ this week. The cost of living for the average kiwi household, as measured by the household living-costs price indexes (HLPIs), increased 7.4% in the June 2022 quarter compared with a year ago. Higher prices for housing and petrol were the main contributors to the increase across all the household groups.

The HLPIs are arguably truer of cost-of-living pressures than the CPI in that they capture (rising) mortgage payments. Against this challenging backdrop, there is perhaps one ray of light. Oil prices have dropped which could ease pain at the pumps, and plenty of other places, down the track.

The forthcoming earnings season will show us which kiwi companies are dealing with inflation, and which aren’t.

One company which doesn’t appear to be coping so well is Restaurant Brands. The shares fell heavily this week after the company issued weak profit guidance. Inflationary pressures are taking their toll on the company which holds the franchises for KFC, Pizza Hut, Carl’s Jr. and Taco Bell.

Sales are on the rise, with turnover in the second quarter increasing 10% to $309.5 million in the second quarter, aided by new store openings and a weaker currency (the company has stores in Australia and the US). The problem however is at the bottom line – the company expects half year net profits after tax to be between $14 million and $16 million (half year 2021 NPAT was $34.5m, although was boosted by a $11.4 million in ‘one off’ income). Restaurant Brands shares are down 40% over the past 12 months, and a lack of pricing power given the backdrop of rising inflation appears problematic. None of the Devon funds have exposure to Restaurant Brands.

Back to the original question, are we nearing peak inflation? Certainly, the high CPIs that have been clocked up recently will be hard to top mathematically, all the more so with prices of commodities such as oil coming down. Indeed, record levels of inflation may already be yesterday’s news.

A recent Bank of America monthly fund manager survey highlighted this year’s flight away from risk assets, with the investor allocation to stocks reaching levels last seen in October 2008, while cash has reached the highest levels since 2001. The poll showed that participants are concerned over the risks of a recession, along with the impact of higher inflation and interest rates this year. At the same time, the highest proportion of investors since the GFC are now picking that inflation will be lower in 2023, as will interest rates. It is quite possible however that this timeline has already crept forward.

And if this is true then it also potentially follows that assessment of how high interest rates will go (and how quickly), and how far the economy will sink, are also off base. This could then mean that investors flock back to stocks that have sold off this year. A rising tide may not lift all boats and the fact that interest rates are not about to fall any time soon will likely not do any favours for companies that are still on stretched valuations. But there are plenty of high-quality companies that are not in this camp. The investment team at Devon continues to seek out such names.

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « Fundamentals have gone missing in 2022 | Inflation really weighs on returns » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |