Seeing the light

Several global markets have enjoyed very strong performances in June and so far this year. NZ and Australian markets have delivered positive performances but have lagged in comparison. Index performances are though but a yardstick for astute active investors.

Friday, July 7th 2023, 6:57AM

by Devon Funds

By Greg Smith, Head of Retail at Devon Funds

June was a busy month again for markets. Another ‘crisis’ was averted, with the US debt ceiling raised after weeks of negotiations. The notion that the end of a sustained period of interest rate tightening was coming to an end was reinforced by the US Federal Reserve which paused interest rates, ending a string of 10 consecutive increases over the previous 18 months, Other central banks were beating a slightly different drum, but officials in New Zealand and Australia also suggested that the end of the interest rate hiking period was in sight.

Many economies were resilient, with New Zealand a clear exception as we entered a technical recession in the first quarter. Corporate announcements domestically were fairly thin on the ground locally, although several of those that were forthcoming did see a significant investor reaction as a result.

Market wise, large global markets were out in front. Investor hype around AI helped to propel those markets with strong technology weighting higher. The Nasdaq soared over 6.5% during June, and the 32% gain during the first six months of the year marked the best half since 1983. The broader S&P500 also gained 6.5% during June and is up 16% in the first six months of the year.

It was a month when records were broken. AI hype saw shares of chip maker Nvidia surge, and join an exclusive club of companies with a market cap of US$1 trillion or more. One member of that club, Apple, also hit record highs, with the tech titan’s valuation above US$3 trillion. Microsoft, the top holding in the Devon Global Sustainability Fund, also hit a record high.

Helping matters at the start of the month was the resolution of the US debt ceiling saga, and before the June 5 ‘X-date’ at which point federal obligations may have gone unpaid. Lawmakers passed the Fiscal Responsibility Act, ending a standoff which lasted over a month.

The US earnings season also showed that most corporates are doing better than many expected. Nearly 80% of companies reporting delivered a positive earnings-per-share surprise for the quarter. Earnings growth was more contained, with companies beating earnings estimates by 6.5% in aggregate, which reflects that growth is slowing down for many names post the pandemic.

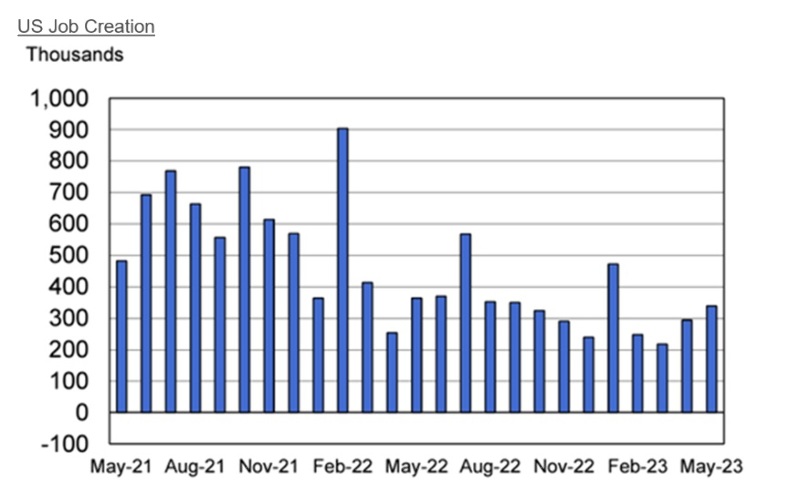

That said the world’s largest economy has remained resilient, and the jobs market in particular. The non-farm payrolls report showed that the US created 339,000 jobs in May, across a range of sectors, awell ahead of the 190,000 expected. It marked the 29th straight month of positive job growth. With more people entering the workforce, the unemployment rate ticked up slightly however, and wage growth also eased.

Source; US Labour Department

Durable goods orders (for things such as televisions, appliances and transportation equipment) came in higher than expected for May, as did new home sales, and retail sales, while consumer confidence was at its highest level in 18 months in June. US March quarter GDP was also upwardly revised upwards to a 2% annualized pace, well above the previous estimate of 1.3% and 1.4% consensus forecasts. Manufacturing is weak but the services side of the economy is strong.

The Federal Reserve’s declaration that the big banks have all passed its annual stress test was further testament to the current and potential future resilience of the economy - and undermines the narrative that the US is heading towards a recession.

Inflation prints also tended to track lower in the US (the 4% increase in the CPI for May was the lowest in two years), which helps the Fed’s cause to ease back on rate tightening, and consumers battling cost of living pressures. A data-dependent Fed pressed the pause button on rate hikes during the month, although Jerome Powell has continued to talk up since the notion that the battle against inflation is not yet won, and there would be “one or two more” rate hikes yet in 2023. At the end of the month, core PCE, the Fed’s preferred inflation gauge rose just 0.3%, further suggesting that inflationary pressures are winding down.

Encouragingly Powell still believes that the US economy will achieve a soft landing – recent data continues to give credence to this view. The Fed lifted its forecasts for the US economy, predicting it will expand by 1% this year. This is significantly higher than the 0.4% estimate released in March.

While the tech sector has stolen the limelight, the reality that the US economy is nearing the end of an aggressive rate tightening program in good shape, is also showing up the breadth of the market rally. The Russell 2000 (a small-cap index) was up 8% in June. The consumer discretionary sector (with travel stocks a tailwind) surged 10% during the month.

It was a similar theme across the Atlantic, with central banks saying there was more work to do on inflation, which is generally coming down – the UK being a notable exception. UK inflation came in at a 31-year high in May, prompting the Bank of England to put through a larger-than-expected 50bps rate hike during the month.

In Asia, there was meanwhile a quiet achiever in Japan’s Nikkei, one of the best-performing global indices, rising 7% during the course of June and mustering a year-to-date performance of nearly 30%. The export nation’s renaissance has been driven by a weaker yen, with the Bank of Japan committed to ultra-loose monetary policies despite inflation being above target. Prior to Covid, Japan suffered from decades of debilitating inflation, and officials wants to ensure inflation hands around this time.

As for New Zealand and Australia, the indices down under clearly lagged. The NZX50 rose less than 1% for the month, and is up around 4% for the first 6 months of the year. The ASX200 gained less than 2% in June, and is up not much more than that so far in 2023. Markets in Australia have not had the same tech tailwinds, and the two economies have arguably been somewhat more uneven for varying reasons.

The unevenness of the post-Covid recovery in China, the two nation’s largest customer hasn’t helped. Officials though in China do however appear to be giving the economy a nudge towards growth targets, cutting key rates during the month, The key question is whether more is to follow.

While March quarter GDP undershot forecasts, Australia for its part has also been resilient as well. The trade surplus (driven a lot by China) remains healthy and this is good news for the resource sector and companies such as BHP and Rio This also has trickle-down impacts to other parts of the economy,

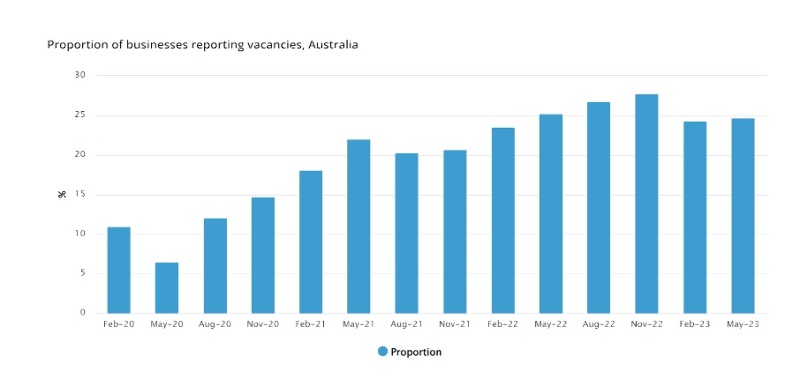

Aussie retail sales and jobs data came in stronger than expected during the month. Job vacancies have fallen by around 10% over the past year, but they remain 89% above where there were in February 2020, just before the onset of COVID. The jobs market has remained strong despite the RBA’s tightening process, which may not be lost on officials who are also concerned that strong wage growth is occurring without associated productivity gains.

Source: ABS

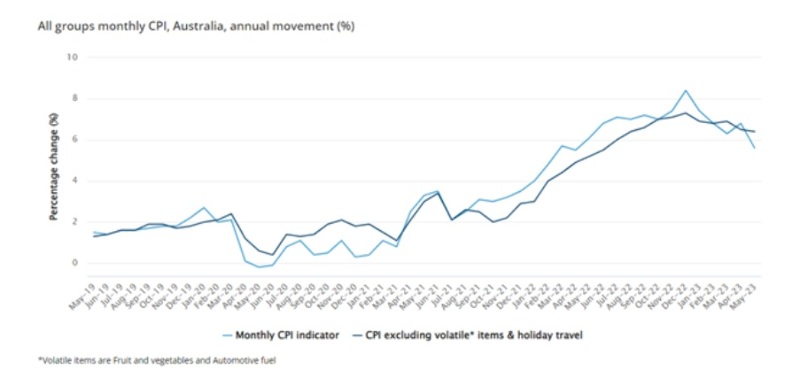

The RBA raised rates by 25bps during the month, but the immediate prospect of another increase has been diminished by a fall in inflation reported during the month. The CPI rate for May came in at 5.6%, sharply lower than April’s 6.8% and under consensus estimates of 6.1%.

Source: ABS

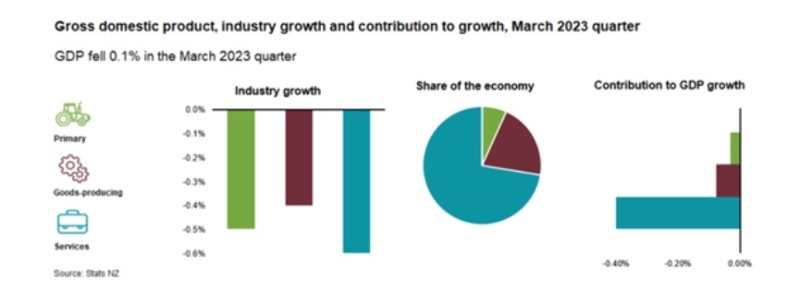

In New Zealand our central bank sat on the sidelines during the month, but will have watched with interest as the country entered a technical recession, with -0.1% growth in the March quarter, The December quarter was also revised down slightly to -0.7%. The March print was also at odds with the RBNZ’s projection for 0.3% growth, and the recession has come earlier than the central bank predicted (2nd quarter). The economy is 2.9% bigger than it was a year ago, but this is also below forecasts.

The weather events and cyclone had an impact. The services sector, which accounts for two thirds of GDP, contracted 0.6%. Primary industries contracted 0.5% while goods producing industries declined 0.4%. It is also interesting to note that migration has been a tailwind, and GDP per capita has declined 0.7%. Bright spots were however a lift in household consumption expenditure and investment in fixed assets of 2.4% and 2% respectively. Tourism flows also helped lower our trade deficit. The consumer and businesses seem to be in ok shape, and this has since been confirmed by recent confidence surveys.

Source: Stats NZ

It will be Interesting to see how the RBNZ responds. Clearly the overall economy has cooled and some sectors more than others. Lower than expected growth also has implications for government tax revenues. The housing market however does appear to be bottoming. Sales volumes rose in parts of the country in May. Median days to sell has also declined. Green shoots? Time will tell.

Weather events certainly had a strong impact on key parts of the economy, including construction, Fletcher Building moved earnings (EBIT) guidance to the lower end of its forecast range at circa $800m during the month. Soft residential markets in New Zealand and Australia were a driver.

Weather could not be blamed on developments at two other companies during the month though. Pacific Edge shares (not held in any of the Devon funds) tumbled as the company’s Cxbladder product lost Medicare coverage in the US. EBOS meanwhile lost its contract with Australian Chemist Warehouse. This is a significant hit to earnings for one of New Zealand’s biggest companies.

Better news for A2 Milk and Synlait, with the latter confirming it has received approval from China’s State Administration for Market Regulation (SAMR) for the re-registration of A2’s China-label infant milk formula product. The approvals for the manufacture of the formula will run through September 2027.

Travel stocks were in the news. Air New Zealand came through with an earnings upgrade. The airline (and others) is though still not happy that Auckland Airport is putting up its landing charge prices. Auckland Airport for its part, cut airlines some slack during the pandemic, and it makes the point that landing charges represent 3-3.5% of the average cost of a domestic or international airfare. Domestic jet aeronautical charges have barely risen in real terms over the last decade. The terminal meanwhile is well overdue a refresh to be made fit for current and future purposes. Auckland Airport was also in the frame as the Auckland Council after some debate jettisoned 8% of its 18% stake.

Seeing a stake go the other way was infrastructure player Infratil which launched an equity raise of $850m, which is being partly directed towards the acquisition of the remaining 49.95% shareholding in One NZ (formerly Vodafone) for $1.8 billion.

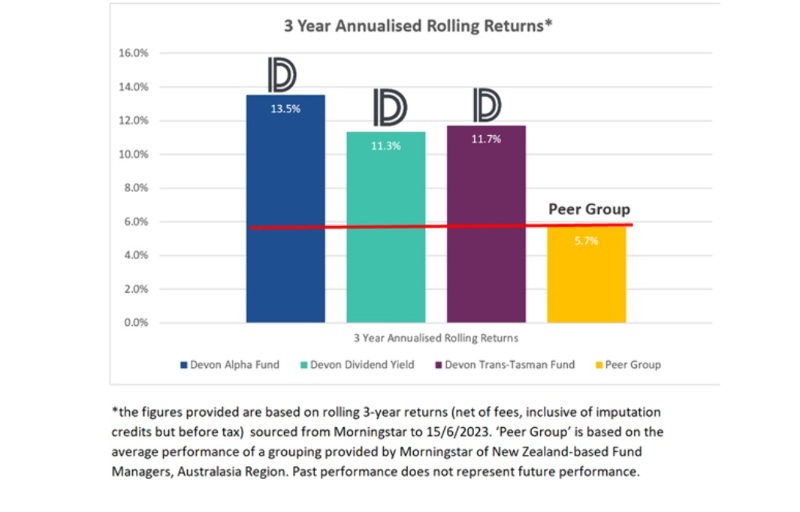

So all in all, another busy month for markets. Looking at the headline performance of the New Zealand and Australian markets versus the likes of the S&P500 may spark the question of when a period of catch-up with ensue. Dissecting which (and the weighting of) stocks to be in, and which to not, is generally more fruitful for active stock pickers. This is evidenced in the below graph of the performance of the Devon Funds versus peers over the past 3 years.

We are committed to doing all of our own research, based on regular meetings with the companies that we are considering for investment and thoroughly understanding the key drivers of value in the sectors that these businesses operate in. This primary analysis enables Devon to form independent views on stock valuations and this, in turn, gives us the confidence to make decisions. Volatility (and uncertainty) in markets is a very productive environment for this approach.

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « Are investors missing out on once in a generation opportunities? | The Australian Superannuation Performance Test: Sensible but flawed? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |