‘Excess dividends’ in the Electricity sector - the other side of the argument

New Zealand’s big electricity companies have come under fire recently, accused of generating ‘scarcity’ and prioritising ‘excess dividends’ over the past decade.

Monday, November 28th 2022, 12:26PM

by Devon Funds

By Greg Smith, Head of Retail at Devon Funds

A report co-authored by FIRST Union, NZCTU and 350 Aotearoa contends that the resultant “systemic underinvestment” has left generating capacity practically flat over the period. The electricity companies are allegedly profiteering from elevated market prices, while consumers are losing out.

This is an emotive issue, with many Kiwis facing increasing cost-of-living pressures. These will only be exacerbated by Wednesday’s Reserve Bank decision and accompanying outlook statement, which suggests borrowers could face mortgage rates in excess of 7 per cent next year.

The report does raise some important factual points, however as with most things, there are two sides to every story.

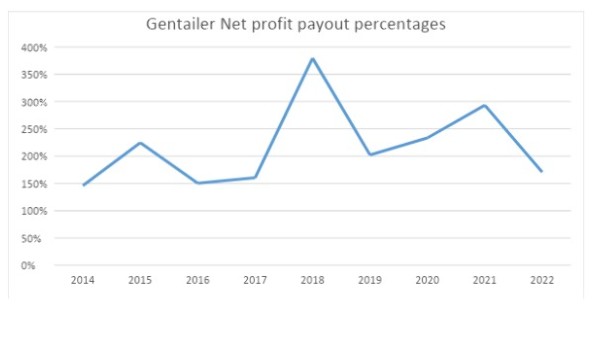

The report notes that from 2014 to 2021, the big four electricity companies distributed $8.7 billion in dividends against $5.35b in earnings. The assertion is that there has been $3.7b in excess dividends to shareholders over this period, averaging $459 million annually.

Looking at average net profit pay-out percentages across the sector, the electricity companies are paying out more in dividends than they are earning at the bottom line. Since 2014, the percentage of net profit after tax paid out as dividends across the industry has consistently averaged over 150 per cent, and indeed has been much higher at times.

Source: Devon Funds

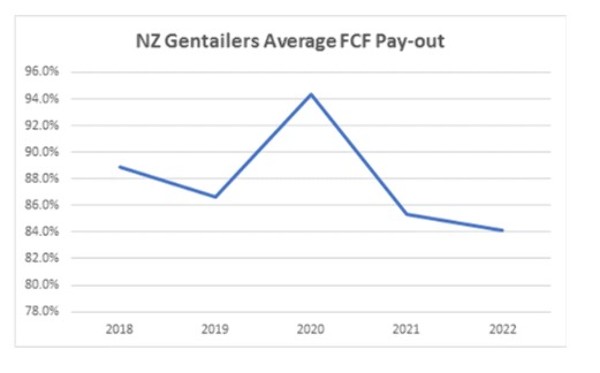

Context is always important, however. Simply defining excess dividends in terms of net profit does not adjust for ‘front-loaded’ depreciation charges across the industry which are non-cash items. Allowing for these, the percentages are still high but far less alarming. Over the last five years the industry dividend pay-out ratio relative to free cash-flow is circa 80 percent. This ratio is how the electricity companies mark their own dividend policies.

Source: Devon Funds

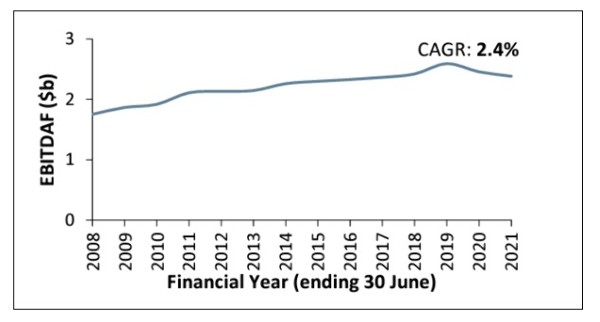

Reflecting on the report’s point on profiteering, it is important to also consider underlying earnings across the industry. It is highly debatable whether a compound annual growth rate of 2.4 per cent since 2008 is excessive.

Industry earnings before tax, depreciation, amortisation and fair value adjustments

Source: Mercury NZ

The report notes that generating capacity has remained largely flat in recent years. That said, there is no mention of the Tiwai Point aluminium smelter and its potential closure. If Rio Tinto did elect to go down this path, we could find 13 per cent of New Zealand’s electricity supply looking for a new home.

The make-up of this generation has however changed. The report claims there has been an “underinvestment” in renewable generation (with existing gas and coal-generating facilities kept on ‘life support’). However, New Zealand’s renewable generation has risen to around 84 per cent and is continuing to grow. Of note, we have the fourth-highest renewable electricity percentage in the OECD. While we could improve further, this is still something to be proud of, particularly as the world grapples with the huge challenges of hitting Net Zero by 2050.

New Zealand is aiming to achieve 100 per cent renewable electricity by 2035, and to transition to a carbon-neutral economy by 2050. The report suggests that as the largest shareholder, the government should require a minimum profit re-investment target to rapidly develop new renewable generation. However, the electricity companies are already on this journey.

Contact Energy has $1.7b of renewable energy developments underway. New geothermal power stations will see renewable electricity generation increase by 25 per cent, and bolster New Zealand’s total renewable electricity supply by over 5 per cent annually. The closure of the Te Rapa power station will reduce scope 1 and 2 greenhouse gas emissions by around 20 per cent/200,000 tonnes per annum, which is the equivalent of taking 44,000 vehicles off the road.

Mercury, now the largest wind generator in the country, has 2.3 terawatt-hours (TWh) of new renewable generation (or 5 per cent of existing generation) under construction. Meridian reports having a ‘deep pipeline’ of 5.4 TWh of development options. Genesis is meanwhile progressing developments in solar and biofuels.

The sector is already well along the decarbonisation journey (to 98 per cent renewable electricity by 2030), spurred on by elevated electricity prices. Significant investment (over $40b in the 2020s alone) will help New Zealand have a greener future, reducing New Zealand emissions by an expected 8.7 million tonnes of carbon dioxide equivalent per year. At the same time, average annual household bills are forecast to fall by around $700 a year.

The report also suggests that the government should levy a ‘windfall’ tax against the electricity companies for ‘excess dividends.’ Notwithstanding the problems around definition, it is unclear how such a tax would provide the incentives needed for electricity companies to invest in new, greener generation.

The report also calls for the government to redeploy “excess dividends”, buyback gentailer shares and ringfence fossil fuel generation facilities for non-commercial use. It is not obvious how such interventions will change the path that the electricity companies are already on.

On the subject of government intervention, it is also worth highlighting the manner in which the electricity companies have thrived since being privatised. Shareholder returns have been strong, and not just from dividends. Since their IPOs, the share prices of Genesis, Meridian, Contact, and Mercury have appreciated between 65 per cent and 215 per cent.

These share price performances are also a reminder of the benefits accruing to investors under public versus government ownership. Another prime example here is in the ports sector, where full local government ownership at Ports of Auckland has coincided with a period of sustained financial and operational underperformance. Port of Tauranga has meanwhile flourished as a publicly listed company, to become the largest port in the country.

Turning back to the gentailers, the report does highlight a constant predicament around balancing returns with due consideration of environmental, social and governance (ESG) impacts. However, there is no black and white solution. It is a journey.

Good stewardship is about responsibly allocating and managing capital to create and preserve long-term value for current and future generations. Engaging with companies, such as the gentailers, to encourage them to allocate capital accordingly is part of this process. Devon is a founding signatory of the recently launched Stewardship Code, which aims to strengthen recognition and consideration of ESG factors by listed companies.

- Greg Smith is the Head of Retail at Devon Funds www.devonfunds.co.nz

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « Santa Pause could be coming to the rescue | How inflation stole Christmas » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |