Kiwis risk missing out with limited benchmarks

When it comes to international equities, many New Zealand investors limit themselves to developed markets and are missing a significant slice of the world’s investment markets, says Russell Investments.

Wednesday, April 5th 2023, 2:32PM

by Andrea Malcolm

The latest benchmarking paper from Russell, ‘What’s (not) in your benchmark?’ looks at four popular global equity indices and index oriented funds used by Kiwi investors, and says many local managers do not have the capability to access emerging markets efficiently.

It goes on to assert that clients of such managers are limited to developed markets only offerings, or access via inefficient feeder fund structures, or potentially tax-inefficient offshore funds.

The investable global equity market includes more than 70 countries and around 10,000 stocks exceeding NZ$100 trillion in capital. Countries are split into developed, emerging and frontier markets.

MSCI provides indices for all three, with the MSCI All Country World Index (ACWI) and the MSCI Frontier Markets Investable Market Index combined capturing about 99% of the global equity opportunity set.

The paper examines popular index-oriented funds used by New Zealand investors: the FTSE Global All Cap (99% coverage of all markets), MSCI ACWI (88% coverage), MSCI World (78% coverage), and S&P Global 100 (25% coverage), or ex-Australia variants, as benchmarks. Only the first two have emerging markets allocations; 12% and 11% respectively.

Many NZ investors find themselves unintentionally ignoring a large part of the opportunity set due to their fund and benchmark selection, e.g Emerging Markets, Small & Mid Cap, are missing out on return opportunities and diversification benefits, says Russell Investment analyst and author Sam Tither.

While the Kiwi preferred indices are similar in their representation of broad sector opportunities, Tither points out that New Zealand index-oriented funds often apply exclusions, such as tobacco and controversial weapons, whereas index funds in other markets tracking the broad indices may not.

“Many investors that buy feeder funds, i.e funds that invest in offshore ETFs or index funds, inadvertently find themselves owning companies involved in controversial weapons, tobacco, thermal coal, etc. This is a major drawback of the feeder fund structure for equities and partly explains the decline in popularity of this replication approach in New Zealand.”

Regarding performance over the four benchmarks, the strong out-performance of developed markets and large caps over the last decade is clear, says the report. But asks could emerging markets be poised for superior returns over the next decade?

“Investors holding all country global equity funds – those that invest in developed and emerging markets, will have an allocation to these markets within their core equity exposure. As we have communicated for many years, we believe emerging markets are an essential component of modern global multi-asset portfolios.”

Impact of exclusions

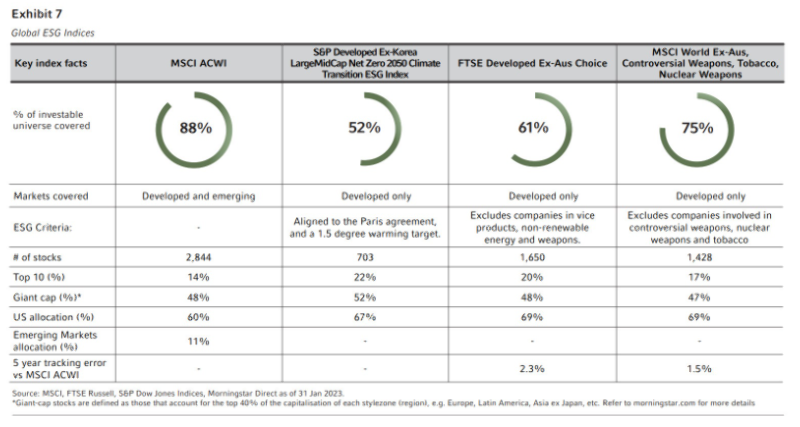

The report also compares coverage of the MSCI AWCI (88%) to ESG indices commonly used by New Zealand investors: the S&P Developed Ex-Korea LargeMidCap Net Zero 2050 Climate Transition ESG Index (52% coverage; aligned to Paris Agreement), the FTSE Developed Ex-Aus Choice (61% coverage; excludes vice, non-renewable energy, weapons) and the MSCI World Ex-Aus, controversial weapons, tobacco, nuclear weapons (75%).

It says ESG oriented investors should be aware of the tracking and performance risks they introduce to their portfolios by adopting these highly constrained and restrictive indices, especially if their fund is based on an index-based feeder fund.

| « Finding new members a sign of the times | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |