Sharesies KiwiSaver to include stocks in a self-select option

Online investment platform Sharesies will have a DIY option in its KiwiSaver scheme which it plans to launch this quarter.

Thursday, May 4th 2023, 6:00AM  4 Comments

4 Comments

by Andrea Malcolm

The impending KiwiSaver scheme was announced last December and now has a waiting list of 18,000. Sharesies joint CEO Leighton Roberts says the scheme will roll out to select staff and clients from next week.

Once it is available, members will have a choice of five base funds as well as the option to customise their portfolios from a range of individual company shares and exchange traded funds (ETFs).

The initial DIY offering will cover 40 ETFs and 60 individual stocks which will be PIE-wrapped to limit the top tax rate of 28% and allow members to buy fractions of shares.

Sharesies head of KiwiSaver Matt Macpherson says the ETF range isn’t fully finalised but all ETFs bar one from Salt, will be Smartshares including Smartshares S&P 500, Total World and Total World Bonds.

As the scheme is developed, access to US markets will be added later in the year followed by ASX listings, he says.

Other self-select KiwiSaver schemes which allow members to customise their portfolios with individual stocks and ETFs are available from Consilium and Craigs Investment Partners although their individual equity offerings are not structured as PIEs.

Online investment platform InvestNow also lets KiwiSaver members build their own portfolios from a range of funds not including individual shares.

At least 50% of Sharesies KiwiSaver portfolios will be required to include one of five base funds chosen from among Sharesies Pathfinder Ethical Growth Fund, Sharesies Smartshares Growth Fund, Sharesies Pie Global Growth 2 Fund,

Sharesies Smartshares Balanced Fund and Sharesies Smartshares Conservative Fund. This extends the partnership Sharesies already has with Pathfinder, PIE and Smartshares which are available on the Sharesies platform.

Sharesies says there will be no additional management or administration fees on top of the fund managers’ own fees. Although self-selected shares and ETFs won’t attract management fees there will be an administration fee of 0.15%, and a transaction fee of 1% for investments up to $1000, and 0.1% for investments of more than $1000.

Guardrails

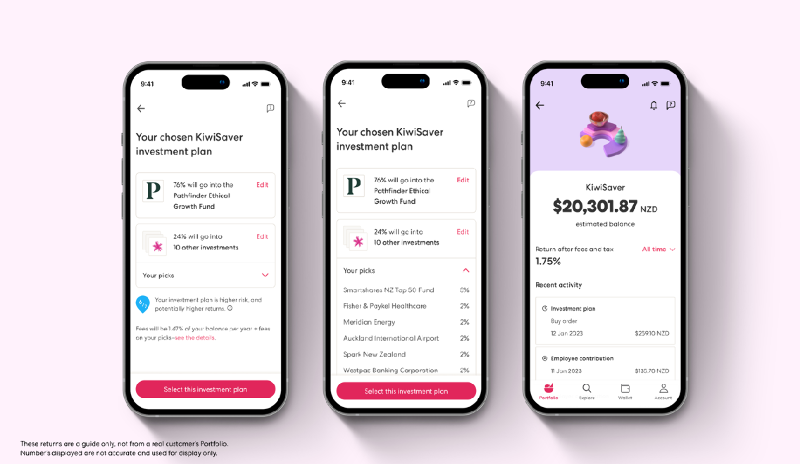

Would-be members will have to sign up to Sharesies to join the scheme which will be on the Sharesies app and will have to complete an investment plan. Members will be able to update the plan at any time to suit their changing risk profiles, goals, or values.

The KiwiSaver scheme will include built-in limits and tools (guardrails) to promote diversification so investors can manage their risk. As well as having to allocate at least half their KiwiSaver investment to a base fund, members will not be able to allocate more than 5% of their total KiwiSaver investment to any single share or ETF. To assess the risk before locking in their investment plan, members will see a risk indicator from 1 (low risk) to 7 (high risk).

Roberts says just over 10% of current members use the platforms’ autoinvest feature and Sharesies members have proved to be sophisticated in their investment decisions including steering clear of panic selling.

“Kiwis have told us they want to feel more connected to their KiwiSaver investments, and have more control and confidence over how and where they invest,” he says.

| « Employers including KiwiSaver as part of pay packets instead of on top | A good quarter for KiwiSaver » |

Special Offers

Comments from our readers

One thing I have noticed with the Sharesies launch is that a lot of work is done at the beginning to limit exposures, or the guardrails that are in place, but what about the support when markets are volatile or falling.

Sharesies does not have advisers, and are perhaps limited in their ability to give advice, so how will they remind customers to stay the course?

Just as the banks with their thousands of clients. The Sharesies experience has been great to introduce and encourage the public to dip their toe further into investing.

But the feedback I have experienced from investors is mostly disappointment. Throwing mud at the wall is not a great strategy and lacks structure and discipline which comes from advice.

11 KiwiSaver providers earnt less than $3m which makes this a hobby, not a business.

Looks like Sharesies is trying to copy the Craigs IP scheme. Certainly a leader at the time, but does not look like the numbers seem to stack up.

Sign In to add your comment

| Printable version | Email to a friend |