Crystal ball gazing into 2023

It's hard to believe we're already through the first month of 2023.

Friday, February 3rd 2023, 6:07AM

by Devon Funds

By Greg Smith, Head of Retail at Devon Funds

In New Zealand many people are still only just putting 2022 to the back of their minds and getting back from their (somewhat ‘wet’ in many cases) summer holidays. With this in mind, it is still probably early enough to roll out the tradition of crystal ball gazing, making big picture predictions on developments and factors that will influence markets and portfolios in the rest of the year ahead.

Looking back on our top 10 predictions from just over a year ago, there were certainly more hits than misses. The “Great Rotation” from growth to value did indeed click up a few gears, while a harsh dose of reality did set in for investors in crypto-currencies.The kiwi housing market did indeed weaken more than most expected while workers both at home and abroad became more pay-packet conscious. The groundswell for a third supermarket operator in NZ was not as loud as it could have been, but the prediction that tensions would ratchet higher on the geopolitical front proved to be somewhat of an understatement, given Russia’s invasion in the Ukraine.

Markets generally were not resilient, although the kiwi market did hold up better than many counterparts. Our predictions that the world’s central banks would call the tune throughout the year was on point, and while inflationary fears did not disappear, there were signs that inflation had peaked in the latter stages of the year.

What will the rest of 2023 dish up?

No one knows exactly, but below is a list of how the ‘Top Ten’ may play out in terms of big themes this year.

1.The “most anticipated” recession in history proves more benign than anticipated.

Markets are pricing in a recessionary scenario this year, with some economists seeing the probability of a downturn at close to 100%. Not many things in life have a 100% probability, and it is conceivable that once again that the worst-case fears (just as was the case in March 2020 at the start of the pandemic) do not eventuate.

For the soft-landing scenario to emerge, a central plank would be that inflation moderates more quickly than expected (we have already seen signs of this in early 2023 with inflation prints across Europe). With global supply chains opening up and growth moderating (but not collapsing), it is entirely possible that two primary levers of inflation work together in a conducive manner. The latter could also dampen wage pressures as unemployment rates return to more sustainable levels.

Such a scenario could set the stall for a significant sustained snap back in equity markets (which have already started 2023 on the front foot), given considerable negativity has already been priced in.

Much of course will depend on the Fed (and other central banks), but recent signals have provided cause for optimism. The last Fed minutes indicated that officials will make rate decisions on a ‘meeting by meeting’ basis. This month’s meeting is meanwhile imminent. Nothing is pre-destined, and this potentially also goes for arguably the “most anticipated” recession in living memory (and with the recent US Q422 GDP print coming in ahead of forecasts).

This also presumes a base case where the war in Ukraine continues to drag on. Any move towards the negotiating table (possibly driven by increasing public opposition in Russia) would be very well received by markets.

2.China’s reopening helps blunt some of the impact, with easing trade global tensions also a good thing

China's economy grew at around 3% in 2022, well short of official targets of around 5.5%. The World Bank expects the reopening of China's economy will lift growth to 4.3% in 2023. Nearer term, there are concerns over how a consequent surge in infections will impact the economic rebound in the country. However, just as was the case in the West, Chinese consumers will be emerging from their lockdown with stronger household balance sheets – time will tell how quick they are to spend these reserves.

An eagerness for China to get back on the growth path could also lead to a cooling of trade tensions which have built up during a period of confinement. We have already seen some cause for optimism here, with reports that China is looking at resuming imports of Australian coal after a two-year ban.

3.NZ’s economic downturn is exacerbated by mortgage holders rolling off pandemic fixed deals. Discretionary consumer spending heavily pressured

Arguably the “forthcoming recession” is one of the most predicted in living memory. The “R’ word is being regularly used in the mainstream commentaries, with investors and consumers alike being prepped for this scenario. The RBNZ itself now expects four quarters of negative growth from the June quarter of this year onwards (-0.5%, -0.3%, -0.1% and -0.1%).

The NZ economy has surprised with its resilience at times, and some further help could be forthcoming from a well-known quarter. The re-opening of China, our largest customer, could come at just the right time to soften the economic headwinds which are being faced elsewhere.

There are still some key domestic areas which look to be facing some stern challenges. The notion that consumer activity will not be dented by falling house prices (despite the negative wealth effect on sentiment), as suggested by some commentators, feels very optimistic. Rising interest rates are more than just “annoying” and have real-life consequences for someone moving from a mortgage rate with a ‘2’ in front of it to a ‘6 or even a 7.’ Half of kiwi mortgage holders are set to come off fixed mortgage rates in the next six months. Households fortified their finances during the pandemic, but these funds will be called upon. Consumers are therefore going to be less likely to “splash out” on discretionary (particularly bigger ticket) items.

The notion that consumers will not be worried because there are plenty of jobs also may be brought into question. The RBNZ is expecting unemployment to rise from 3.2% to 4.8% by year end, and 5.7% by 2024. Growing concerns over household finances and job security could well exert pressure on discretionary spending this year.

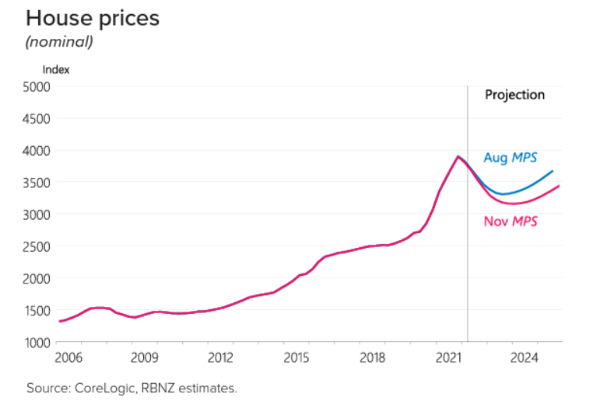

4.Kiwi housing market continues to weaken through the year, equaling the peak to trough downturn seen in GFC

House prices have been falling but over the course of calendar year 2022 were still only down nationally around 5% (according to CoreLogic). This is the largest annual decline since June 2009, but still compares to a property market which rose by over 30% at the peak during the pandemic. New Zealand’s property market was expensive by global standards heading into the pandemic, marked by elevated price-to-income and price-to-rent ratios. This situation will need to correct further and will ultimately be aided by a degree of selling as mortgage holders trade down amidst elevated mortgage rates. A peak to trough fall of 20%+ (more in real terms) is therefore not inconceivable.

5.The OCR tops out sooner than expected as RBNZ realises it has gone too hard. Inflation gets back to within the band, at around 3%

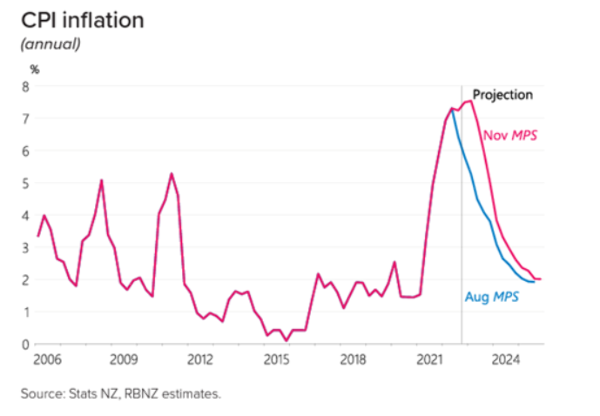

The RBNZ rounded out 2022 in hawkish fashion, increasing the OCR by 75bps to a 14-year high of 4.25% (compared to a pandemic low of 0.25%), and contemplating a 100bps move. Officials expect the OCR to peak at 5.50% in September this year and remain at this level through to June 2024.

Against this backdrop, the RBNZ is forecasting annual CPI inflation to hit 7.5% in the December 2022 and March 2023 quarters before tracking lower, but not going below 3% until September 2024. The December quarter CPI came in line with expectations recently at 7.2% but at the same time did not throw up any nasty surprises, and was at least below the 7.5% that the RBNZ had expected to be. A 50bps rate hike at the meeting on February 22 remains a viable option.

A plausible scenario is one where inflation, which rose much quicker than officials anticipated, now does the same on the other side and falls away faster than the Reserve Bank anticipates. Falling energy prices and a firmer currency could quickly change the game as it relates to imported inflation. This is already happening in other countries, with recent inflation prints in Europe, the US and Australia coming in below expectations. Robust commodity prices are a headwind to this scenario but weakening pockets of domestic activity, particularly in housing and construction markets, would be deflationary and also provide a harder economic landing than expected by central bank officials – this would be one they would need to react to.

It is therefore conceivable that inflation gets back to the RBNZ’s band, and below 3%, sooner than 2024, and potentially in the latter stages of 2023. This type of an inflationary trend through the year, and a deteriorating economy, could well prompt a more dovish pivot by the RBNZ, with the OCR not reaching 5.5%, and topping out some time in the middle of the year.

6.Commodities remain buoyant, with a long-term deal locked in with Rio over Tiwai

Commodity prices remain buoyant in 2023, helped by an easing US dollar, and also as demand in China picks up amid the pivot from Covid-zero (which will more than compensate for an easing of demand elsewhere). Aluminium prices remain well above US$2000, making New Zealand’s Aluminium Smelter (NZAS) at Tiwai highly profitable, and one of the most environmentally friendly smelters globally. Tiwai averages around two tonnes of CO2 per tonne of carbon produced, versus an average of over six times that for aluminium smelters globally.

While accounting for around 12% of New Zealand’s electricity, roles will be reversed at the negotiating table and Rio will be eager to lock in a long-term supply deal with Meridian. Tighter rules around “sweetheart” wholesale power deals will also be to Meridian (and Contact’s), benefit with higher prices being negotiated, and also given the fact that supply is not trapped to the extent it was last time terms were agreed.

An eagerness to get a deal done will also see NZAS make assurances to the (new) government around emissions, better waste management, power “co-operation” during peak periods, and a pledge to invest in and support new renewable generation projects.

7.Brown gets moving on strategies around the port (moving it)

As highlighted in an opinion piece last year (click here to view the article) the Ports of Auckland has been a sense of consternation for many Aucklanders. Since being taken off the NZX, the port has seen a huge amount of value destruction, underperforming financially and operationally under full council ownership, while also having an appalling safety record. No surprise that the Ports was once again centre of attention in last year’s mayoral race.

A clear election promise by Wayne Brown has been to sort the issue of the port once and for all. Having already made significant noises around plans to overhaul the port, 2023 will be the year that Brown (unlike the botched automation project) swings into action and pushes the boat out on his plans.

Before then, Brown will have to deal with the criticism of his handling of the Auckland floods. Presuming he navigates the fall-out, he will seek to restore credibility on a number of fronts. He will ensure there is more detail on the phased timeline to return waterfront land “to the people of Auckland” from 2024, as well as easing congestion in and around the CBD. After years of circular arguments, tough decisions will be made and set into motion. Container freight will be transitioned to rail, and the vehicle operations will head to Northport. The roadmap will be also laid out for the overall port operations to actually become commercial and to the benefit of Auckland ratepayers.

8.The National coalition wins election in comprehensive fashion, economy front and centre

While a new leader has been installed, time and broken promises will be the enemies for Labour as the Government attempts in vein to secure a third term at this year’s general election (the 30th anniversary of MMP as it goes). With New Zealanders having been rocked by unprecedented cost-of-living pressures and low wage growth, the move for many homeowners to unpleasantly high mortgage rates will be too much to bear for voters. With the economy likely to be in recession, it will be National and ACT’s election to lose.

With the economy at the centre of the campaign, National under Christopher Luxon will widen the gap on Labour as the election draws closer. The ACT Party will also have a very strong showing, with David Seymour’s constructive “arrogance” continuing to score points, and helping to give the Coalition a resounding victory. Law and order will also be a big focus for voters with Labour seen as soft on crime. Luxon and Seymour will win hearts with a promise to bring an end to the all too regular news of ram-raids and attacks on dairy owners. Chris Hipkins will make policy tweaks but this will likely be in vain.

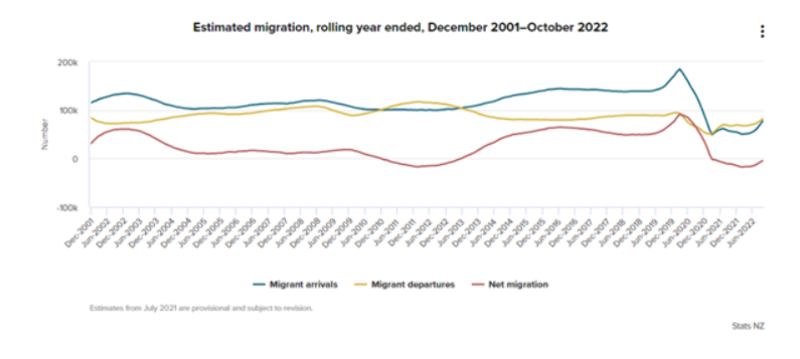

9.The ‘Brain Drain” resumes in force to Australia (and elsewhere)

With the virus now largely in the rear-view mirror, New Zealand will be an appealing destination to many non-New Zealand citizens in 2023, which will be helpful to the hospitality and education sectors amongst others.

However, deteriorating economic conditions, lower relative wages, and a structurally higher cost of living than many other countries will all be incentives for the Brain Drain to resume. A housing market which will remain one of the most unaffordable globally (even after the correction noted above) will further dent the inclination for kiwi workers to stay put. An Australian economy which holds together much better than New Zealand’s this year will also cause many kiwi workers to take flight across the Tasman in particular.

10.With a number of challenges ever present, market conditions remain productive for active value-oriented investors

Last year presented its fair share of challenges for markets, but it was one in which active, value-oriented investors were presented with a productive environment. While most markets were softer, ‘growthier’ sectors came under much more pressure. Market dynamics, amidst elevated levels of inflation and the onset of a global rate tightening phase, also raised questions around the merits of “passive” versus “active” investing strategies.

Passive investing strategies have arguably suited many investors well during the bull market, but equally, active strategies often start to display their credentials in a scenario where “a rising tide no longer lifts all boats.” Given the ambiguity around where inflation, interest rates, and a raft of economic data are likely to end up, this environment could well remain in force in 2023.

From a style perspective, the rotation from growth to value gained momentum in 2022. While interest rates are unlikely to rise at the same vicious pace in 2023, they are unlikely to fall quickly either. This could continue to present a headwind for growth companies that fail to deliver on expectations. Those that do meanwhile will be rewarded.

As a value-oriented manager, our approach at Devon Funds continues to be seeking out and maintaining exposure to high quality companies with excellent investment credentials, including strong track records, robust balance sheets, great management, robust competitive moats, and strong long-term earnings prospects.

And from the left of field……

11.Argentina do the ‘double’ and win the Rugby World Cup

The 2023 Rugby World Cup in France promises to be one of the most hotly contested yet. The All Blacks safely navigate the Group stage but are beaten by Ireland in the quarters. Hosts France make it to the final however are tripped up by Los Pumas as Argentina matches its football world cup triumph, lifting the Webb Ellis Cup for the first time.

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « A closer look into the dark art of technical trading | From the courtroom to the trading floor » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |