Baking a small but better pie

Two former Pie Funds portfolio managers last week launched their new equity fund and aim to improve on the old receipt.

Saturday, September 3rd 2022, 10:10AM

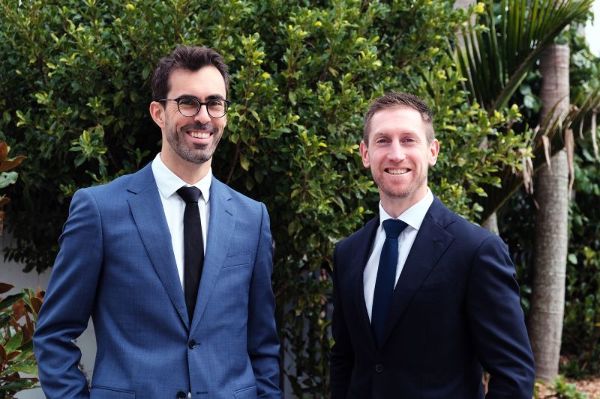

Discovery Funds has been set up by former Pie Funds portfolio manager Chris Bainbridge and last week Pie's former chief investment officer Mark Devcich joined the firm.

Bainbridge says Discovery will have just one Australasian equity fund and it will be capped at $300 million. The fund is very similar to funds they ran at their former manager, but they plan to enhance their offering.

Bainbridge says one of the key aspects to Discovery is that it will just have one fund and that will be the home for all their best investment ideas, as opposed to spreading ideas across a series of different funds.

He says it will be "pretty similar" to the funds they formerly managed.

The funds will own up to 20 companies and it will be looking to invest in "high quality companies that are undervalued."

He is reluctant to describe the style as value and prefers to the GARP (growth at a reasonable price) description.

The new fund is a wholesale offering with a minimum investment of $250,000. Bainbridge said that minimum was pretty much a standard for these types of funds.

| « FMA makes permanent stop order against adviser | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |