FMA to give confidentiality order recipients more support info

Concerns about possible mental harm to individuals on the receiving end of confidentiality orders under the Financial Markets Authority Act, have prompted a meeting between the Boutique Investment Group and the financial regulator.

Monday, July 10th 2023, 12:31PM

by Andrea Malcolm

BIG chair Simon Haines says the group, a forum of more than 30 fund and wealth managers, thought it was an issue to look into.

“There has been a lot of unease permeating the industry around sections 25 and 44 of the Financial Markets Authority Act 2011.”

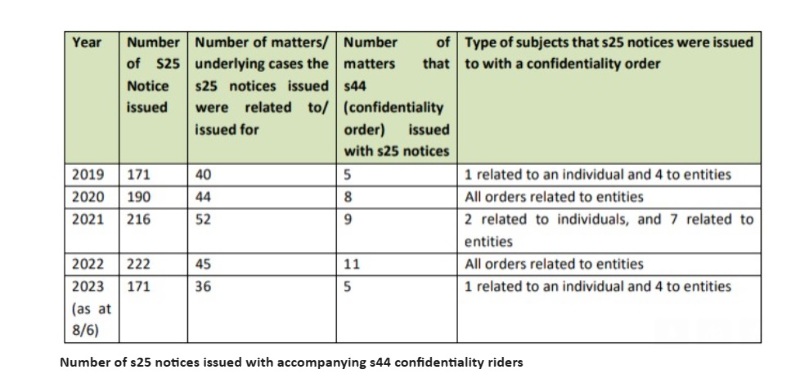

Section 25 empowers the FMA to order individuals or entities to provide information on possible violations of financial services and securities markets legislation. It can also impose a confidentiality order under section 44, prohibiting the communication of any information provided in connection with the inquiry or investigation.

This power is limited by the New Zealand Bill of Rights Act which protects the right to freedom of expression, including the freedom to seek, receive, and impart information.

Haines says confidentiality orders can potentially cause significant isolation and mental harm to those on the receiving end.

“The issue is not so much the section 25 notices because we have to provide information on all kinds of things, all the time. Companies on the most part are big enough and ugly enough to deal with that themselves. The issue is more around the health and safety considerations of an ordinary person in an ordinary job.

“If an ordinary person receives a threatening notice saying they must collate information against the company they work for and they are not allowed to talk to anyone at all about what they are doing, that could be hugely detrimental to a person’s stress levels. I think after the [Covid] lockdowns, we have probably all become more aware of the dangers of making people fearful and isolated at the same time.”

Haines says the issue, regardless of whether junior or mid-level individuals have been targeted, as some industry sources claim, or not, is that they potentially can be.

FMA legal counsel Liam Mason says the regulator aims to serve notices on those in a senior position, although a request for a discreet piece of information might go to those further down company ranks.

“The other possibility is where we are investigating senior management at a firm. In that case we would first try to go to the independent directors but that reach can be limited and we might have to go to a specific person in the firm.”

He says the FMA is working on extra materials for recipients including more on where they can go for legal help, as well as general guidance to the market.

Confidentiality orders are served for two reasons, says Mason. To protect the person providing the information and the information itself. Or to preserve the information’s integrity such as to preventing unconscious tainting of witness evidence if they speak to others.

He says confidentiality orders aren’t issued as part of regulatory monitoring.

“They are always in relation to a specific matter, especially a confidentiality order, because they do limit people’s ability to communicate. There is quite an internal process to go through when issuing a notice. Confidentiality orders are subject to a legal review.”

He also says it is common for those on the receiving end to ask the FMA if they can talk to others to help them respond to the request. “There would be some broadening of the order in the majority of cases.”

Mason says the amount of time gathering information could range from hours to days. “Some requests would take a long time because we’re asking them to collate several years of data.”

BIG and the FMA discussed whether there should be a committee or more than one person from the FMA’s executive leadership team signing off on orders.

“We are governed by a crown entity information and the board has delegated to the chief executive which delegates to the senior executives. We are quite comfortable that the requirements for specific legal reviews means we have the balance right.”

Haines says he wants to credit the FMA with being open and responsive on the issue.

“We're not attempting to stop the FMA from investigating people that need investigation. There are many situations where they need to preserve secrecy for good reasons and there is behaviour out there that needs to be stopped. But if there is risk to individuals that could be mitigated, then that's a good thing to do.”

| « Generate gets thematic | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |