SmartShares sets growth target

The NZX took many in the industry with surprise last week announcing plans to acquire QuayStreet Asset Management, and more acquisitions can be expected.

Monday, November 28th 2022, 7:39AM  1 Comment

1 Comment

It says in an Investor Day presentation that its analysis shows a fund manager needs between $15 billion and $20 billion which is where cost basis are their most efficient.

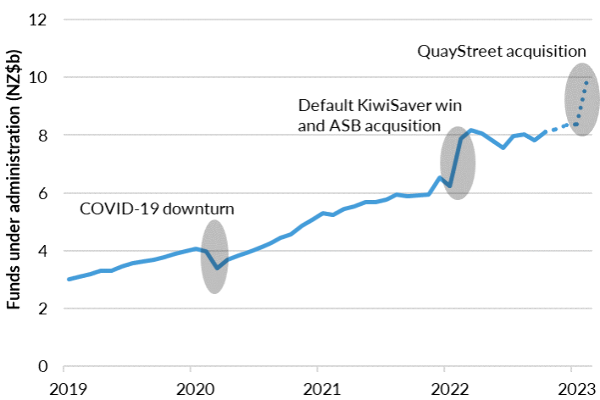

Currently, NZX’s SmartShares business manages around $8 billion.

The surprise to many was that a passive manager was buying an active manager.

Smartshares says there will be “no immediate change for QuayStreet clients.”

It says the QuayStreet funds will be offered as “a premium product set, complementing Smartshares' existing systematic and passively managed product offering.”

NZX also says it will explore the idea of listing QuayStreet funds.

Smartshares says its ambition is to “grow into a full service, automated, digital fund manager.”

It wants to move from manual operations where “staff are the machines” to “automated operations where staff operate the machine”.

Its further goal is to transform from passive investment management to be a “full in-house systematic investment management with ESG.” The target date is 2027.

Forsyth Barr says in a research report, that "despite acquiring the active fund manager, NZX reiterated it has no intention to move into active management itself and intends to market the acquired funds as a premium 'enhanced passive' product.

Under the deal Craigs Investment Partners is incentivised to continue to direct funds under management to Quay Street for an additional three years following the acquisition, with an earn-out clause capped at $19 million. It says this would equate to another $1.2 billion of funds under management.

| « Financial advisers to be referred to disciplinary body | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |

I'm also curious about the fate of those investors who subscribed to the Quay Street philosophy, only to find that this will eventually be changed by their new owners.