Kiwi funds fattened by fossil fuels

Despite fund managers touting ESG (environmental, social and governance) investment principles, a bumper year for fossil fuels saw Kiwi dollars surge into oil and gas stocks.

Thursday, June 29th 2023, 6:00AM  1 Comment

1 Comment

In the year September 2021 to 2022, KiwiSaver and retail fund investment in fossil fuel producers increased significantly, new research from Mindful Money has revealed.

This includes 80% investment growth (now close to NZ $3 billion) in companies that have backtracked on public pledges to cut fossil fuel production and transition to renewable energy.

Since Russia’s invasion of Ukraine forced up oil prices, fossil fuel companies including Exxon Mobil, BP and Shell have cast aside climate commitments made when oil prices were low.

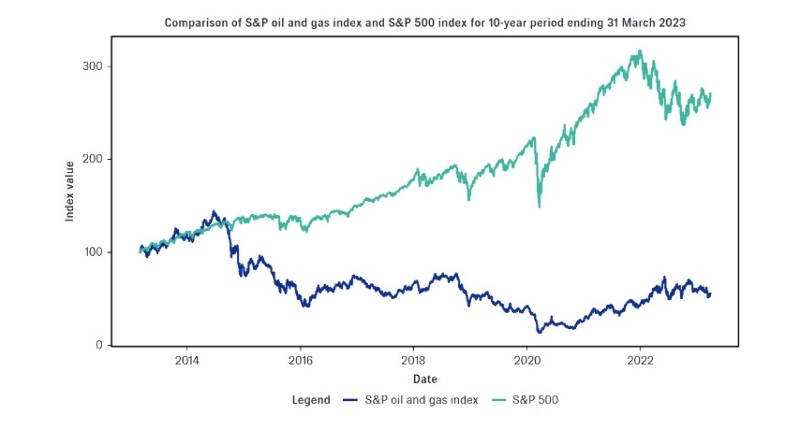

But Mindful Money founder Barry Coates says despite higher returns in 2022, a comparison between the fossil fuel sector and the share market over the past decade shows annual losses of 5.6% for the US Oil & Gas Index and annual returns of 10.5% for the S&P 500 Index.

He wants to see a greater appreciation of the risks posed by fossil fuel investment as opposed to the short term gains 2022.

“There was this blip in profits because of the Ukraine war. People are saying, ‘Yes [fossil fuels] will be a stranded asset but not while I’m holding the shares.’ The main financial advice you ever get is that you can’t time the market. Yet by holding these shares that’s exactly what you’re doing.”

The latest company to backtrack on its climate commitments is Shell. CEO Wael Sawan announced earlier this month that instead of cutting production by 1-2% per year for the rest of the decade, oil production will now remain stable. Sawan became Shell’s chief executive last September, replacing Ben van Beurden who had set a target of achieving net zero carbon emissions by 2050, with gradual reductions in fossil fuel output.

Shell’s largest investor is asset management giant Blackrock which owns a 9.6% stake. From there ownership is dispersed with no other investor owning more than a 5% stake as of December 2022.

Coates says the about-turn will result in an extra 29 million tonnes of carbon pumped into the atmosphere each year. Meanwhile through their KiwiSaver accounts, New Zealanders have nearly NZ $352 million invested in Shell. Others to have U-turned are ExxonMobil and BP.

Expanding versus transitioning

Mindful Money used data on 901 oil and gas companies from the Global Oil and Gas Exit List (GOGEL) and its own analysis of 349 KiwiSaver funds and 453 retail holdings to discover what fossil fuel companies New Zealanders are invested in, and whether they are expanding exploration and production or transitioning to renewable energy sources.

It found investment in 260 upstream and midstream oil and gas companies with planned expansion, with the biggest flow of Kiwi dollars into BHP, Shell, Santos, Cheniere Energy, and Woodside Energy. These companies are also among the top global expanders.

The report also lists eight thermal generators on the pathway to renewable energy by 2040, including New Zealand Contact Energy. The majority leading the transition to clean energy are electricity utilities switching from burning coal and oil to solar, wind, geothermal and hydropower as main inputs into their electricity production.

These attracted $1.7billion in investment, primarily in Contact, compared to the $3 billion which went to fossil fuel expanders. Contact currently has around 17% of its generating capacity and 8% of revenue in gas as a fuel for electricity generation.

Coates doesn’t think active ownership and engagement with those oil and gas companies that are expanding production again is working.

“The fossil fuel industry has had plenty of time to transition. It’s now profitable to produce renewable energy. If you’re engaging with a company that for 30 years has been saying it will transition to renewable energy and it hasn’t, either you’re very gullible or you just want to invest in them.

“Pushing it to the precipice if the system collapses and we haven’t made the transition, we will have major disruption and everyone loses.”

The Mindful Money website, where investors can see what non-ethical holdings they have in their KiwiSaver and managed funds, will now identify which fossil fuel companies are expanding or transitioning for each fund available to retail investors.

| « If the FMA comes knocking can you supply docs in time? | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |

Paraphrasing Professor Aswath Damodaran from NYU, “ESG was born from a UN document. It is being sold without shame while companies have no idea how to measure this.”

He continued to say, “ESG was born out of sanctimony, nurtured with hypocrisy and sold with sophistry”.

Enough said.