Fidelity continues to adapt in a challenging environment

Fidelity Life's annual report shows it was a year of achievements, but also a tough year.

Wednesday, November 9th 2022, 2:07PM

by Kerry Meadows-Bonner

Fidelity Life chairman, Brian Blake says the acquisition of Westpac Life is a game changer and a stand out moment for the company.

“It has been incredibly positive for the business, significantly lifting our in-force market share and providing us with an all important scale,” he says in the company's annual report.

He says the key part of the deal was not only raising the capital needed but ensuring the business was resourced appropriately to deliver on its Westpac Life transition obligations and integration.

In addition to the Westpac Life acquisition, Fidelity Life has worked towards a broader transformative programme that included the launch of its new $25 million technology platform Tahi, which brought Project Watson to a close.

The technology project underpins Fidelity’s five year transformative strategy to "reimagine" life insurance for New Zealanders.

Project Watson is set to drive innovation, productivity, resilience and improved support for Fidelity’s advisers and will allow development of simple, more flexible products to deliver better outcomes for customers.

Fidelity's market share of in-force and group business increased from 11.6% to 16.4%.

Chief executive Melissa Cantwell said this year "a key focus will be progressing the transition and integration of Fidelity Insurance into Fidelity Life so we’re one business, focused on the needs of all our customers."

“We’ll also be advancing other important transformation projects, such as our new underwriting engine, and data and insights tools, as well as working on adapting to various new legislative regimes coming into effect over the next few years - not to mention facing into expected economic headwinds."

THE NUMBERS EXPLAINED

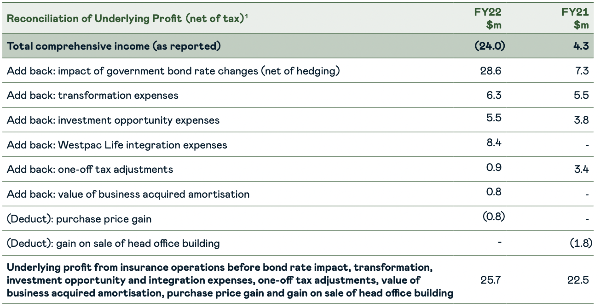

Fidelity Life's numbers can be looked at in two ways. According to the financial statements the company made a significant loss in the year. However, Blake presents a different picture in his report with a "reconciliation of underlying profit" which adds back investment losses, and one-off expenses relating to "transformation" and acquisitions, even though these are costs of doing business.

His reconciliation turns a $23.49 million loss into a $25.7 million dollar profit. (See reconciliation below).

Fidelity's audited accounts show it went from a $4.33 million net profit after tax in 2021 to a $23.99 million loss in 2022. This was largely driven by losses on its investments. These plummeted $27.84 million from a $18.10 million gain last year to a $9.75 million loss in 2022.

The results are not directly comparable with last year as this year includes four months of earnings from Westpac Life, now called Fidelity Insurance.

Earnings per share fell from $2.07 to negative $8.27 on an increased number of shares following investments from its new shareholders.

Insurance premium revenue rose 21.45% from $278.6 million to $348.37 million, while claims paid rose 25.86% from $130.79 million to $164.61 million.

Oddly, commission expenses were only up 2.05% to $58.74 million.

Another surprise is that top paid employee, assumedly the chief executive saw her pay rise from the $640,000 - $650,000 band to the $930,00-$940,000 band.

These numbers include remuneration and grossed-up benefits.

Two other employees also had remuneration above the top level in the previous year. Overalluy 137 employees had remuneration of more than $100,000 compared to 126 last year. However, the current year includes Westpac Life staff who transferred to Fidelity. The highest paid of these people had remuneration in the $200,000 to $210,000 band.

| « Insurance Link gets new owner | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |