Rent freeze suggested to private landlords’ surprise

The Human Rights Commission wants an immediate freeze on rent increases and an increase in the accommodation supplement because of the cost-of-living crisis.

Wednesday, August 17th 2022, 1:20PM  2 Comments

2 Comments

by Sally Lindsay

Rental property owners say the suggestion is incredible when inflation overall has gone up 7.1% and rents only 4.3%. “Why is the commission picking on only landlords when groceries, fruit and vegetables and petrol have gone up more than rent,” says Andrew King, New Zealand Property Investors Federation president. “Why doesn’t the commission suggest a freeze on these goods?”

The last time there was a rent freeze was during 2020, the first year of Covid-19. It lasted for six months. King says landlords then could see the reason for the temporary rent freeze as everybody was affected by the lock-downs. “They wanted to do the best for their tenants.”

It did mean at the end of the six months tenants faced, in some cases, quite big rent increases instead of gradual rises over the six months, says King.

He says the burning question is how long will the cost-of-living crisis last? The commission has not defined how long a rent freeze should be imposed.

“Why should landlords bear the brunt of the crisis for the greater good. They have costs like everybody else. Unfortunately, the commission seems to have brought into the narrative private landlords are rich fat cats and the majority are far from it. They are just earning a living and planning for retirement, so they are not a burden on the state.”

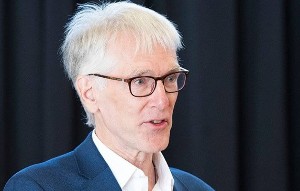

The commission says the rent freeze is needed because some students, low-income or single-wage families are having to make trade-offs between the right to adequate food and the right to a decent home, Paul Hunt ,Human Rights commissioner.

“The government has to ensure all New Zealanders can meet their basic living needs. The cost of living payment doesn’t go far enough to address unaffordable rents faced by many low-income renters,” he says.

Accommodation supplement

The commission also wants an increase to the accommodation supplement to ensure those on the lowest incomes pay no more than 30% or more of their income (after tax) on housing.

King agrees with this, but sees little hope of the Government implementing it. “It gives 100% of rent increases to social housing providers but ony 70% to private landlords and tenants have to pick up the other 30%. It should be the same level of help from the Government for every tenant no matter who their landlord is.”

He says many people believe the accommodation supplement is paid directly to private landlords but this is not the case and this is where problems can arise, particularly with rent arrears. More than 80% of cases lodged with the Tenancy Tribunal are about rent arrears.

Commissioner Hunt says almost half of renters spent 30% or more of their income (after tax) on housing in the year ended June 2020. Rent has also risen significantly faster than income and inflation over the past several years.

“Not only that, but the proportion of people renting in Aotearoa New Zealand is increasing. A third of New Zealanders and half the adult population now rent their homes.”

Vee Blackwood, the Human Rights Commission’s housing iInquiry manager says the existing rental system is not designed for this growth in renters or the emergence of a permanent rental class.

“Alongside these urgent measures, a systemic overhaul of the rental system is necessary to enable all people to achieve their human right to a decent home grounded on Te Tiriti o Waitangi,” says Blackwood.

As part of its housing inquiry, the commission is measuring progress on the right to a decent home. Data released so far confirms that renters are less likely to find their housing affordable than homeowners and have significantly worse housing quality.

“We’d like to see the Government reevaluate what a fair rent system looks like in order to meet the human rights of tenants," says Blackwood.

This could also include safeguards such as improved tenure security, long-term limits on rent increases (unless the property has undergone significant improvements), and more transparency about the rent paid by previous tenants.

“We’re pleased to see the Government giving tax exemptions to developers offering long-term tenancy opportunities. Longer term tenancies such as 10-year leases will dramatically improve security of tenure, and help tenants build and maintain connections in their community.

The Human Rights Commission will later this month launch the next stages of its housing inquiry.

“We want to hear from people about their experiences and their views on what a fairer housing system would look like, whether they are renters or landlords, homeowners or those struggling to find a place to call home.”

| « Tax exemption discriminates against ordinary landlords | Vile abuse leads to big compensation awards » |

Special Offers

Comments from our readers

everything else has sky rocketed from basic food items to other goods, so why there is no constraints on those.

also i know this been declined before under the banner it's too hard, why GST is not removed from basic goods, Australia is doing so it's not that too hard.

how about all other exemption to private sector, I know if you own a business you kind of offset your shiny new company car as an expense and it is rightly so for some, but do you really need the latest model every year and you own for example a small grocery shop, pharmacy or a restaurant, these are just an example I'm not picking on anybody but about being fair.

Sign In to add your comment

| Printable version | Email to a friend |

Surely it would be more logical to call for a freeze on food prices.