Investors' confidence maybe misplaced

The latest investor confidence survey shows New Zealanders are pretty upbeat, but that sentiment maybe misplaced.

Thursday, September 22nd 2022, 2:00AM

by Jenni McManus

While New Zealand is emerging from the pandemic in relatively good shape and might have dodged a recession, FSC CEO Richard Klipin warns of a potential “perfect storm” on the back of over-confidence when it comes to savings.

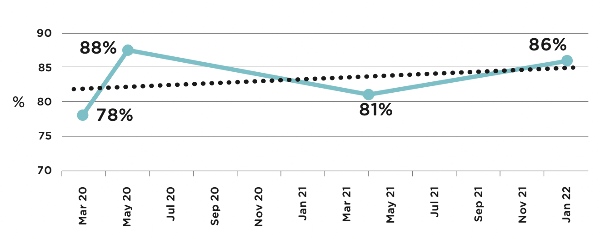

The FSC’s latest research shows 86% of New Zealanders are reasonably to extremely confident about their finances, an increase of 8% since 2020.

Figure 1: Key Indicator 1 - Financial confidence

“In spite of encouraging financial confidence levels, other findings from the report suggest this confidence may now be misplaced, given the economic volatility, rising living costs and increasing interest rates we’ve witnessed in the months after the most recent data was released,” Klipin says.

“In January 2022, just under 30% of respondents could last for a month or less without earning an income. Forty percent didn’t know if they could raise $5,000 in a week in times of emergency and 45% said they would rely on friends or family or weren’t sure how they would manage if they were suddenly to be unemployed/unable to work for more than three months.

“Half of respondents said they had experienced financial issues that affected their overall wellbeing. What’s more, financial literacy is on the decline, with 44% of survey respondents reporting being financially literate, a decline of 6%.

“What the research tells us is there are some clear warning signs that there is a perfect storm brewing due to financial overconfidence, insufficient rainy-day funds or retirement investments and economic uncertainties such as rising interest rates and inflation.

continued.

“The over-reliance on friends and whānau and uncertainty on managing finances in times of crisis is worrying, as when everyone is doing it tough, this can be a recipe for hardship.

“Factoring in how the economic environment has significantly changed since January this year, it is likely that the present picture is even more concerning. It’s important that increased financial confidence is reflected in the other indicators: financial literacy, financial preparedness, job security and wellbeing.

“This latest research emphasises just how important growing the financial confidence and wellbeing of New Zealanders is, and as we continue to track these key indicators into 2023 and beyond, our objective is to see them all move in a positive direction.”

| « An “Age of Confusion” dawns for investors | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |