Slow down in average Auckland rents

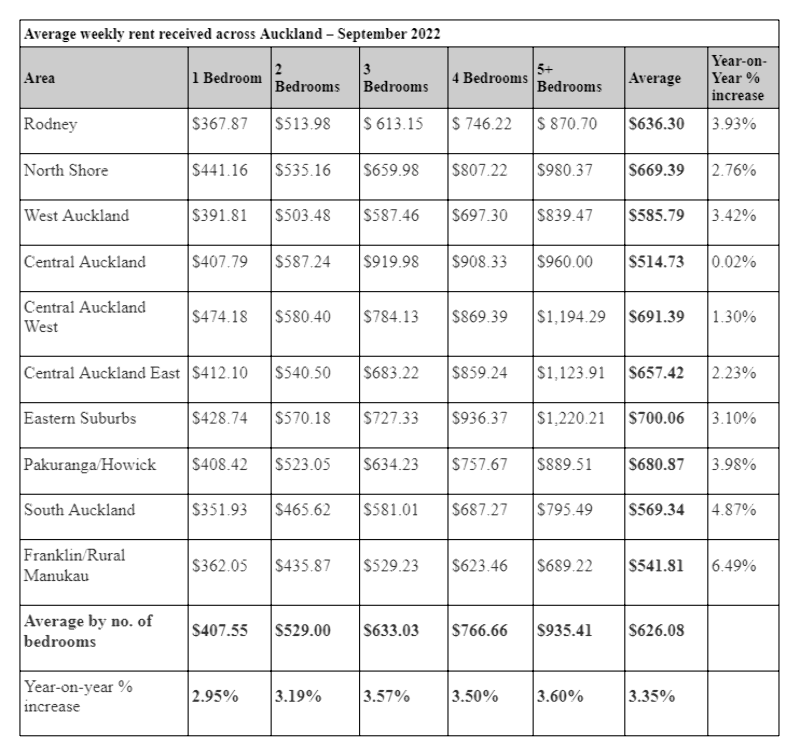

Auckland’s average weekly rent in Auckland rose by just half a percent during the third quarter of this year, reaching $626.08 at the end of September, up $3.64 on the average at the end of June.

Tuesday, November 1st 2022, 12:42PM

Year-on-year, to the of end September the Auckland average of $626.08 a week is up $20 (3.35%) from last year’s $605.77 for the 16,500 properties managed by Barfoot & Thompson, the city’s biggest real estate agency.

Barfoot & Thompson director Kiri Barfoot says it is a slower rate of increase than recorded in the previous two quarters. “However, looking over the past year, the city continues to follow its well-established pattern of rents, rising by about 3% annually.

What is particularly visible in the data are the differences in price movements across the city.

Rents have been steady in the central suburbs and fringes of the city, with increases between 0.02 and 2.23%. The lowest average increase was just 11 cents a week for a central city apartment, for example.

At the same time rents for homes further to the east and south are increasing near and above 4%. In Franklin and rural Manukau the year-on-year rent rise reached 6.49%, about $30 more a week on average.

“While these areas are still among some of the lowest priced in the region, such pronounced shifts could be a sign they are catching up, as people are attracted to these traditionally more affordable areas.,” says Barfoot.

“While there is still scope for this recent, slower quarterly movement in rents to continue, leading to softer annual figures, there are also many factors to support continued price growth at or above 3%.

“The rising cost of living is putting pressure on renters, at the same time as the rising cost of operating and servicing rentals is affecting property owners,” she says. “Some property owners may be looking to increase rents to cover their rising costs, but many are also aware of the need to remain accessible as renters tighten their budgets.”

Barfoot expects property owners will also be assessing the impact of higher interest rates and deductibility changes on their balance sheets, and considering what the future holds for their investment.

| « New housing rules create dilemmas | Building consents continue to defy gravity » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |