Advisers can ride on non-bank coat-tails says broker

A long-standing mortgage adviser who heads iLender Mortgages has an optimistic message for Christmas which contrasts with the prevailing gloom.

Friday, December 16th 2022, 6:28AM

by Eric Frykberg

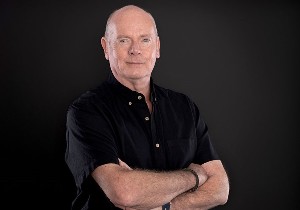

Jeff Royle thinks the non-bank lending lending sector will grow and can take advisers along for the ride.

Royle is a man who sometimes brings an eccentric air to an often straight-laced industry – he calls himself a “financial paramedic” and says he is the “skipper” at iLender.

He is even a “mortgage guru”.

But he is deadly serious about his latest forecast.

Essentially, he says the gap between bank and non-bank lending rates is shrinking, and even disappearing.

He cites the case of Resimac, whose 7.34% floating rate for loans with an 80% LVR or better, beats the industry average as well as that of many mainstream banks.

Royle's argument is that as the OCR rises, bank mortgages rise as well, with floating rates frequently costing 7.99% and two-year fixed rates having a median of 6.95%.

But at those levels, the gap between banks and non-banks seems relatively less, and can even disappear. This can make non-banks more attractive to advisers and their clients.

“About ten years ago, if you had gone from a bank to a non-bank lender, you would have been facing about a 2% hike,” Royle said.

“That has changed significantly …. There are a huge number of options out there. A non-bank does not always mean a higher rate, it can do, but not necessarily.”

Royle adds even when the rate is higher, a non-bank will sometimes grant a loan when a main bank won't, and that can be worth the extra interest rate.

So what does this trend mean for advisers?

According to Royle, advisers account for around 50% of bank originations but over 85% of non-bank originations.

That means that any strengthening of the non-bank sector can only be good news for an industry that needs some help right now to combat a weak housing market and confusing layers of regulation.

Royle added the trend that helped advisers would also help customers. He cited the case of one of his own clients, who sought a first home on an 85% LVR. The client's own bank would not offer a loan but a non-bank stepped in with an offer at 7.75% and the loan was secured.

Royle said examples like this indicated there were reasons for optimism despite the prevailing economic gloom.

“For a company like Resimac to be able to come out with a floating rate that is lower than ANZ speaks volumes about their confidence,” he said.

And he thought the mortgage advice industry was highly placed to take advantage of these moments of hope, and bring adviser penetration in the New Zealand market closer to the far higher levels that apply in Australia or the UK.

| « The latest billion dollar broker | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |